Increased Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver for the integrated cardiology-devices market. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing emphasis on investing in advanced medical technologies. This trend is fueled by both public and private sectors, as they seek to improve patient care and outcomes. Integrated cardiology devices are increasingly viewed as essential tools in achieving these goals, leading to higher adoption rates among healthcare facilities. Furthermore, reimbursement policies are evolving to support the use of innovative devices, thereby encouraging hospitals and clinics to invest in integrated solutions. This financial commitment is likely to bolster market growth, as healthcare providers recognize the long-term benefits of adopting advanced cardiology technologies.

Regulatory Support and Incentives

Regulatory support and incentives play a pivotal role in shaping the integrated cardiology-devices market. The US government and regulatory bodies are increasingly recognizing the importance of advanced medical technologies in improving healthcare outcomes. Initiatives aimed at expediting the approval process for innovative devices are fostering a conducive environment for market growth. Additionally, programs that provide financial incentives for adopting integrated solutions are encouraging healthcare providers to invest in these technologies. This regulatory landscape is likely to enhance competition among manufacturers, driving innovation and leading to the development of more effective cardiology devices. As a result, the integrated cardiology-devices market is expected to benefit from a favorable regulatory environment that promotes the adoption of cutting-edge technologies.

Aging Population and Lifestyle Changes

The demographic shift towards an aging population in the US is a crucial factor influencing the integrated cardiology-devices market. As individuals age, the risk of developing cardiovascular diseases escalates, necessitating the use of advanced cardiology devices for effective management. Additionally, lifestyle changes, including increased sedentary behavior and poor dietary habits, contribute to the rising prevalence of heart-related conditions. This demographic trend is expected to drive demand for integrated cardiology devices that offer comprehensive monitoring and treatment options. The market is likely to expand as healthcare systems adapt to the needs of an older population, focusing on preventive care and early intervention strategies. Consequently, manufacturers are encouraged to innovate and develop devices tailored to this demographic.

Technological Integration and Innovation

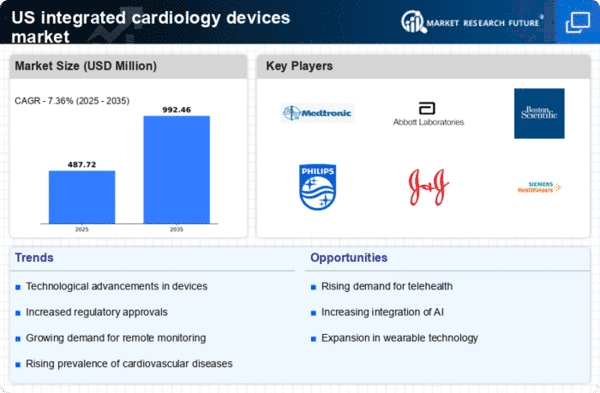

Technological advancements are significantly shaping the integrated cardiology-devices market. Innovations such as remote monitoring, telehealth capabilities, and AI-driven analytics are becoming integral to cardiology practices. These technologies not only improve patient engagement but also enhance the accuracy of diagnostics and treatment plans. For instance, wearable devices that monitor heart rhythms in real-time are gaining traction, allowing for timely interventions. The market is expected to witness a surge in demand for devices that offer seamless integration with electronic health records (EHRs), facilitating better data management and patient tracking. As a result, manufacturers are focusing on developing devices that incorporate cutting-edge technology to meet the evolving needs of healthcare providers and patients alike.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in the US is a primary driver for the integrated cardiology-devices market. According to the CDC, heart disease remains the leading cause of death, accounting for approximately 697,000 fatalities annually. This alarming statistic underscores the urgent need for advanced diagnostic and therapeutic devices. As the population ages, the prevalence of conditions such as hypertension and arrhythmias is expected to rise, further propelling demand for integrated cardiology devices. The market is projected to grow at a CAGR of around 8% over the next five years, reflecting the critical role these devices play in managing cardiovascular health. Consequently, healthcare providers are increasingly investing in integrated solutions that enhance patient outcomes and streamline care delivery.