Focus on Data Privacy

Data privacy concerns are becoming paramount in the IT asset-disposition market. With the implementation of laws such as the California Consumer Privacy Act (CCPA), organizations are under pressure to ensure that customer data is securely disposed of. Failure to comply with these regulations can result in hefty fines, which may reach up to $7,500 per violation. This heightened focus on data privacy drives companies to adopt comprehensive asset-disposition strategies that prioritize secure data destruction. As a result, the market is expected to grow as businesses invest in solutions that safeguard sensitive information during the disposal process.

Increased IT Spending

The it asset-disposition market is benefiting from the rising IT spending across various sectors. In 2025, IT spending in the US is anticipated to exceed $1 trillion, driven by digital transformation initiatives. As organizations upgrade their technology infrastructure, the volume of obsolete IT assets increases, necessitating effective disposition strategies. This trend indicates a growing demand for asset recovery services, which can help organizations recoup value from retired equipment. Consequently, the IT asset-disposition market is likely to experience robust growth as businesses prioritize efficient asset management and recovery.

Rising E-Waste Concerns

The growing awareness of electronic waste (e-waste) and its environmental impact is a significant driver for the IT asset-disposition market. In the US, e-waste is projected to reach 9.4 million tons by 2025, highlighting the urgent need for responsible disposal methods. Companies are increasingly recognizing their corporate social responsibility to manage e-waste effectively. This trend is likely to propel the market as organizations seek certified disposal services that comply with environmental standards. The it asset-disposition market is expected to expand as businesses invest in sustainable practices to mitigate their environmental footprint.

Technological Integration

The integration of advanced technologies into the IT asset-disposition market is reshaping how organizations manage their retired assets. Innovations such as artificial intelligence and blockchain are being utilized to enhance tracking and reporting of disposed assets. These technologies provide transparency and accountability, which are crucial for compliance and sustainability efforts. As organizations increasingly adopt these technologies, the it asset-disposition market is likely to see a surge in demand for tech-enabled services. This trend suggests a shift towards more efficient and secure asset management practices, potentially leading to a more streamlined disposition process.

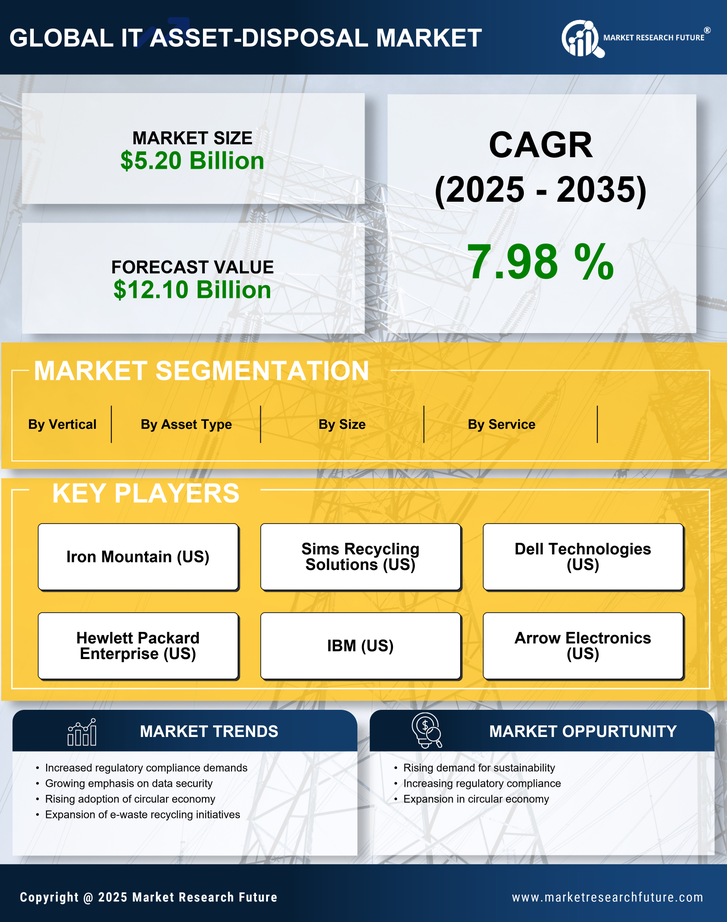

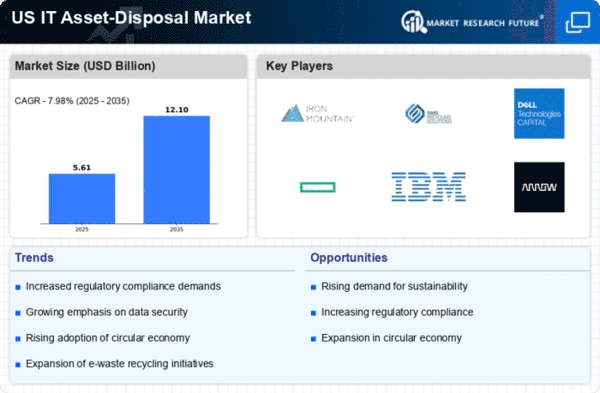

Regulatory Compliance Pressure

the IT asset-disposition market is increasingly influenced by regulatory compliance requirements. Organizations are mandated to adhere to various federal and state regulations regarding data protection and environmental sustainability. For instance, the Federal Information Security Management Act (FISMA) necessitates that federal agencies implement stringent security measures for data disposal. This regulatory landscape compels businesses to engage in proper asset disposition practices, ensuring that sensitive information is irretrievably destroyed. As a result, the market is projected to grow at a CAGR of approximately 10% over the next five years, driven by the need for compliance with these regulations.