Regulatory Support and Frameworks

The microinsurance market in the US benefits from evolving regulatory support aimed at fostering innovation and accessibility. Recent legislative efforts have focused on creating a conducive environment for microinsurance providers, encouraging the development of products that meet the needs of low-income individuals. For instance, the introduction of simplified licensing processes and consumer protection regulations has facilitated market entry for new players. This regulatory landscape is crucial for the microinsurance market, as it not only enhances consumer trust but also promotes competition, ultimately leading to better product offerings and pricing for consumers.

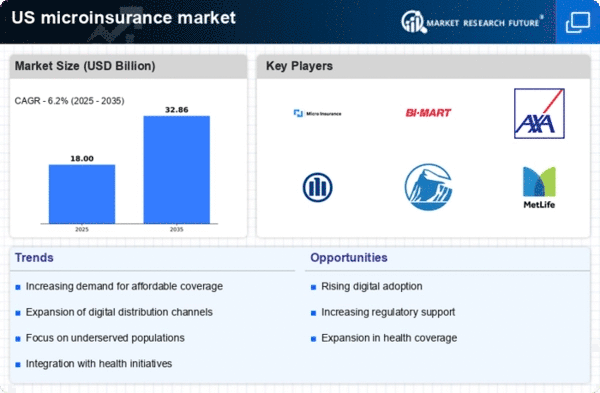

Rising Demand for Affordable Coverage

The microinsurance market in the US is experiencing a notable increase in demand for affordable insurance solutions. As economic disparities persist, a growing segment of the population seeks low-cost insurance options that provide essential coverage. This trend is particularly evident among low-income households, where traditional insurance products may be financially out of reach. According to recent data, approximately 30% of US households are underinsured, highlighting a significant opportunity for microinsurance providers to fill this gap. The microinsurance market is thus positioned to cater to this demand, offering tailored products that address the unique needs of underserved communities.

Partnerships with Community Organizations

The microinsurance market in the US is increasingly characterized by strategic partnerships with community organizations. These collaborations are essential for reaching target demographics that may otherwise remain unaware of available insurance options. By working with local nonprofits and community groups, microinsurance providers can effectively disseminate information and build trust within communities. This approach not only enhances the visibility of microinsurance products but also fosters a sense of community engagement. The microinsurance market is likely to see growth as these partnerships facilitate access to insurance for underserved populations.

Increased Awareness and Financial Literacy

There is a growing awareness of microinsurance products among consumers in the US, driven by initiatives aimed at improving financial literacy. Educational programs and community outreach efforts have played a pivotal role in informing potential customers about the benefits of microinsurance. As financial literacy improves, more individuals are likely to recognize the value of these products, leading to increased uptake. The microinsurance market stands to gain from this trend, as informed consumers are more inclined to seek out affordable insurance solutions that meet their specific needs.

Technological Advancements in Distribution

Technological advancements are reshaping the distribution channels within the microinsurance market in the US. The rise of digital platforms and mobile applications has enabled microinsurance providers to reach a broader audience, particularly in remote or underserved areas. Data indicates that over 50% of consumers now prefer online channels for purchasing insurance products. This shift towards digitalization allows for more efficient customer engagement and streamlined processes, which are essential for the microinsurance market. As technology continues to evolve, it is likely that innovative distribution methods will further enhance accessibility and affordability of microinsurance products.

Leave a Comment