Supportive Regulatory Environment

The US Medical Lasers Market is supported by a favorable regulatory environment that facilitates the approval and commercialization of new laser technologies. Regulatory bodies, such as the Food and Drug Administration (FDA), have established streamlined processes for the evaluation of medical lasers, which encourages innovation and market entry. This supportive framework not only enhances the safety and efficacy of laser devices but also instills confidence among healthcare providers and patients. As regulatory pathways continue to evolve, the US Medical Lasers Market is likely to experience accelerated growth, with new products entering the market to meet the increasing demand for advanced laser therapies.

Growing Awareness of Laser Treatments

The US Medical Lasers Market is benefiting from a growing awareness of the effectiveness and safety of laser treatments among both healthcare professionals and patients. Educational initiatives and marketing efforts have played a crucial role in disseminating information about the advantages of laser therapies, leading to increased patient inquiries and demand. As more individuals become informed about the potential benefits of laser treatments for various medical and aesthetic applications, the market is expected to expand. This heightened awareness is likely to encourage healthcare providers to invest in advanced laser technologies, thereby contributing to the overall growth of the US Medical Lasers Market.

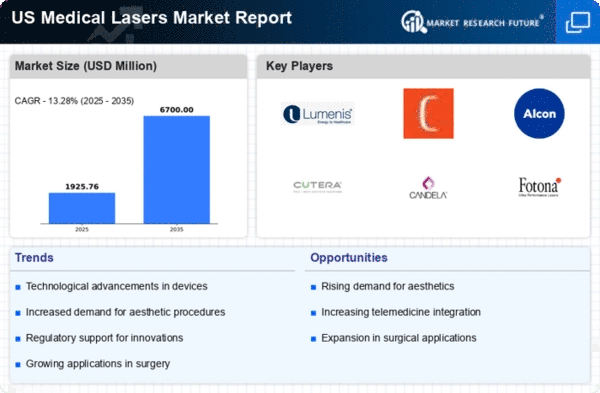

Rising Demand for Aesthetic Procedures

The US Medical Lasers Market is experiencing a notable increase in demand for aesthetic procedures, driven by a growing societal emphasis on physical appearance. Non-invasive and minimally invasive treatments, such as laser hair removal and skin resurfacing, are becoming increasingly popular among consumers. According to recent data, the aesthetic segment of the medical lasers market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This trend is further fueled by advancements in laser technology, which enhance treatment efficacy and patient satisfaction. As more individuals seek cosmetic enhancements, the US Medical Lasers Market is likely to expand, presenting opportunities for manufacturers and healthcare providers to innovate and cater to evolving consumer preferences.

Increasing Prevalence of Chronic Diseases

The US Medical Lasers Market is significantly influenced by the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions. These diseases often require advanced treatment options, including laser therapies for effective management. For instance, laser treatments are utilized in ophthalmology for diabetic retinopathy and in dermatology for vascular lesions. The market for medical lasers is projected to reach USD 5 billion by 2026, reflecting a growing recognition of laser technology's role in treating chronic conditions. As healthcare providers increasingly adopt laser-based solutions, the US Medical Lasers Market is poised for substantial growth, driven by the need for innovative and effective treatment modalities.

Technological Innovations in Laser Systems

Technological innovations are a key driver of the US Medical Lasers Market, as advancements in laser systems enhance treatment capabilities and patient outcomes. New laser technologies, such as fractional lasers and picosecond lasers, offer improved precision and reduced recovery times for patients. These innovations not only expand the range of treatable conditions but also increase the efficiency of procedures. The integration of artificial intelligence and machine learning into laser systems is also emerging, potentially revolutionizing treatment protocols. As these technologies continue to evolve, the US Medical Lasers Market is likely to witness increased adoption rates among healthcare providers, further propelling market growth.