Focus on Cost Efficiency and ROI

Cost efficiency remains a pivotal driver in the mobile unified-communication-collaboration market. Organizations are increasingly scrutinizing their communication expenditures and seeking solutions that offer a strong return on investment (ROI). In 2025, it is expected that 40% of companies will prioritize cost-effective communication tools that do not compromise on quality. This focus on ROI is indicative of a broader trend towards financial prudence in business operations. Companies are looking for solutions that not only reduce costs but also enhance productivity and collaboration among employees. As a result, mobile communication solutions that demonstrate clear financial benefits are likely to gain traction in the market, influencing purchasing decisions and shaping vendor offerings.

Advancements in Mobile Technology

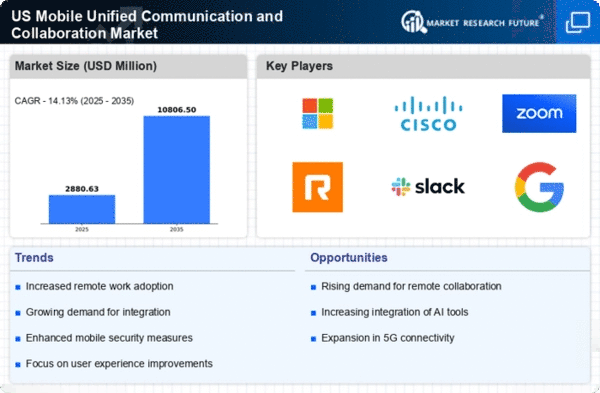

Technological advancements in mobile devices significantly influence the mobile unified-communication-collaboration market. The proliferation of 5G technology enhances connectivity, enabling faster data transmission and improved user experiences. As of November 2025, it is estimated that 5G adoption in the US will reach 60%, facilitating high-quality video calls and real-time collaboration. This technological evolution allows businesses to leverage mobile applications that support complex communication needs, thereby fostering a more agile workforce. Furthermore, the integration of advanced features such as augmented reality (AR) and virtual reality (VR) into mobile communication tools is likely to reshape user interactions. These advancements not only improve functionality but also enhance user engagement, making mobile communication solutions more appealing to organizations.

Rising Importance of Data Analytics

Data analytics plays a crucial role in shaping the mobile unified-communication-collaboration market. Organizations are increasingly leveraging data to gain insights into communication patterns and employee engagement. By analyzing usage data, companies can identify areas for improvement and optimize their communication strategies. In 2025, it is anticipated that 30% of organizations will implement data-driven decision-making processes in their communication practices. This trend suggests that businesses are not only focused on the tools themselves but also on how to utilize data to enhance their effectiveness. The integration of analytics into mobile communication solutions allows organizations to tailor their offerings to meet specific needs, thereby improving overall user satisfaction and productivity.

Growing Emphasis on Employee Collaboration

The mobile unified-communication-collaboration market is witnessing a growing emphasis on employee collaboration. Organizations are increasingly recognizing the value of collaborative tools that enable teams to work together effectively, regardless of their physical location. In 2025, it is projected that investments in collaboration software will increase by 20%, reflecting a shift towards fostering teamwork and innovation. This trend is particularly relevant in industries where project-based work is prevalent, as effective collaboration can lead to improved outcomes and faster project completion. The focus on collaboration tools is indicative of a broader cultural shift within organizations, where teamwork and collective problem-solving are prioritized. As a result, mobile communication solutions that facilitate collaboration are becoming essential components of organizational strategies.

Increased Demand for Real-Time Communication

The mobile unified-communication-collaboration market experiences heightened demand for real-time communication solutions. As businesses increasingly rely on instant messaging, video conferencing, and collaborative tools, the need for seamless integration across mobile platforms becomes paramount. In 2025, the market is projected to grow by approximately 15%, driven by the necessity for efficient communication in a fast-paced business environment. Companies are seeking solutions that enhance productivity and facilitate quick decision-making, which is essential in maintaining competitive advantage. This trend indicates a shift towards mobile-first strategies, where organizations prioritize mobile accessibility in their communication tools. The ability to communicate effectively in real-time is not merely a preference but a requirement for success in today's dynamic market landscape.