Enhanced Safety Awareness

The motorcycle insurance market is positively influenced by heightened safety awareness among riders. Educational campaigns and safety training programs have been instrumental in promoting responsible riding practices, which in turn affects insurance premiums. Insurers often reward riders who complete safety courses with lower rates, thereby encouraging more individuals to participate in such programs. This trend is reflected in a 10% reduction in accident rates among trained riders, leading to fewer claims and lower costs for insurance providers. As safety awareness continues to grow, the motorcycle insurance market may experience a shift towards more competitive pricing structures, benefiting both insurers and consumers.

Increasing Motorcycle Ownership

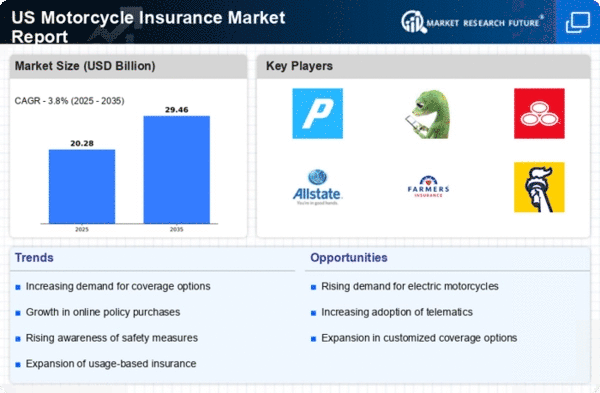

The motorcycle insurance market is experiencing growth due to a notable increase in motorcycle ownership across the United States. As more individuals opt for motorcycles as a primary mode of transportation or leisure activity, the demand for insurance coverage rises correspondingly. Recent data indicates that motorcycle registrations have surged by approximately 5% annually, reflecting a growing trend among consumers. This increase in ownership not only expands the customer base for insurance providers but also necessitates tailored insurance products that cater to diverse rider needs. Consequently, the motorcycle insurance market is likely to see a significant uptick in policy sales, as new riders seek to protect their investments and ensure compliance with state regulations.

Regulatory Developments and Compliance

The motorcycle insurance market is influenced by ongoing regulatory developments that shape the landscape of insurance requirements. State regulations regarding minimum coverage levels and mandatory insurance can vary significantly, impacting how insurers structure their policies. Recent legislative changes have introduced stricter compliance measures, compelling insurers to adapt their offerings to meet new standards. This regulatory environment creates both challenges and opportunities for the motorcycle insurance market, as companies must navigate compliance while also innovating to attract customers. As regulations evolve, the market may witness a shift towards more comprehensive coverage options that align with legal requirements.

Technological Advancements in Insurance

This market is being transformed by technological advancements that streamline the insurance process. Innovations such as telematics and mobile applications allow insurers to gather real-time data on rider behavior, enabling personalized insurance plans. This data-driven approach not only enhances risk assessment but also fosters a more engaged customer experience. For instance, riders can monitor their riding habits and receive feedback, potentially leading to lower premiums for safe driving. As technology continues to evolve, the motorcycle insurance market is likely to see increased adoption of these tools, which could lead to more efficient operations and improved customer satisfaction.

Economic Factors Influencing Insurance Costs

The motorcycle insurance market is subject to fluctuations driven by various economic factors. Changes in the economy, such as inflation rates and disposable income levels, can significantly impact insurance premiums. For instance, a rise in disposable income may lead to increased motorcycle purchases, subsequently driving up demand for insurance. Conversely, economic downturns could result in higher claim rates, prompting insurers to adjust their pricing strategies. Recent trends suggest that the average premium for motorcycle insurance has increased by approximately 7% over the past year, reflecting these economic pressures. As such, the motorcycle insurance market must remain agile to adapt to these economic shifts.