Advancements in Manufacturing Processes

Innovations in manufacturing processes are playing a crucial role in shaping the polymer dispersion market. The introduction of advanced techniques such as high-shear mixing and microfluidization enhances the quality and performance of polymer dispersions. These advancements allow for better control over particle size and distribution, leading to improved product characteristics. As manufacturers strive for higher efficiency and lower production costs, the polymer dispersion market is likely to benefit from these technological improvements. The ability to produce customized formulations tailored to specific applications further strengthens the market's position in various industries, including automotive and textiles.

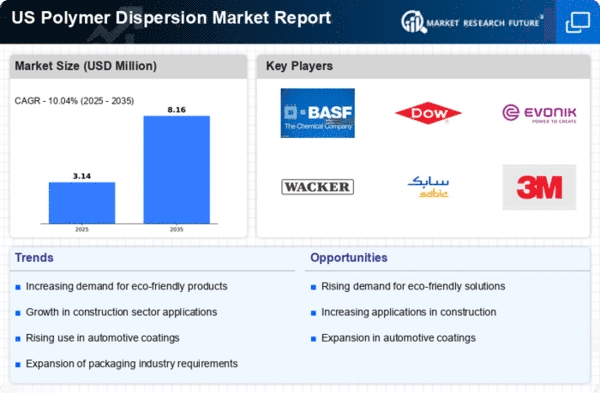

Rising Demand for Eco-Friendly Products

There is a notable increase in demand for eco-friendly products.. This trend is driven by heightened consumer awareness regarding environmental issues and a shift towards sustainable practices. Industries such as paints and coatings, and adhesives are increasingly adopting polymer dispersions that are low in volatile organic compounds (VOCs). In the US, the market for eco-friendly coatings is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030. This shift not only aligns with regulatory requirements but also caters to consumer preferences for greener alternatives, thereby propelling the polymer dispersion market forward.

Increased Application in Automotive Sector

The automotive sector is emerging as a significant application area for polymer dispersions, contributing to the market's expansion. With the growing emphasis on lightweight materials and fuel efficiency, manufacturers are increasingly utilizing polymer dispersions in coatings, adhesives, and sealants. The US automotive industry is projected to grow at a CAGR of around 4% through 2027, which may lead to a corresponding rise in the demand for polymer dispersions. These materials offer excellent adhesion, flexibility, and resistance to harsh environmental conditions, making them ideal for automotive applications. This trend indicates a promising future for the polymer dispersion market.

Regulatory Support for Low Emission Products

Regulatory frameworks in the US are increasingly favoring low emission products, which is positively impacting the polymer dispersion market. Government initiatives aimed at reducing VOC emissions and promoting sustainable manufacturing practices are encouraging industries to adopt polymer dispersions that comply with these regulations. The Environmental Protection Agency (EPA) has set stringent guidelines that are likely to drive the demand for compliant products. As industries adapt to these regulations, the polymer dispersion market is expected to witness growth, as manufacturers seek to innovate and develop products that meet environmental standards while maintaining performance.

Growth in Construction and Infrastructure Development

The polymer dispersion market is significantly influenced by the growth in construction and infrastructure development across the US. With the increasing investment in residential and commercial construction, the demand for high-performance coatings and adhesives is on the rise. The US construction industry is expected to reach a value of $1.8 trillion by 2026, which will likely drive the consumption of polymer dispersions. These materials are favored for their durability, adhesion properties, and resistance to environmental factors, making them essential in modern construction practices. Consequently, this growth in construction activities is a key driver for the polymer dispersion market.