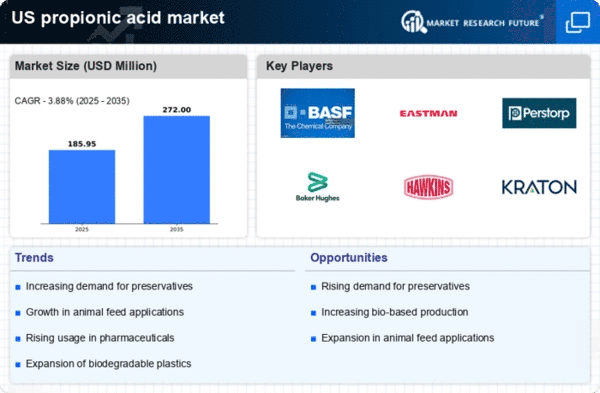

The propionic acid market exhibits a dynamic competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for propionic acid in food preservation, agriculture, and pharmaceuticals. Major companies such as BASF SE (Germany), Eastman Chemical Company (US), and Perstorp Holding AB (Sweden) are strategically positioned to leverage these trends. BASF SE (Germany) focuses on innovation and sustainability, investing in bio-based production methods to enhance its product portfolio. Eastman Chemical Company (US) emphasizes digital transformation and supply chain optimization, aiming to improve operational efficiency and customer engagement. Perstorp Holding AB (Sweden) is actively pursuing partnerships to expand its market reach and enhance its product offerings, particularly in the agricultural sector. Collectively, these strategies shape a competitive environment that is increasingly focused on sustainability and technological advancement.Key business tactics in the propionic acid market include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting influence over pricing and product availability. This fragmentation allows for niche players to thrive, while larger companies leverage economies of scale to maintain competitive pricing. The collective influence of these key players fosters a competitive atmosphere where innovation and operational efficiency are paramount.

In October BASF SE (Germany) announced the launch of a new bio-based propionic acid production facility in North America, aimed at reducing carbon emissions by 30%. This strategic move underscores BASF's commitment to sustainability and positions the company as a leader in environmentally friendly production methods. The facility is expected to enhance supply chain reliability and meet the growing demand for sustainable products in various applications.

In September Eastman Chemical Company (US) unveiled a digital platform designed to streamline customer interactions and improve order fulfillment processes. This initiative reflects Eastman's focus on digital transformation, which is likely to enhance customer satisfaction and operational efficiency. By integrating advanced analytics and AI, the company aims to optimize its supply chain and respond more effectively to market fluctuations.

In August Perstorp Holding AB (Sweden) entered into a strategic partnership with a leading agricultural firm to develop innovative solutions for crop protection using propionic acid derivatives. This collaboration is expected to expand Perstorp's product offerings and strengthen its position in the agricultural sector. The partnership highlights the growing trend of cross-industry collaborations aimed at addressing sustainability challenges in agriculture.

As of November current competitive trends in the propionic acid market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are shaping the landscape, enabling companies to pool resources and expertise to drive innovation. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability initiatives, and supply chain reliability. Companies that can effectively navigate these trends will likely secure a competitive edge in the evolving market.