US Pharmacy Market Overview

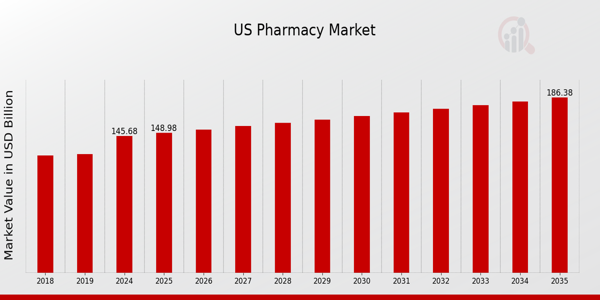

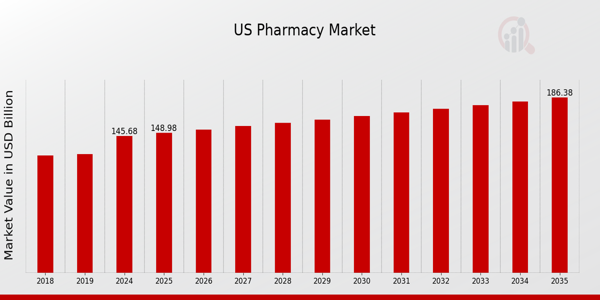

As per MRFR analysis, the US Pharmacy Market Size was estimated at 140.92 (USD Billion) in 2023. The US Pharmacy Market Industry is expected to grow from 145.68(USD Billion) in 2024 to 186.38 (USD Billion) by 2035. The US Pharmacy Market CAGR (growth rate) is expected to be around 2.265% during the forecast period (2025 - 2035).

Key US Pharmacy Market Trends Highlighted

The US pharmacy market is undergoing substantial transformations as a result of numerous critical market variables. The demand for prescription medications and pharmacist services is on the rise due to the increasing prevalence of chronic diseases and an aging population. In addition, the integration of technology into pharmacies is noteworthy, particularly with the emergence of telepharmacy services, which enable patients to access consultations and medications without the necessity of visiting a physical location.

Furthermore, the pharmacy's position as a healthcare provider has been enhanced by the expansion of accessible healthcare services, as a result of policies like the Affordable Care Act. This has resulted in increased foot traffic and service engagement.

The expansion of personalized medicine and the implementation of sophisticated data analytics to customize medication therapies for individual patients are potential opportunities for investigation. As the emphasis on improved patient outcomes increases, pharmacies that allocate resources to these sectors may acquire a competitive advantage.

The proliferation of e-pharmacy services is also noteworthy, as consumers continue to adopt online platforms for medication ordering, thereby establishing new distribution channels and transforming conventional pharmacy operating models. In recent years, pharmacies have evolved into destinations for healthcare advice and lifestyle management, as a result of trends such as the increased emphasis on health and wellness. Wellness services, immunizations, and health assessments are among the services that numerous pharmacies are incorporating into their offerings.

In addition, there has been a discernible shift in consumer preferences toward over-the-counter and natural remedies, which is indicative of a more generalized trend toward holistic healthcare practices. In general, the US pharmacy market is undergoing a rapid transformation, incorporating a combination of conventional pharmaceutical roles and innovative healthcare solutions.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

US Pharmacy Market Drivers

Increasing Prevalence of Chronic Diseases

The US Pharmacy Market Industry is experiencing significant growth driven by the rising prevalence of chronic diseases such as diabetes, hypertension, and heart disease. According to the Centers for Disease Control and Prevention (CDC), nearly 6 in 10 adults in the United States have a chronic disease, which corresponds to approximately 150 million people as of 2020. This increasing number of patients drives the demand for prescription medications and long-term care management, directly contributing to market growth.

Major pharmaceutical companies like Pfizer and Johnson & Johnson are actively engaged in developing new medications targeting these chronic conditions, further boosting the market. The urgency to manage chronic diseases effectively results in increased pharmacy visits and demand for prescription refills in the US, thereby propelling the US Pharmacy Market Industry.

Technological Advancements in Pharmacy Operations

Advancements in technology are reshaping the US Pharmacy Market Industry by enhancing the efficiency of pharmacy operations. With an increasing adoption of automated dispensing systems and electronic health records, pharmacies can better manage inventory, reduce dispensing errors, and improve patient safety. According to a report from the American Pharmacists Association, around 90% of pharmacies in the US are now using some form of electronic health record system, significantly improving operational workflows. Companies like CVS Health and Walgreens are at the forefront of these technological changes, implementing innovative pharmacy management systems to enhance customer service and operational efficiency.

This trend is expected to continue driving growth in the US Pharmacy Market Industry.

Aging Population and Increasing Demand for Health Services

The demographic shift towards an older population in the United States is a major driving factor for the US Pharmacy Market Industry. By 2030, it is projected that 20% of the US population will be over 65 years old, leading to an increase in healthcare consumption and the need for prescription medications. The Administration on Aging reports that the number of older adults is expected to rise from 52 million in 2018 to over 76 million by 2035. This aging demographic is prone to more health issues, which necessitates more medications and increased pharmacy visits.

Established organizations and pharmacies like Rite Aid have recognized this trend, adapting their services and product offerings to cater to the specific needs of elderly patients. This demographic shift is critically influencing the growth trajectory of the US Pharmacy Market Industry.

US Pharmacy Market Segment Insights

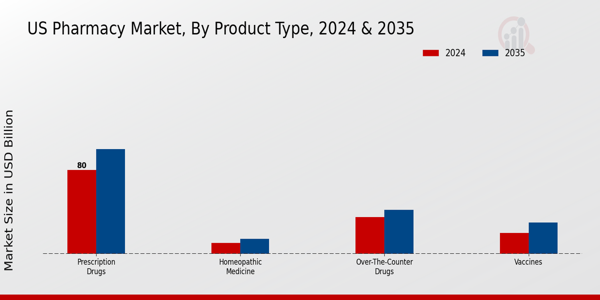

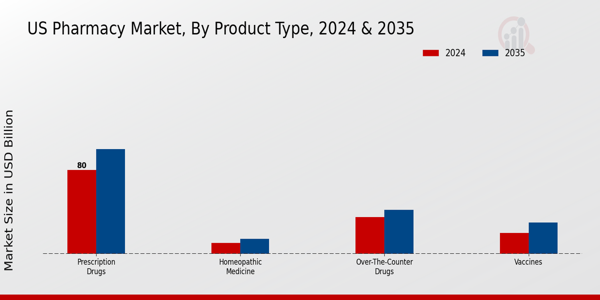

Pharmacy Market Product Type Insights

The US Pharmacy Market plays a critical role in healthcare, encompassing various product types that serve distinct consumer needs. Prescription drugs have long been the cornerstone of pharmacy sales, as they address chronic conditions and acute illnesses, with a significant portion of the population relying on these medications for ongoing treatment and management of conditions such as diabetes, hypertension, and mental health disorders. The growing prevalence of these diseases, coupled with advancements in pharmaceutical research and development, continues to bolster the demand for prescription medications across the United States.

Over-The-Counter (OTC) drugs represent another vital segment of the pharmacy landscape, catering to consumers seeking immediate relief from everyday ailments, such as headaches, colds, and allergies. The increasing trend of self-medication has empowered consumers to take charge of their health, resulting in a robust market for OTC products. Meanwhile, vaccines, which have gained immense focus due to recent public health initiatives, play a key role in disease prevention and community health. The growing awareness surrounding vaccine efficacy and the importance of immunization has led to increased vaccination rates, further solidifying this segment's significance within the pharmacy sector.

Homeopathic medicine is gradually capturing consumer interest as individuals turn towards natural remedies and alternative therapies. This segment reflects a growing trend toward holistic health approaches and personalized patient care, which resonate well with specific demographics prioritizing wellness and alternative healing methods. Overall, the diverse product types within the US Pharmacy Market illustrate the complexity and dynamism of the industry, adapting to consumer preferences and health trends while striving to provide essential healthcare solutions for the American population.

The concerted efforts of stakeholders in driving product innovation, ensuring accessibility, and raising awareness about health and wellness underline the immense potential for growth across these segments as they align with ongoing shifts in consumer behavior and health priorities. Furthermore, the regulatory landscape plays an integral role in shaping market dynamics, as compliance and safety regulations govern the pharmaceutical and pharmacy operations in the U.S. Market trends indicate a growing investment in technology, including e-pharmacy services and telehealth platforms, enhancing consumer experiences and access to medications.

The ongoing evaluation of these segments and responsive strategies to meet changing consumer expectations is essential for stakeholders seeking to harness opportunities for growth in this ever-evolving market. Consequently, ongoing research and awareness efforts will be key in addressing the unique challenges each product type faces, ensuring that the US Pharmacy Market continues to meet the diverse healthcare needs of its population.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Pharmacy Market Distribution Channel Insights

The Distribution Channel segment of the US Pharmacy Market plays a vital role in ensuring that medications and health products reach consumers effectively. Retail Pharmacies, which include numerous chain and independent stores, dominate this space due to their accessibility and convenience, often becoming the first point of contact for patients. Hospital Pharmacies are crucial for providing specialized medications to inpatients and ensuring they receive the proper treatment, thus maintaining a significant position in the overall healthcare ecosystem. Online Pharmacies have gained prominence, particularly as consumers increasingly prefer the convenience of home delivery and the ability to order medications discreetly.

This shift has been accelerated by the digital transformation and changing consumer behaviors in the US. Specialty Pharmacies focus on high-cost, complex medications that require special handling, making them indispensable for patients with chronic or severe conditions. The interplay between these channels is shaped by market dynamics, regulatory factors, and advances in technology, which together influence the US Pharmacy Market revenue and segmentation, showcasing its diversity and importance in overall healthcare delivery. Enhanced customer experiences, the convenience of access, and improved patient outcomes continue to drive growth across these diverse channels.

Pharmacy Market Therapeutic Area Insights

The US Pharmacy Market, focused on the Therapeutic Area, exhibits significant diversity, addressing critical health concerns across various domains. The segment is characterized by its key categories, such as Cardiovascular, Oncology, Diabetes, Neurology, and Infectious Diseases, each contributing to the overall market dynamics. Cardiovascular drugs remain essential due to the high prevalence of heart-related conditions, driving substantial research and development efforts in this area. Oncology stands out as a rapidly growing segment, with increasing incidence rates prompting continuous innovation in treatment options.

Diabetes care products are vital as the United States grapples with a growing epidemic of diabetes, necessitating an urgent focus on effective therapies and management solutions. Neurology, with its vast array of disorders including Alzheimer's and multiple sclerosis, reflects an urgent need for advanced treatment modalities. Lastly, Infectious Diseases maintain relevance, particularly in light of recent global health challenges, underscoring the necessity for ongoing advancements in vaccine and antibiotic development. Together, these segments shape the US Pharmacy Market landscape, reflecting the changing health priorities and demands of the population, fostering opportunities for market growth and evolution.

The US Pharmacy Market segmentation in this area demonstrates a robust integration of therapeutic innovation and patient care, aligning with national health priorities.

Pharmacy Market Formulation Insights

The Formulation segment of the US Pharmacy Market encompasses various delivery forms such as Tablets, Injectables, Topicals, and Liquids, each integral to patient care and treatment regimens. Tablets have historically been the most favored choice by patients and healthcare providers due to their ease of use and convenience, contributing significantly to the market growth. Injectables serve essential roles in treatments requiring immediate drug action, such as vaccines and biologics, and are critical in managing chronic diseases. Meanwhile, Topicals have gained traction for localized treatments, particularly in dermatology, where they offer targeted relief with minimal systemic exposure.

Liquids, including syrups and solutions, are particularly valuable in pediatrics and geriatrics, enabling easier administration. The US Pharmacy Market revenue reflects the growing preference for specialized formulations that cater to diverse patient needs, fostering innovation and competition among pharmaceutical developers. Overall, the effective use of varied forms aligns with trends toward personalized medicine, targeting specific patient populations, and enhancing therapeutic outcomes.

US Pharmacy Market Key Players and Competitive Insights:

The competitive landscape of the US Pharmacy Market is shaped by a multitude of factors, including the presence of large pharmaceutical distributors, retail pharmacy chains, and pharmacy benefit managers. This market comprises a wide array of stakeholders, each influencing how medications are delivered to consumers and how pharmacy services are rendered. The competition is intense, with key players striving to improve their service offerings, reduce operational costs, and enhance customer experiences.

Various trends, such as the rise of e-commerce in pharmaceutical sales, the increasing importance of specialized medications, and the evolution of healthcare policies, all contribute to the dynamic nature of this market. Moreover, mergers and acquisitions play a significant role, allowing companies to consolidate resources, access new technologies, and expand their geographic footprint, thereby intensifying the competition among existing players. AmerisourceBergen stands out as a pivotal player in the US Pharmacy Market, primarily focusing on pharmaceutical distribution and services. Its extensive network enables the company to achieve significant economies of scale, which enhances its competitive advantage.

The company leverages its solid relationships with pharmaceutical manufacturers and healthcare providers, ensuring a streamlined supply chain that effectively meets the demands of various healthcare settings. AmerisourceBergen’s capabilities in revealing market insights and data analytics also empower pharmacies to optimize their operations and improve patient outcomes.

Additionally, the company has strategically invested in advanced technology solutions, making it easier for pharmacies to manage inventory and access critical information needed for effective patient care. This strong positioning allows AmerisourceBergen to maintain its relevance and competitive edge in a rapidly evolving market. Humana, recognized for its significant impact in the US Pharmacy Market, focuses on providing comprehensive healthcare services, including pharmacy benefits management. Through its integrated approach, Humana facilitates smoother access to medications for its members, showcasing strengths like personalized service and an expansive formulary that includes a vast array of drugs.

The company has formed strategic partnerships and invested in innovative solutions to improve medication adherence and patient health outcomes. With a focus on enhancing the overall patient experience, Humana’s key services include robust care management programs and specialized pharmacy services. Notably, the company has engaged in mergers and acquisitions to bolster its market presence and expand its portfolio of offerings, allowing it to better serve various demographic segments. This strategic growth and commitment to quality position Humana as a formidable competitor in the US Pharmacy Market.

Key Companies in the US Pharmacy Market Include:

US Pharmacy Market Industry Developments

Recent developments in the US Pharmacy Market have seen significant activity, including advancements in telehealth and increasing partnerships among major players. Notably, in October 2023, Walmart announced a strategic partnership with Humana to enhance health services in their pharmacies, aiming to improve access for their customers. CVS Health has been expanding its digital health initiatives, aligning with the trend of merging traditional pharmacy services with advanced technology. In terms of mergers and acquisitions, AmerisourceBergen, in September 2023, announced the acquisition of a key distribution firm that consolidates its supply chain efficiency.

Walgreens Boots Alliance has also been focusing on reducing operational costs while enhancing its pharmacy services through various collaborations. The market valuation of companies like UnitedHealth Group and Cigna has shown substantial growth as they innovate their service offerings in line with evolving consumer demands and regulatory changes. McKesson, Cardinal Health, and others continue to navigate this dynamic environment, striving to optimize their logistical capabilities and improve patient care. Over the last few years, the integration of e-commerce through platforms like Amazon Pharmacy has disrupted traditional paradigms, contributing to a more competitive landscape within the US Pharmacy Market.

Pharmacy Market Segmentation Insights

Pharmacy Market Product Type Outlook

Pharmacy Market Distribution Channel Outlook

Pharmacy Market Therapeutic Area Outlook

Pharmacy Market Formulation Outlook

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

140.92(USD Billion)

|

|

Market Size 2024

|

145.68(USD Billion)

|

|

Market Size 2035

|

186.38(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

2.265% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

AmerisourceBergen, Humana, Kroger, UnitedHealth Group, CVS Health, Cigna, Optum, Cardinal Health, McKesson, Centene, Amazon Pharmacy, Rite Aid, Walgreens Boots Alliance, Walmart, Express Scripts

|

|

Segments Covered

|

Product Type, Distribution Channel, Therapeutic Area, Formulation

|

|

Key Market Opportunities

|

Telehealth integration, Specialty drug management, Personalized medicine innovations, E-commerce pharmacy growth, Health and wellness services expansion

|

|

Key Market Dynamics

|

pharmaceutical regulations, increasing chronic diseases, e-prescribing adoption, healthcare consolidations, and growing telepharmacy services

|

|

Countries Covered

|

US

|

Frequently Asked Questions (FAQ):

The US Pharmacy Market is expected to be valued at 186.38 USD billion by 2035.

The expected CAGR for the US Pharmacy Market from 2025 to 2035 is 2.265 %.

Prescription Drugs are expected to hold the largest market share, valued at 100.0 USD billion in 2035.

The market value for Over-The-Counter Drugs is expected to be 35.0 USD billion in 2024.

Key players include AmerisourceBergen, CVS Health, and Walgreens Boots Alliance, among others.

The market value for Vaccines is projected to reach 30.0 USD billion by 2035.

Homeopathic Medicine is expected to have a market value of 10.68 USD billion in 2024.

The market for Prescription Drugs is expected to grow from 80.0 USD Billion in 2024 to 100.0 USD billion in 2035.

Challenges include regulatory changes and increasing competition among key players.

The overall US Pharmacy Market is expected to increase from 145.68 USD Billion in 2024 to 186.38 USD Billion in 2035.