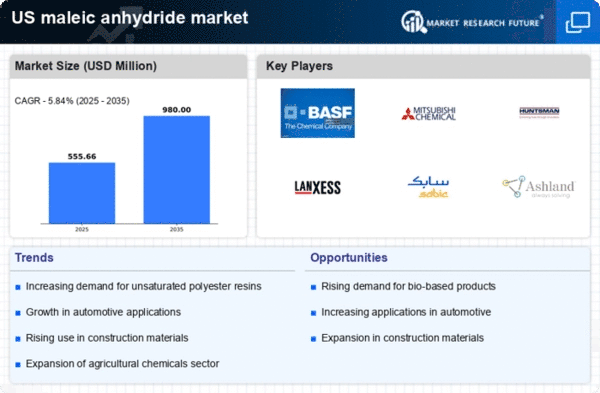

The maleic anhydride market exhibits a competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for unsaturated polyester resins (UPR) in the automotive and construction sectors, alongside the rising focus on sustainable chemical processes. Major companies such as BASF SE (Germany), Huntsman Corporation (US), and Mitsubishi Chemical Corporation (Japan) are strategically positioned to leverage these trends. BASF SE (Germany) emphasizes innovation through its commitment to sustainable production methods, while Huntsman Corporation (US) focuses on expanding its product portfolio to cater to diverse industrial applications. Mitsubishi Chemical Corporation (Japan) appears to be enhancing its operational efficiency through digital transformation initiatives, collectively shaping a competitive environment that prioritizes sustainability and technological advancement.Key business tactics within the market include localizing manufacturing to reduce logistics costs and optimizing supply chains to enhance responsiveness to market demands. The competitive structure is moderately fragmented, with a few dominant players exerting considerable influence. This fragmentation allows for niche players to thrive, yet the collective strength of major companies like SABIC (Saudi Arabia) and Ashland Global Holdings Inc. (US) ensures that competition remains robust and dynamic.

In October Huntsman Corporation (US) announced the expansion of its maleic anhydride production capacity at its facility in Texas. This strategic move is likely to enhance its market share and meet the growing demand for UPRs, particularly in the automotive sector. By increasing production capabilities, Huntsman positions itself to capitalize on the anticipated growth in applications requiring high-performance materials.

In September BASF SE (Germany) launched a new line of bio-based maleic anhydride products, aligning with global sustainability trends. This initiative not only reflects BASF's commitment to reducing its carbon footprint but also caters to the increasing consumer preference for environmentally friendly products. The introduction of bio-based alternatives may provide BASF with a competitive edge in a market that is progressively leaning towards sustainable solutions.

In August Mitsubishi Chemical Corporation (Japan) entered into a strategic partnership with a leading technology firm to enhance its digital capabilities in production processes. This collaboration aims to integrate AI and IoT technologies into its manufacturing operations, potentially leading to improved efficiency and reduced operational costs. Such advancements may allow Mitsubishi to respond more swiftly to market changes and customer needs, reinforcing its competitive position.

As of November current competitive trends are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming pivotal in shaping the landscape, enabling companies to pool resources and expertise. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in the evolving market.