Focus on Environmental Sustainability

The US Integrated Marine Automation System Market is increasingly aligning with global trends towards environmental sustainability. As concerns about climate change and marine pollution intensify, there is a growing emphasis on developing automation systems that minimize environmental impact. Automation technologies enable more efficient fuel consumption, optimized routing, and reduced emissions, contributing to greener maritime operations. The market is responding to these demands by innovating solutions that not only enhance operational efficiency but also adhere to sustainability goals. For example, automated systems can analyze fuel usage patterns and suggest modifications to reduce carbon footprints. This alignment with environmental sustainability is likely to attract investment and foster growth in the US Integrated Marine Automation System Market, as stakeholders prioritize eco-friendly practices.

Technological Advancements in Automation

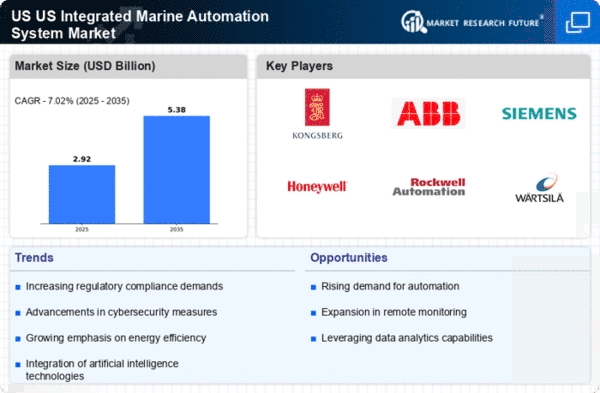

The US Integrated Marine Automation System Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as artificial intelligence, machine learning, and the Internet of Things (IoT) are being integrated into marine automation systems. These technologies facilitate real-time data analysis, predictive maintenance, and improved decision-making processes. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years, driven by the increasing demand for automation in maritime operations. As vessels become more sophisticated, the need for advanced automation systems that can manage complex tasks autonomously is becoming paramount. This trend not only streamlines operations but also reduces human error, thereby enhancing safety and efficiency in the US Integrated Marine Automation System Market.

Regulatory Compliance and Safety Enhancements

In the US Integrated Marine Automation System Market, regulatory compliance plays a crucial role in shaping market dynamics. The implementation of stringent safety regulations by agencies such as the Coast Guard and the Environmental Protection Agency (EPA) necessitates the adoption of advanced automation systems. These systems are designed to ensure compliance with safety standards and environmental regulations, thereby mitigating risks associated with maritime operations. The market is witnessing a shift towards automation solutions that not only meet regulatory requirements but also enhance overall safety. For instance, automated systems can monitor vessel performance and environmental impact in real-time, allowing for immediate corrective actions. This focus on compliance and safety is expected to drive market growth, as companies seek to avoid penalties and enhance their operational integrity in the US Integrated Marine Automation System Market.

Increased Investment in Maritime Infrastructure

The US Integrated Marine Automation System Market is benefiting from increased investment in maritime infrastructure. Government initiatives aimed at modernizing ports and shipping facilities are creating opportunities for the adoption of advanced automation systems. The US government has allocated significant funding for infrastructure projects, which includes upgrading existing facilities to accommodate automated technologies. This investment is expected to enhance operational efficiency and competitiveness in the maritime sector. As ports become more technologically advanced, the demand for integrated marine automation systems is likely to rise. Furthermore, the integration of automation in logistics and supply chain management is anticipated to streamline operations, reduce turnaround times, and improve overall service delivery in the US Integrated Marine Automation System Market.

Growing Demand for Enhanced Operational Efficiency

The US Integrated Marine Automation System Market is witnessing a growing demand for enhanced operational efficiency among maritime operators. Companies are increasingly recognizing the benefits of automation in optimizing their operations, reducing costs, and improving service delivery. Automation systems facilitate streamlined processes, from navigation to cargo handling, thereby minimizing delays and enhancing productivity. Recent studies indicate that organizations implementing integrated marine automation systems have reported up to a 30% increase in operational efficiency. This trend is driven by the need to remain competitive in a rapidly evolving market, where efficiency and cost-effectiveness are paramount. As a result, the demand for sophisticated automation solutions is expected to rise, further propelling growth in the US Integrated Marine Automation System Market.