Emphasis on Patient-Centric Care

The US Pharmacy Management System Market is witnessing a paradigm shift towards patient-centric care, which is reshaping pharmacy operations. As healthcare moves towards a more holistic approach, pharmacies are increasingly focusing on personalized services and patient engagement. Pharmacy management systems are being designed to facilitate better communication between pharmacists and patients, enabling tailored medication management and counseling. This trend is supported by data indicating that patient satisfaction and adherence rates improve when pharmacies adopt patient-centric practices. Consequently, the emphasis on patient-centric care is likely to drive the adoption of advanced pharmacy management systems, further influencing the dynamics of the US Pharmacy Management System Market.

Increasing Demand for Automation

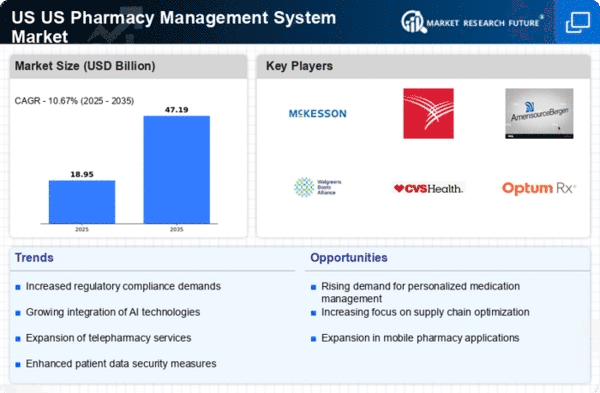

The US Pharmacy Management System Market is experiencing a notable shift towards automation, driven by the need for efficiency and accuracy in pharmacy operations. Automation technologies, such as robotic dispensing systems and automated inventory management, are being increasingly adopted to reduce human error and streamline workflows. According to recent data, the market for pharmacy automation is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2026. This trend indicates that pharmacies are prioritizing automation to enhance service delivery and patient safety, thereby transforming the operational landscape of the US Pharmacy Management System Market.

Growth of Chronic Disease Management

The rising prevalence of chronic diseases in the United States is significantly impacting the US Pharmacy Management System Market. With chronic conditions such as diabetes, hypertension, and cardiovascular diseases on the rise, pharmacies are becoming essential players in managing these health issues. Pharmacy management systems are being tailored to support medication therapy management (MTM) and patient adherence programs, which are crucial for improving health outcomes. Data indicates that the market for chronic disease management solutions within pharmacy systems is expanding, as pharmacies seek to provide comprehensive care and support to patients. This trend underscores the evolving role of pharmacies in the healthcare continuum and their contribution to the US Pharmacy Management System Market.

Regulatory Compliance and Standardization

The US Pharmacy Management System Market is heavily influenced by stringent regulatory requirements and the push for standardization. Compliance with regulations set forth by the Food and Drug Administration (FDA) and the Drug Enforcement Administration (DEA) is paramount for pharmacies. These regulations necessitate the implementation of robust management systems that ensure accurate record-keeping, secure medication dispensing, and adherence to safety protocols. As a result, pharmacies are increasingly investing in management systems that facilitate compliance, which is expected to drive market growth. The emphasis on standardization also promotes interoperability among systems, further enhancing the efficiency of pharmacy operations in the US.

Technological Advancements in Pharmacy Software

Technological advancements are reshaping the US Pharmacy Management System Market, with innovative software solutions enhancing operational capabilities. The integration of cloud-based systems, mobile applications, and advanced analytics is enabling pharmacies to optimize their services and improve patient engagement. For instance, cloud-based pharmacy management systems allow for real-time data access and collaboration among healthcare providers, which is increasingly vital in today's interconnected healthcare environment. The market for pharmacy software is projected to witness substantial growth, driven by the demand for enhanced functionalities and user-friendly interfaces. These advancements are likely to play a pivotal role in the future of the US Pharmacy Management System Market.