Increased Exploration Activities

Heightened exploration activities in the US are driving the oil gas-separator market. As domestic energy production continues to expand, particularly in shale regions, the need for effective separation technologies becomes critical. The US Energy Information Administration (EIA) reports that crude oil production has reached unprecedented levels, necessitating advanced separation solutions to handle the increased output. This surge in exploration is likely to propel the oil gas-separator market, with estimates suggesting a growth rate of around 5% annually over the next five years. Companies are investing in innovative separation technologies to enhance efficiency and meet the growing demand.

Rising Demand for Energy Efficiency

The oil gas-separator market is experiencing a notable increase in demand for energy-efficient solutions. As energy costs continue to rise, companies are seeking technologies that minimize energy consumption while maximizing output. This trend is particularly pronounced in the US, where energy efficiency regulations are becoming more stringent. The market for oil gas-separators is projected to grow as operators look for systems that not only separate oil and gas effectively but also reduce operational costs. In 2025, the energy efficiency segment is expected to account for approximately 30% of the total market share, indicating a significant shift towards sustainable practices in the oil and gas industry.

Focus on Environmental Sustainability

Environmental sustainability is becoming a pivotal driver for the oil gas-separator market. With increasing public awareness and regulatory pressures regarding environmental impacts, companies are compelled to adopt greener technologies. There is a shift in the oil gas-separator market towards systems that minimize waste and emissions. In 2025, it is anticipated that environmentally friendly separators will constitute nearly 25% of the market, reflecting a broader industry commitment to sustainability. This trend is further supported by government incentives aimed at reducing carbon footprints, which could enhance the adoption of advanced separation technologies.

Growing Investment in Infrastructure Development

Investment in infrastructure development is a crucial driver for the oil gas-separator market. As the US government and private sector increase spending on energy infrastructure, the demand for efficient separation technologies is likely to rise. This investment is aimed at modernizing existing facilities and constructing new ones to support increased production capacities. The oil gas-separator market is projected to benefit from this trend, with infrastructure-related expenditures expected to reach $100 billion by 2026. This influx of capital is anticipated to stimulate innovation and enhance the overall efficiency of separation processes, thereby propelling market growth.

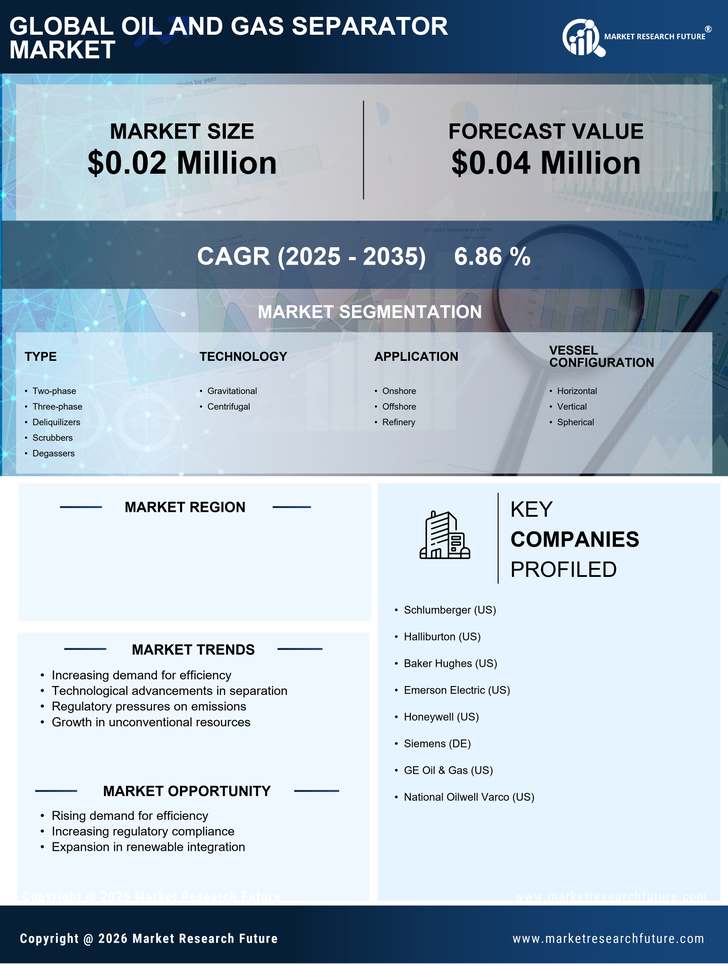

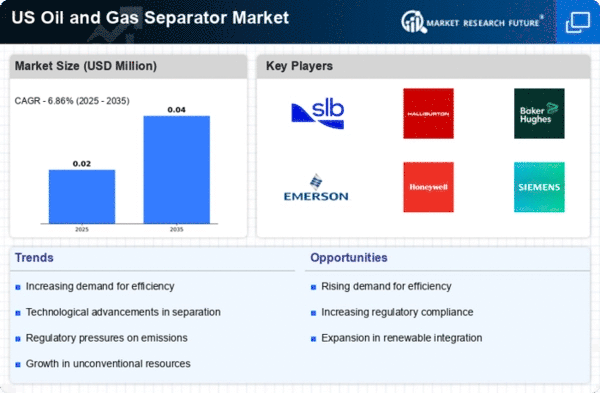

Technological Innovations in Separation Processes

Technological innovations are significantly influencing the oil gas-separator market. The introduction of advanced materials and processes is enhancing the efficiency and effectiveness of separation technologies. Innovations such as membrane separation and advanced filtration systems are gaining traction, offering improved performance over traditional methods. The market is expected to see a compound annual growth rate (CAGR) of approximately 6% as these technologies become more widely adopted. Companies are increasingly investing in research and development to create cutting-edge solutions that address the evolving needs of the oil and gas sector, thereby driving growth in the oil gas-separator market.