US Methyl Isobutyl Ketone Market Summary

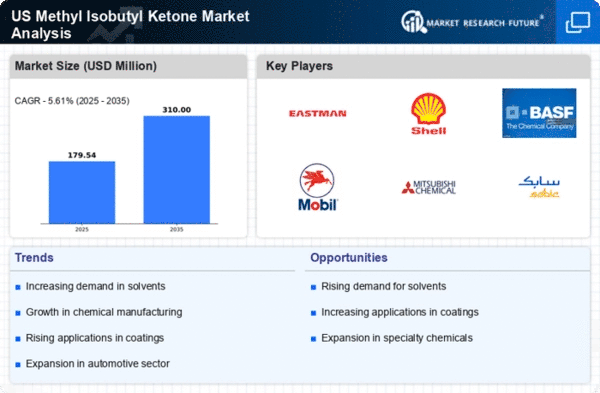

As per Market Research Future analysis, the US methyl isobutyl-ketone market Size was estimated at 170.0 USD Million in 2024. The US methyl isobutyl-ketone market is projected to grow from 179.54 USD Million in 2025 to 310.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US methyl isobutyl-ketone market is poised for growth driven by sustainability and technological advancements.

- Sustainability initiatives are increasingly influencing production processes in the methyl isobutyl-ketone market.

- Technological advancements are enhancing the efficiency of methyl isobutyl-ketone production, potentially lowering costs.

- The automotive sector emerges as the largest segment, while the paint and coatings industry is recognized as the fastest-growing segment.

- Rising demand in the automotive sector and regulatory support for solvent use are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 170.0 (USD Million) |

| 2035 Market Size | 310.0 (USD Million) |

| CAGR (2025 - 2035) | 5.61% |

Major Players

Eastman Chemical Company (US), Shell Chemicals (GB), BASF SE (DE), ExxonMobil Chemical (US), Mitsubishi Chemical Corporation (JP), SABIC (SA), LyondellBasell Industries (NL), Huntsman Corporation (US)