Rising Pet Ownership Rates

The increasing trend of pet ownership in the US appears to be a significant driver for the milk replacers market. As more households adopt pets, particularly dogs and cats, the demand for specialized nutrition products, including milk replacers, is likely to rise. According to recent statistics, approximately 70% of US households own a pet, which translates to over 90 million homes. This growing pet population necessitates the availability of high-quality milk replacers to support the health and growth of young animals. The milk replacers market is thus positioned to benefit from this trend, as pet owners seek reliable nutrition solutions for their pets, particularly during the critical early stages of life.

Expansion of E-commerce Platforms

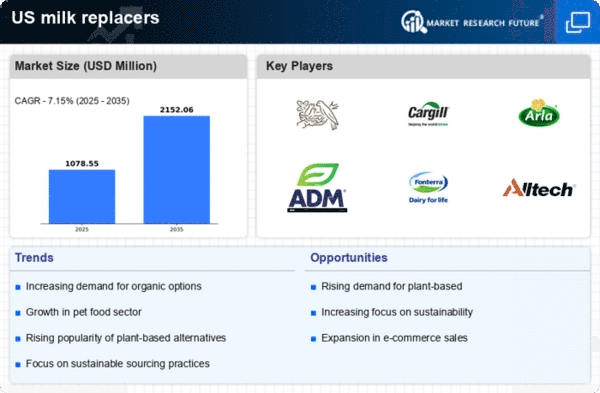

The expansion of e-commerce platforms in the US is transforming the way consumers access pet nutrition products, including milk replacers. With the convenience of online shopping, pet owners can easily compare products, read reviews, and make informed purchasing decisions. This shift towards digital retailing is likely to drive sales in the milk replacers market, as consumers increasingly prefer the ease of online transactions. Reports indicate that e-commerce sales in the pet food sector have surged, with a notable increase of over 30% in recent years. The milk replacers market stands to gain from this trend, as online platforms provide a broader reach and accessibility to a diverse range of products.

Growing Demand for Organic Products

The increasing consumer preference for organic products is influencing the milk replacers market in the US. As more pet owners seek organic and natural options for their pets, the demand for organic milk replacers is likely to rise. This trend reflects a broader shift towards healthier and more sustainable choices in pet nutrition. Market data indicates that organic pet food sales have experienced a growth rate of approximately 15% annually, suggesting a robust market for organic milk replacers. The milk replacers market is thus adapting to this demand by offering organic formulations that align with consumer values, potentially enhancing market competitiveness.

Regulatory Support for Animal Health

Regulatory support for animal health and nutrition in the US is emerging as a crucial driver for the milk replacers market. Government initiatives aimed at improving animal welfare and health standards are likely to encourage the use of high-quality milk replacers. The US Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have established guidelines that promote the use of safe and effective nutritional products for young animals. This regulatory framework not only ensures consumer safety but also fosters innovation within the milk replacers market, as manufacturers are motivated to develop products that meet stringent quality standards.

Increased Awareness of Animal Nutrition

There is a growing awareness among pet owners regarding the importance of proper nutrition for their animals, which is likely to positively impact the milk replacers market. Educational campaigns and resources have made pet owners more informed about the nutritional needs of their pets, particularly during infancy. This heightened awareness suggests that consumers are more inclined to invest in premium milk replacers that offer essential nutrients for growth and development. The milk replacers market is responding to this trend by introducing innovative products that cater to the specific dietary requirements of various animal species, thereby enhancing market growth opportunities.