Growing Geriatric Population

The expanding geriatric population in the US is a crucial driver for the nasal splints market. As individuals age, they often experience a higher incidence of nasal and respiratory issues, necessitating effective treatment solutions. The elderly population is particularly susceptible to conditions that may require surgical intervention, leading to an increased demand for nasal splints during recovery. Current demographic trends indicate that by 2030, nearly 20% of the US population will be aged 65 and older. This demographic shift suggests a corresponding rise in the need for nasal splints, as healthcare systems adapt to cater to the unique needs of older patients. Consequently, the nasal splints market is poised for growth as it aligns with the healthcare demands of this expanding demographic.

Increase in Surgical Procedures

The rise in surgical procedures, particularly those related to nasal and sinus surgeries, significantly impacts the nasal splints market. As surgical techniques advance and become more common, the need for post-operative care solutions, such as nasal splints, becomes increasingly critical. Data suggests that the number of nasal surgeries performed annually in the US has seen a steady increase, with estimates indicating a growth rate of around 5% per year. This trend is likely to continue, as more patients opt for surgical interventions to address chronic nasal issues. Consequently, the nasal splints market is expected to benefit from this surge in surgical activity, as healthcare professionals increasingly utilize nasal splints to aid in recovery and ensure optimal healing outcomes.

Growing Awareness of Nasal Health

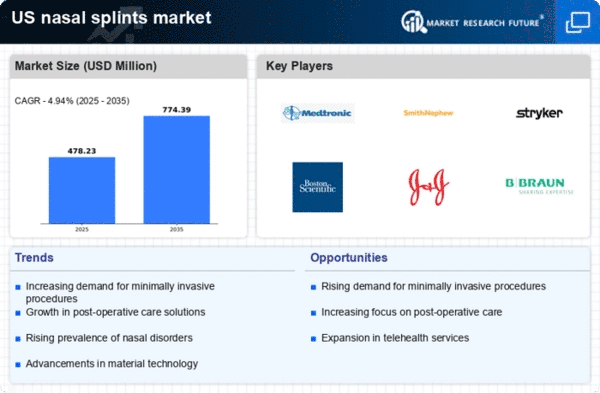

The increasing awareness regarding nasal health among the population is a pivotal driver for the nasal splints market. As individuals become more informed about the implications of nasal conditions, there is a corresponding rise in demand for effective treatment options. This heightened awareness is reflected in the growing number of educational campaigns and health initiatives aimed at promoting nasal health. Consequently, healthcare providers are more frequently recommending nasal splints as a viable solution for various nasal issues. Market data indicates that the nasal splints market is projected to grow at a CAGR of approximately 6% over the next five years, driven by this awareness. The emphasis on preventive care and early intervention further propels the demand for nasal splints, as patients seek to address nasal problems before they escalate.

Advancements in Material Technology

Innovations in material technology are transforming the nasal splints market, offering enhanced comfort and effectiveness. The development of biocompatible materials and customizable designs allows for improved patient experiences and outcomes. These advancements enable manufacturers to produce nasal splints that are not only functional but also comfortable for prolonged use. As healthcare providers increasingly prioritize patient comfort, the demand for these advanced nasal splints is expected to rise. Market analysis indicates that the introduction of new materials could potentially increase market share by up to 15% over the next few years, as patients and healthcare professionals alike seek out superior options that enhance recovery and minimize discomfort.

Rising Incidence of Allergies and Respiratory Disorders

The escalating incidence of allergies and respiratory disorders in the US is a significant driver for the nasal splints market. With environmental factors contributing to a rise in conditions such as allergic rhinitis and sinusitis, there is a growing need for effective management solutions. Nasal splints are often recommended to alleviate symptoms and support nasal passages during treatment. Recent statistics indicate that approximately 30% of adults in the US suffer from allergies, which correlates with an increased demand for nasal splints. This trend suggests that as the prevalence of these conditions continues to rise, the nasal splints market will likely expand to meet the needs of affected individuals seeking relief and improved quality of life.