Focus on Vehicle Safety Regulations

The US Led Fog Lamp Market is significantly influenced by stringent vehicle safety regulations imposed by government authorities. These regulations mandate the use of advanced lighting systems to enhance visibility and reduce accidents during foggy or low-light conditions. The National Highway Traffic Safety Administration (NHTSA) has been actively promoting the adoption of LED fog lamps as they provide superior illumination compared to conventional lighting options. This regulatory push is expected to drive the market, as automakers are increasingly incorporating LED fog lamps into their vehicle designs to comply with safety standards. Furthermore, the growing awareness among consumers regarding the importance of vehicle safety is likely to bolster demand for LED fog lamps. As a result, the US Led Fog Lamp Market is poised for growth, with manufacturers focusing on developing products that meet these regulatory requirements while also appealing to safety-conscious consumers.

Rise of Electric and Hybrid Vehicles

The increasing popularity of electric and hybrid vehicles is reshaping the US Led Fog Lamp Market. As more consumers opt for eco-friendly transportation options, automakers are integrating advanced LED lighting solutions into their electric and hybrid models. LED fog lamps are particularly appealing due to their energy efficiency, which aligns with the sustainability goals of electric vehicle manufacturers. Data indicates that the sales of electric vehicles in the US have been steadily rising, with projections suggesting that they could account for over 30% of total vehicle sales by 2030. This shift towards electrification is likely to drive demand for LED fog lamps, as manufacturers seek to enhance the overall performance and aesthetic appeal of their vehicles. Consequently, the US Led Fog Lamp Market is expected to benefit from this trend, as consumers increasingly prioritize energy-efficient lighting solutions in their vehicle purchases.

Technological Advancements in Lighting

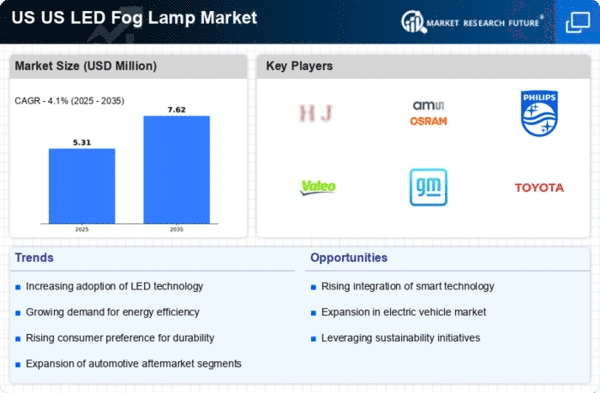

The US Led Fog Lamp Market is experiencing a surge due to rapid technological advancements in lighting solutions. Innovations such as adaptive lighting systems and smart fog lamps are enhancing visibility and safety during adverse weather conditions. The integration of LED technology has led to improved energy efficiency, with LED fog lamps consuming significantly less power compared to traditional halogen lamps. According to recent data, the market for LED fog lamps is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is driven by the increasing demand for high-performance lighting solutions that offer longer lifespans and reduced maintenance costs. As manufacturers continue to invest in research and development, the US Led Fog Lamp Market is likely to witness the introduction of more advanced products that cater to the evolving needs of consumers.

Consumer Preference for Aesthetic Appeal

The US Led Fog Lamp Market is also being driven by changing consumer preferences towards aesthetic appeal in vehicle design. Modern consumers are increasingly seeking vehicles that not only perform well but also look visually appealing. LED fog lamps offer a sleek and modern design that enhances the overall appearance of vehicles. This trend is particularly evident among younger consumers who prioritize style and aesthetics in their purchasing decisions. As a result, automakers are incorporating LED fog lamps into their designs to attract this demographic. Market data suggests that vehicles equipped with LED lighting systems, including fog lamps, tend to have higher resale values, further incentivizing manufacturers to adopt these technologies. The growing emphasis on aesthetics is likely to propel the US Led Fog Lamp Market, as consumers continue to demand innovative and stylish lighting solutions for their vehicles.

Increased Awareness of Environmental Impact

The US Led Fog Lamp Market is witnessing growth due to heightened awareness of environmental issues among consumers. As individuals become more conscious of their carbon footprint, there is a growing preference for energy-efficient products, including LED fog lamps. These lamps consume significantly less energy compared to traditional lighting options, contributing to reduced greenhouse gas emissions. Furthermore, the longevity of LED fog lamps means less frequent replacements, which aligns with sustainable consumption practices. Government initiatives promoting energy efficiency and sustainability are also playing a role in this trend. Data indicates that the market for energy-efficient lighting solutions is expected to expand, with LED technology leading the way. As consumers increasingly prioritize environmentally friendly products, the US Led Fog Lamp Market is likely to experience sustained growth, driven by the demand for eco-conscious lighting solutions.