Emergence of Edge Computing

The rise of edge computing is transforming the open iot-platform market by enabling real-time data processing closer to the source of data generation. This shift is driven by the need for faster response times and reduced latency in IoT applications. As more devices become connected, the volume of data generated increases exponentially, necessitating efficient processing solutions. By 2025, it is anticipated that over 50% of IoT data will be processed at the edge, underscoring the importance of open platforms that can support edge computing architectures. The open iot-platform market stands to benefit from this trend, as organizations seek platforms that can seamlessly integrate edge capabilities while maintaining interoperability with cloud services.

Rising Demand for Smart Devices

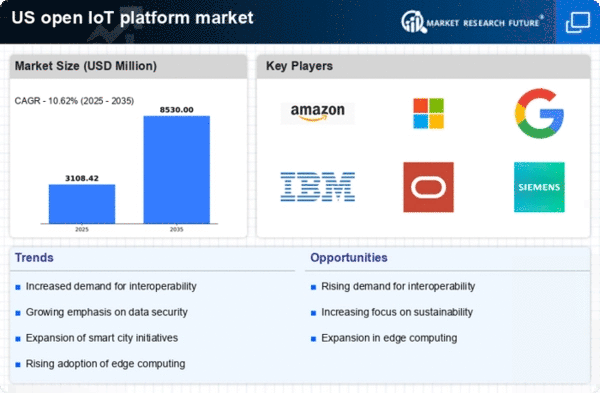

The increasing adoption of smart devices across various sectors is a primary driver for the open iot-platform market. As consumers and businesses alike seek to enhance efficiency and connectivity, the demand for platforms that can seamlessly integrate these devices is surging. In 2025, it is estimated that the number of connected devices in the US will exceed 30 billion, indicating a robust growth trajectory. This proliferation of smart devices necessitates open platforms that can facilitate interoperability and data exchange, thereby fostering innovation. The open iot-platform market is positioned to capitalize on this trend, as organizations look for solutions that can support diverse device ecosystems while ensuring scalability and flexibility.

Increased Focus on Data Analytics

The growing emphasis on data analytics is reshaping the landscape of the open iot-platform market. Organizations are increasingly recognizing the value of data generated by IoT devices, leading to a demand for platforms that can effectively analyze and interpret this information. In 2025, the market for IoT analytics is projected to reach $20 billion in the US, highlighting the critical role of data-driven decision-making. Open platforms that facilitate data collection, processing, and visualization are becoming essential tools for businesses seeking to gain insights and enhance operational efficiency. Consequently, the open iot-platform market is likely to experience significant growth as companies invest in analytics capabilities to harness the full potential of their IoT ecosystems.

Government Initiatives and Funding

Government initiatives aimed at promoting technological advancement and digital transformation are significantly influencing the open iot-platform market. In recent years, federal and state governments have allocated substantial funding to support smart city projects and IoT infrastructure development. For instance, the US government has invested over $1 billion in IoT-related initiatives, which is expected to drive the adoption of open platforms. These investments not only enhance public services but also encourage private sector participation in the open iot-platform market. As a result, the collaboration between government entities and private companies is likely to accelerate the development of innovative solutions that leverage open platforms for improved service delivery.

Growing Importance of Interoperability Solutions

The need for interoperability among diverse IoT devices and systems is a critical driver for the open iot-platform market. As organizations deploy a multitude of devices from various manufacturers, the challenge of ensuring seamless communication and data exchange becomes paramount. In 2025, it is estimated that interoperability solutions will account for a significant share of the open iot-platform market, as businesses prioritize platforms that can bridge the gaps between different technologies. This trend is likely to foster collaboration among vendors and encourage the development of standardized protocols, ultimately enhancing the overall functionality and user experience within the open iot-platform market.