Rising Incidence of Chronic Pain

The increasing prevalence of chronic pain conditions in the US is a primary driver for the pain patch market. According to recent data, approximately 20% of adults in the US experience chronic pain, which significantly influences the demand for effective pain management solutions. As the population ages, the incidence of conditions such as arthritis, fibromyalgia, and neuropathic pain is expected to rise, further propelling the need for innovative pain relief options. The pain patch market is likely to benefit from this trend, as patients seek alternatives to oral medications, which may have adverse side effects. This shift towards topical analgesics, including pain patches, is indicative of a broader movement towards personalized and patient-centric healthcare solutions.

Shift Towards Home Healthcare Solutions

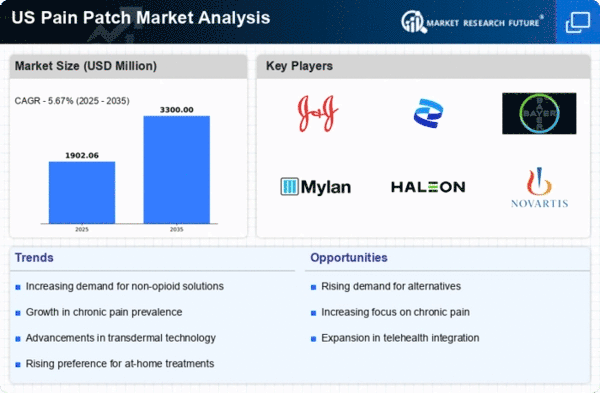

The trend towards home healthcare solutions is reshaping the pain patch market in the US. As patients increasingly prefer to manage their health conditions at home, the demand for convenient and easy-to-use pain relief products is on the rise. Pain patches, which offer localized treatment without the need for invasive procedures, align well with this trend. The market for home healthcare is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 7% in the coming years. This shift is likely to encourage manufacturers to innovate and develop more effective pain patch formulations, catering to the needs of patients seeking autonomy in their pain management. The pain patch market is poised to capitalize on this growing preference for home-based care.

Growing Awareness of Pain Management Options

There is a notable increase in awareness regarding various pain management options among healthcare providers and patients in the US. Educational initiatives and campaigns aimed at informing the public about the benefits of non-invasive pain relief methods are gaining traction. This heightened awareness is likely to drive the pain patch market, as patients become more informed about the efficacy and safety of pain patches compared to traditional pain relief methods. Furthermore, healthcare professionals are increasingly recommending pain patches as part of comprehensive pain management strategies, which could lead to a substantial increase in market penetration. The pain patch market is expected to see a surge in demand as more individuals seek effective and convenient solutions for their pain management needs.

Increased Investment in Research and Development

Investment in research and development (R&D) within the pain patch market is witnessing a significant uptick. Pharmaceutical companies and biotech firms are focusing on developing advanced formulations and delivery systems for pain patches. This investment is driven by the need for more effective pain management solutions that minimize side effects and enhance patient compliance. Recent reports indicate that R&D spending in the healthcare sector has increased by approximately 10% annually, reflecting a commitment to innovation. As new technologies emerge, such as smart patches that can deliver medication in response to real-time pain signals, the pain patch market is likely to experience substantial growth. This focus on R&D is essential for maintaining competitiveness and meeting the evolving needs of patients.

Regulatory Support for Innovative Pain Relief Products

Regulatory bodies in the US are increasingly supportive of innovative pain relief products, which is positively impacting the pain patch market. Recent initiatives aimed at expediting the approval process for new pain management therapies are encouraging manufacturers to bring their products to market more quickly. This regulatory environment fosters innovation and allows for the introduction of advanced pain patches that utilize novel ingredients and technologies. The potential for faster market entry is likely to stimulate competition among manufacturers, leading to a wider variety of options for consumers. As regulatory support continues to evolve, the pain patch market is expected to expand, providing patients with more effective and diverse pain management solutions.

.png)