Advancements in Regenerative Medicine

The field of regenerative medicine is rapidly evolving, contributing to the growth of the orthobiologics market. Innovations in stem cell therapy, tissue engineering, and growth factor applications are enhancing the efficacy of treatments for musculoskeletal injuries. These advancements not only improve patient outcomes but also reduce recovery times, making them attractive options for both patients and healthcare providers. The US market for regenerative medicine is expected to exceed $50 billion by 2026, indicating a robust interest in these technologies. As more practitioners adopt these cutting-edge therapies, the orthobiologics market is likely to benefit from increased investment and research, further driving its expansion.

Growing Awareness of Orthobiologics Benefits

There is a notable increase in awareness regarding the benefits of orthobiologics among both healthcare professionals and patients. Educational initiatives and marketing efforts are effectively communicating the advantages of these treatments, such as reduced recovery times and improved healing processes. This heightened awareness is leading to greater acceptance and utilization of orthobiologics in clinical practice. As a result, the orthobiologics market is experiencing a surge in demand, with projections indicating a market value of approximately $8 billion by 2025. The shift towards evidence-based practices is also encouraging healthcare providers to consider orthobiologics as a first-line treatment option, further solidifying their role in modern medicine.

Increasing Prevalence of Orthopedic Disorders

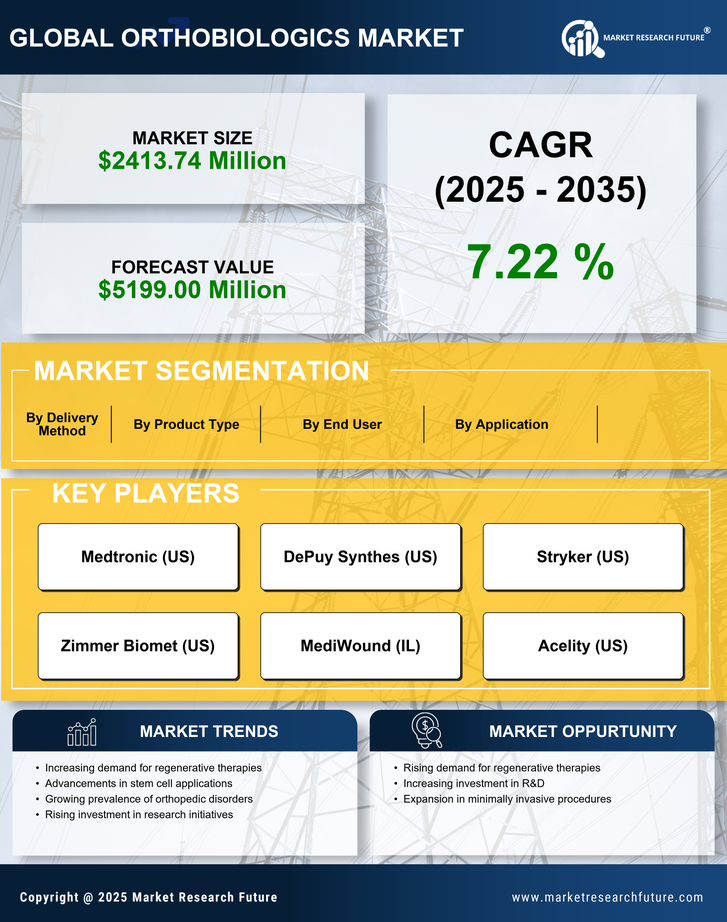

The rising incidence of orthopedic disorders in the US is a primary driver for the orthobiologics market. Conditions such as osteoarthritis, fractures, and sports injuries are becoming more common, leading to a growing demand for effective treatment options. According to recent estimates, approximately 30 million adults in the US suffer from osteoarthritis, which significantly impacts their quality of life. This increasing prevalence necessitates innovative solutions, thereby propelling the orthobiologics market forward. The market is projected to reach $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. As healthcare providers seek to address these challenges, the focus on orthobiologics as a viable treatment option is likely to intensify.

Increased Investment in Research and Development

Investment in research and development (R&D) within the orthobiologics market is on the rise, driven by the need for innovative solutions to address complex orthopedic challenges. Pharmaceutical companies and biotech firms are allocating substantial resources to develop new products and improve existing therapies. This trend is evidenced by the increase in clinical trials and collaborations between academic institutions and industry players. The US R&D expenditure in the healthcare sector is projected to reach $200 billion by 2026, with a significant portion directed towards orthobiologics. This influx of funding is likely to accelerate the introduction of novel therapies, thereby enhancing the overall growth trajectory of the orthobiologics market.

Aging Population and Demand for Joint Replacement

The aging population in the US is a critical factor influencing the orthobiologics market. As individuals age, the likelihood of developing joint-related issues increases, leading to a higher demand for joint replacement surgeries and alternative treatments. The US Census Bureau projects that by 2030, approximately 20% of the population will be 65 years or older, creating a substantial market for orthopedic solutions. This demographic shift is prompting healthcare providers to explore orthobiologics as a means to improve surgical outcomes and reduce the need for invasive procedures. Consequently, the orthobiologics market is expected to grow significantly, with estimates suggesting a market size of $12 billion by 2027.