Expansion of Automotive Sector

The automotive sector's expansion in the US is significantly influencing the lead acid-battery market. With the increasing production of vehicles, particularly in the light-duty segment, the demand for lead acid batteries is expected to rise. In 2023, the US automotive industry produced around 13 million vehicles, with a substantial portion relying on lead acid batteries for starting, lighting, and ignition (SLI) applications. This trend suggests that the lead acid-battery market will continue to thrive as automotive manufacturers seek reliable and cost-effective battery solutions to meet consumer demands. Furthermore, the ongoing development of hybrid vehicles may further bolster the market, as lead acid batteries are often used in conjunction with other battery technologies.

Regulatory Support for Battery Recycling

The lead acid-battery market is positively impacted by regulatory support for battery recycling initiatives in the US. The Environmental Protection Agency (EPA) has established guidelines that promote the recycling of lead acid batteries, which not only helps in reducing environmental hazards but also encourages the sustainable use of resources. In 2023, approximately 99% of lead acid batteries were recycled, showcasing the effectiveness of these regulations. This high recycling rate indicates a strong commitment to sustainability within the lead acid-battery market, as it allows manufacturers to recover valuable materials and reduce production costs. Consequently, this regulatory framework is likely to enhance the market's growth prospects.

Increased Use in Renewable Energy Systems

The integration of lead acid batteries in renewable energy systems is becoming more prevalent, driven by the need for efficient energy storage solutions. As the US aims to enhance its energy independence and reduce reliance on fossil fuels, lead acid batteries are being increasingly utilized in off-grid and grid-tied renewable energy applications. The lead acid-battery market is likely to see growth as these batteries offer a balance of performance and affordability, making them suitable for various renewable energy projects. In 2023, the market for energy storage systems in the US was valued at approximately $4 billion, with lead acid batteries playing a crucial role in this segment, thereby indicating a promising outlook for the industry.

Rising Demand in Telecommunications Sector

The telecommunications sector's growth is driving demand for lead acid batteries, particularly for backup power applications. As the US continues to expand its telecommunications infrastructure, the need for reliable power sources becomes increasingly critical. Lead acid batteries are widely used in uninterruptible power supply (UPS) systems to ensure continuous operation during power outages. In 2023, the telecommunications industry in the US invested over $30 billion in infrastructure development, which is expected to further increase the demand for lead acid batteries. This trend suggests that the lead acid-battery market will continue to benefit from the telecommunications sector's expansion, as these batteries provide a dependable and cost-effective solution for maintaining service continuity.

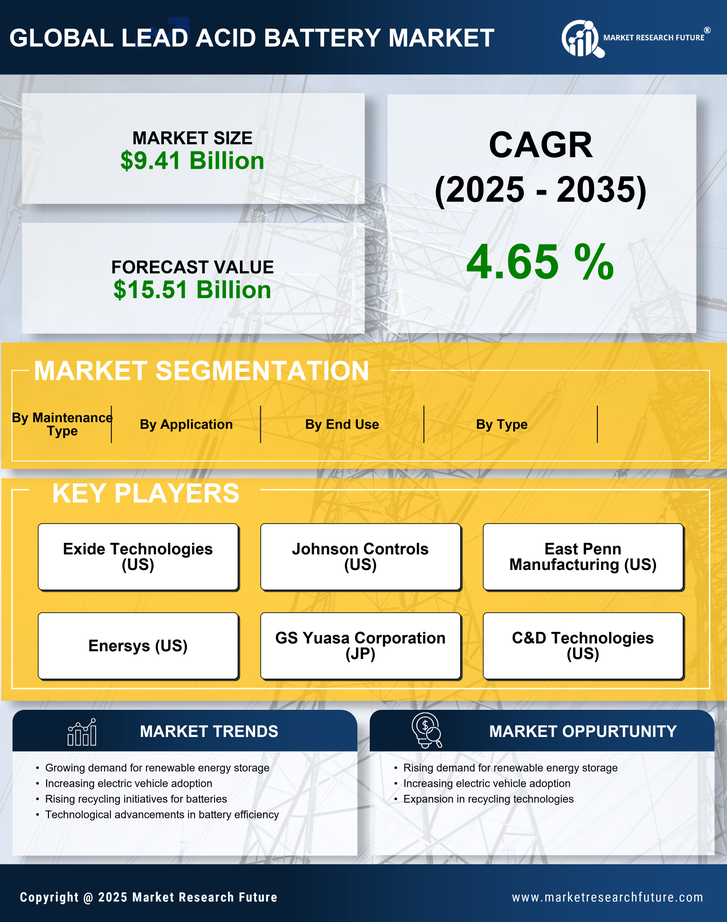

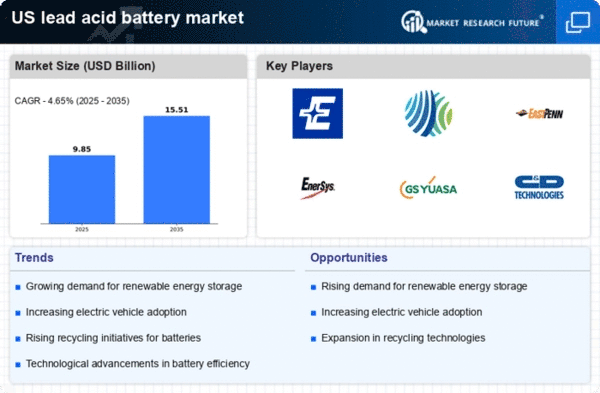

Growing Demand for Renewable Energy Storage

The lead acid-battery market is experiencing a notable surge in demand due to the increasing need for energy storage solutions, particularly in renewable energy applications. As the US transitions towards more sustainable energy sources, lead acid batteries are being utilized for storing energy generated from solar and wind systems. This trend is supported by the fact that the US solar energy capacity reached approximately 121 GW in 2023, indicating a robust market for energy storage solutions. The lead acid-battery market is likely to benefit from this growth, as these batteries provide a cost-effective and reliable means of energy storage, thus enhancing the overall efficiency of renewable energy systems.