Regulatory Compliance and Standards

The medical image-management market is significantly influenced by the need for regulatory compliance and adherence to industry standards. In the US, organizations such as the FDA and HIPAA impose stringent regulations on medical imaging practices, ensuring patient safety and data security. Compliance with these regulations necessitates the adoption of advanced image-management solutions that can facilitate secure data handling and storage. As healthcare facilities strive to meet these regulatory requirements, the demand for compliant image-management systems is likely to increase. This trend is expected to contribute to a market growth rate of approximately 7% annually, as facilities invest in technologies that align with regulatory standards.

Rising Incidence of Chronic Diseases

The medical image-management market is affected by the rising incidence of chronic diseases, such as cardiovascular disorders and cancer. As the prevalence of these conditions increases, the demand for diagnostic imaging services is also on the rise. Medical imaging plays a crucial role in the early detection and management of chronic diseases, leading to a greater need for efficient image-management solutions. The market is projected to grow at a rate of around 9% annually, driven by the increasing volume of imaging studies required for chronic disease management. This trend underscores the importance of effective image-management systems in supporting healthcare providers in delivering timely and accurate diagnoses.

Increased Focus on Patient-Centric Care

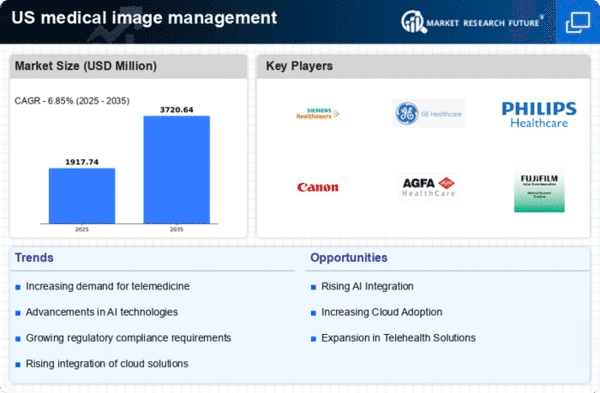

The medical image-management market is evolving in response to an increased focus on patient-centric care. Healthcare providers are prioritizing patient engagement and satisfaction, which necessitates the implementation of efficient image-management systems. These systems enable patients to access their medical images and reports easily, fostering transparency and communication between patients and providers. As a result, healthcare organizations are investing in user-friendly image-management solutions that enhance the patient experience. This shift towards patient-centric care is expected to drive market growth, with projections indicating a CAGR of approximately 6% over the next few years, as facilities seek to improve patient outcomes through better access to imaging data.

Growing Demand for Telemedicine Solutions

The medical image-management market is witnessing a growing demand for telemedicine solutions, driven by the increasing need for remote patient monitoring and consultations. Telemedicine enables healthcare providers to access and share medical images efficiently, facilitating timely diagnoses and treatment plans. This trend is particularly relevant in rural and underserved areas, where access to specialized care may be limited. The market for telemedicine is projected to expand significantly, with estimates suggesting a growth rate of around 10% annually. As telemedicine becomes more integrated into healthcare delivery, the demand for robust image-management systems that support remote access is likely to rise, further propelling market growth.

Technological Advancements in Imaging Techniques

The medical image-management market is experiencing a surge in technological advancements, particularly in imaging techniques such as MRI, CT, and ultrasound. These innovations enhance diagnostic accuracy and efficiency, leading to improved patient outcomes. For instance, the integration of 3D imaging and real-time visualization capabilities is becoming increasingly prevalent. As a result, healthcare providers are investing in advanced imaging systems, which is projected to drive market growth. The market is expected to reach approximately $5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. This growth is indicative of the increasing reliance on sophisticated imaging technologies in clinical settings.