Rising Consumer Awareness

The plant based-meat market is experiencing a surge in consumer awareness regarding health and environmental impacts associated with traditional meat consumption. As individuals become more informed about the benefits of plant based diets, there is a notable shift in purchasing behavior. Reports indicate that approximately 60% of consumers in the US are actively seeking plant based alternatives, driven by concerns over health issues such as heart disease and obesity. This heightened awareness is fostering a growing demand for plant based products, compelling manufacturers to innovate and expand their offerings. Consequently, the plant based-meat market is likely to see continued growth as consumers prioritize healthier, sustainable options in their diets.

Changing Dietary Preferences

Changing dietary preferences among consumers are significantly influencing the plant based-meat market. A growing number of individuals are adopting flexitarian, vegetarian, or vegan lifestyles, driven by ethical considerations and health benefits. Surveys indicate that nearly 30% of Americans identify as flexitarians, often incorporating plant based options into their diets. This shift in dietary habits is prompting food manufacturers to diversify their product lines, catering to a broader audience. As a result, the plant based-meat market is likely to expand, with an increasing variety of products available to meet the evolving tastes and preferences of consumers.

Increased Retail Availability

Increased retail availability of plant based products is a crucial driver for the plant based-meat market. Major grocery chains and retailers are expanding their plant based offerings, making these products more accessible to consumers. Data shows that plant based meat sales have risen by over 25% in retail settings, reflecting a growing acceptance among mainstream shoppers. This trend is further supported by strategic partnerships between plant based brands and retailers, enhancing visibility and distribution. As more consumers encounter plant based options in their local stores, the likelihood of trial and adoption increases, thereby propelling the growth of the plant based-meat market.

Technological Advancements in Production

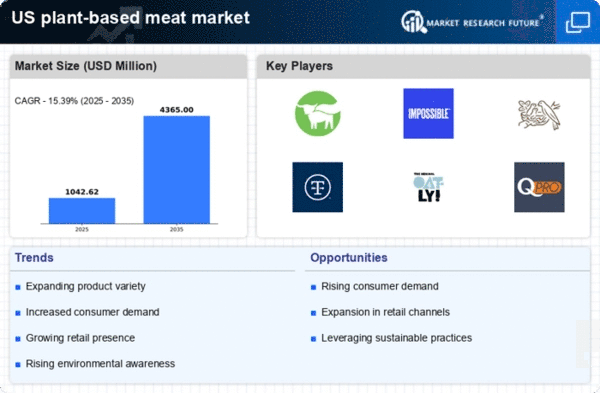

Technological advancements are playing a pivotal role in shaping the plant based-meat market. Innovations in food technology, such as improved extraction methods and flavor enhancement techniques, are enabling manufacturers to create products that closely mimic the taste and texture of traditional meat. For instance, the use of fermentation technology has led to the development of more palatable and nutritious plant based options. As a result, the market is projected to grow at a CAGR of 15% over the next five years, reflecting the increasing consumer acceptance of these products. This trend indicates that ongoing research and development will continue to enhance the appeal of plant based meats, further driving market expansion.

Regulatory Support and Policy Initiatives

Regulatory support and policy initiatives are emerging as significant drivers for the plant based-meat market. The US government has been increasingly promoting plant based diets through various programs aimed at reducing greenhouse gas emissions and improving public health. For example, initiatives encouraging plant based eating in schools and public institutions are gaining traction. This support not only raises awareness but also facilitates access to plant based products, thereby stimulating market growth. As policies evolve to favor sustainable food sources, the plant based-meat market is likely to benefit from enhanced visibility and consumer adoption, potentially leading to a market valuation exceeding $10 billion by 2027.

.png)