Market Consolidation

Market consolidation is emerging as a significant trend within the octg market, as companies seek to enhance their competitive positioning through mergers and acquisitions. This trend is driven by the need for operational efficiencies and expanded market reach. In 2025, it is projected that the number of key players in the octg market will decrease by approximately 15%, leading to a more concentrated market landscape. Such consolidation may result in increased investment in research and development, enabling companies to innovate and offer superior products. Furthermore, this trend could lead to improved supply chain management, ultimately benefiting end-users in the oil and gas sector.

Rising Energy Demand

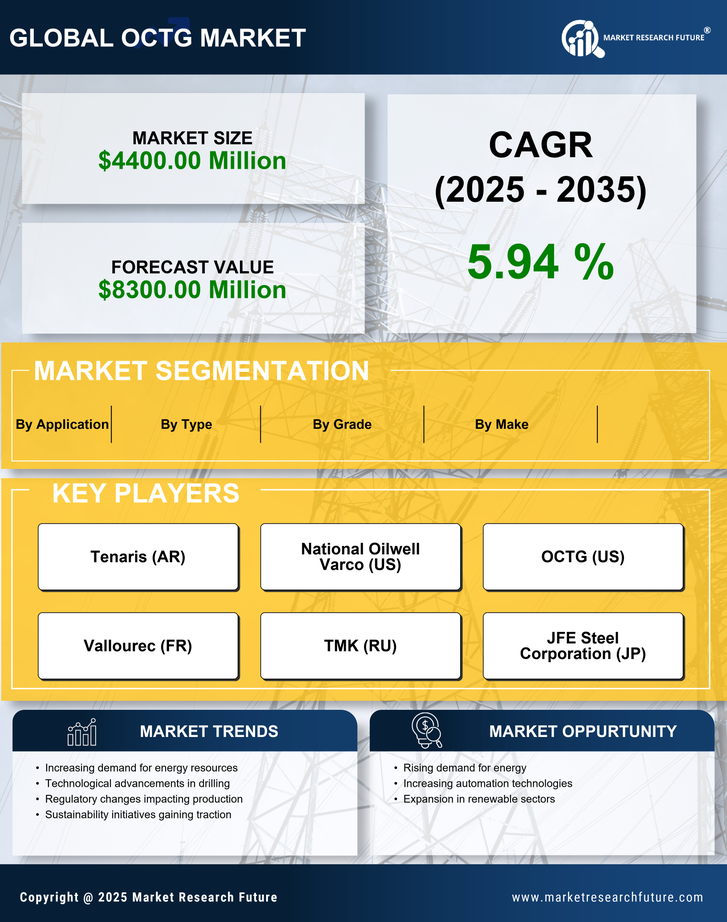

The octg market is experiencing a notable surge in demand driven by the increasing energy requirements across various sectors in the US. As the economy expands, the need for oil and gas production intensifies, leading to a higher consumption of oil country tubular goods (OCTG). In 2025, the US energy consumption is projected to rise by approximately 2.5%, which directly correlates with the demand for OCTG products. This growth is further fueled by the ongoing exploration and production activities in shale formations, which require advanced OCTG solutions. Consequently, manufacturers in the octg market are likely to invest in innovative technologies to meet this escalating demand, thereby enhancing their competitive edge.

Environmental Regulations

Environmental regulations are increasingly shaping the operational landscape of the octg market. As the US government implements stricter environmental policies, companies are compelled to adopt sustainable practices in their operations. In 2025, it is expected that compliance costs related to environmental regulations will rise by 20%, prompting manufacturers to invest in eco-friendly OCTG solutions. This shift not only addresses regulatory requirements but also aligns with the growing consumer demand for sustainable products. Consequently, the octg market is likely to see a rise in the development of environmentally friendly OCTG materials, which could enhance the industry's reputation and marketability.

Technological Innovations

Technological innovations are significantly influencing the octg market, as advancements in drilling and production techniques enhance efficiency and reduce costs. The adoption of smart technologies, such as IoT and AI, is transforming the way OCTG products are utilized in the field. In 2025, it is estimated that around 30% of OCTG manufacturers will integrate advanced technologies into their operations, leading to improved product quality and performance. These innovations not only optimize resource extraction but also contribute to sustainability efforts within the industry. As a result, the octg market is likely to evolve, with manufacturers focusing on developing high-performance OCTG solutions that meet the demands of modern energy production.

Infrastructure Development

Infrastructure development plays a pivotal role in shaping the octg market in the US. The government's commitment to enhancing energy infrastructure, including pipelines and refineries, is expected to bolster the demand for OCTG products. In 2025, the US is anticipated to allocate over $100 billion towards infrastructure projects, which will necessitate substantial quantities of OCTG for construction and maintenance. This investment not only supports the oil and gas sector but also stimulates job creation and economic growth. As infrastructure projects progress, the octg market is likely to witness increased orders for tubular goods, thereby driving revenue growth for manufacturers and suppliers.