Regulatory Push for Accountability

The learning analytics market is influenced by a regulatory push for accountability in educational outcomes. Policymakers are increasingly mandating that educational institutions demonstrate measurable improvements in student performance, which necessitates the use of analytics to track progress. This regulatory environment compels institutions to adopt learning analytics solutions that can provide evidence of effectiveness and compliance with educational standards. As a result, the market is witnessing a shift towards tools that not only analyze data but also facilitate reporting and accountability, thereby driving growth in the learning analytics market.

Rising Focus on Student Engagement

A rising focus on student engagement is shaping the learning analytics market, as educators seek to understand and enhance the factors that contribute to student involvement in the learning process. Analytics tools that measure engagement levels, participation rates, and interaction patterns are becoming essential for institutions aiming to foster a more engaging learning environment. This trend is supported by research indicating that higher engagement correlates with improved academic performance. Consequently, the demand for analytics solutions that provide insights into student engagement is likely to increase, further propelling the growth of the learning analytics market.

Growing Demand for Data-Driven Insights

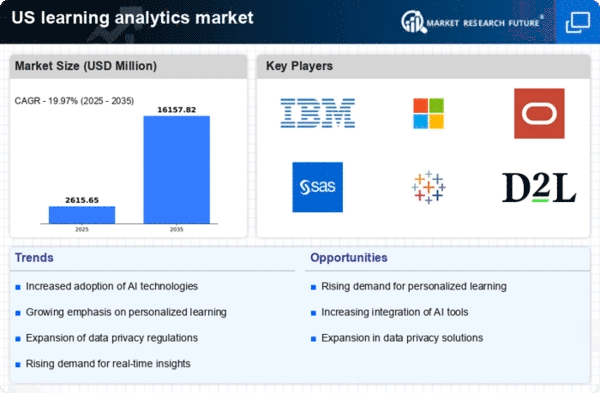

The learning analytics market is experiencing a notable surge in demand for data-driven insights, as educational institutions increasingly recognize the value of leveraging data to enhance student outcomes. This trend is evidenced by a projected growth rate of approximately 25% annually, driven by the need for actionable insights that inform teaching strategies and curriculum development. Institutions are investing in analytics tools to track student performance, engagement, and retention, thereby fostering a culture of continuous improvement. The emphasis on data-driven decision-making is reshaping the learning analytics market, as stakeholders seek to harness the power of analytics to create personalized learning experiences and improve overall educational effectiveness.

Emergence of Adaptive Learning Technologies

The emergence of adaptive learning technologies is a transformative driver in the learning analytics market. These technologies utilize analytics to tailor educational experiences to individual student needs, thereby enhancing learning outcomes. As adaptive learning solutions gain traction, educational institutions are increasingly adopting analytics tools that support personalized learning pathways. This shift is reflected in the market's projected growth, with adaptive learning expected to account for a substantial share of the overall learning analytics market. The integration of adaptive technologies not only improves student engagement but also positions institutions to better address diverse learning styles and paces.

Increased Investment in Educational Technology

Investment in educational technology is a significant driver of the learning analytics market, with funding for EdTech solutions reaching an estimated $20 billion in the US. This influx of capital is facilitating the development and deployment of advanced analytics tools that provide educators with critical insights into student learning behaviors. As schools and universities allocate more resources towards technology integration, the demand for sophisticated analytics solutions is likely to rise. This trend not only enhances the learning experience but also positions institutions to better meet the diverse needs of their student populations, thereby propelling the growth of the learning analytics market.