Increasing Cancer Incidence

The rising incidence of cancer in the US is a primary driver for the radiotherapy market. According to the American Cancer Society, approximately 1.9 million new cancer cases are expected to be diagnosed in 2025. This alarming trend necessitates advanced treatment options, including radiotherapy, which is often a critical component of cancer management. As the population ages and lifestyle factors contribute to higher cancer rates, the demand for effective radiotherapy solutions is likely to increase. This growing patient population is expected to propel investments in radiotherapy technologies and facilities, thereby enhancing the overall radiotherapy market. Furthermore, the increasing awareness of early cancer detection and treatment options is likely to further stimulate market growth.

Growing Awareness and Education

Increasing awareness and education regarding cancer treatment options are driving the radiotherapy market. Public health campaigns and educational initiatives are informing patients about the benefits of radiotherapy as a treatment modality. As more individuals become aware of the effectiveness of radiotherapy in managing various cancers, the demand for these services is expected to rise. In 2025, surveys indicate that nearly 70% of patients diagnosed with cancer are likely to consider radiotherapy as part of their treatment plan. This heightened awareness is fostering a more informed patient population, which is likely to lead to increased consultations and treatment uptake in the radiotherapy market. As a result, healthcare providers may need to enhance their service offerings to meet this growing demand.

Government Initiatives and Funding

Government initiatives aimed at improving cancer care are playing a crucial role in the radiotherapy market. Federal and state programs are increasingly allocating funds to enhance cancer treatment infrastructure and research. For instance, the National Cancer Institute (NCI) has been instrumental in funding innovative research projects that focus on improving radiotherapy techniques. In 2025, government funding for cancer research is anticipated to exceed $6 billion, which is likely to benefit the radiotherapy market significantly. These initiatives not only support the development of new technologies but also aim to increase access to radiotherapy services across diverse populations. As a result, the radiotherapy market is expected to experience growth driven by enhanced funding and support from government entities.

Rising Demand for Outpatient Services

The shift towards outpatient treatment models is influencing the radiotherapy market. Patients increasingly prefer outpatient services due to their convenience and reduced hospital stays. This trend is supported by advancements in radiotherapy techniques that allow for shorter treatment durations and improved patient management. As of 2025, it is estimated that outpatient radiotherapy services will account for over 60% of total treatments administered in the US. This shift not only enhances patient satisfaction but also reduces healthcare costs, making radiotherapy more accessible. Consequently, the radiotherapy market is likely to expand as healthcare providers adapt to this demand for outpatient services, leading to the establishment of more outpatient radiotherapy centers.

Advancements in Radiotherapy Technology

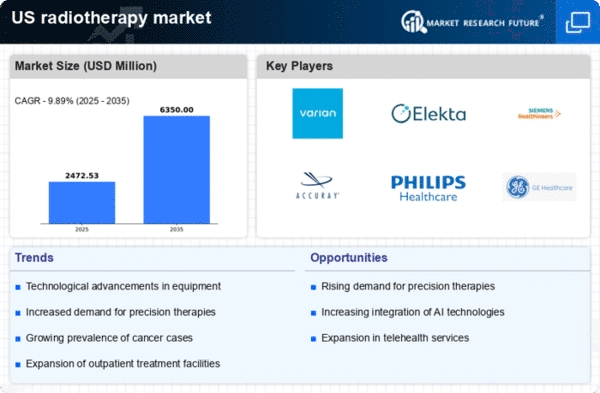

Technological innovations are significantly shaping the radiotherapy market. The introduction of advanced treatment modalities, such as intensity-modulated radiation therapy (IMRT) and stereotactic body radiation therapy (SBRT), has improved treatment precision and patient outcomes. These technologies allow for targeted delivery of radiation, minimizing damage to surrounding healthy tissues. As of 2025, the market for radiotherapy equipment is projected to reach approximately $7 billion, driven by the demand for state-of-the-art treatment options. Additionally, the integration of artificial intelligence and machine learning in treatment planning is expected to enhance the efficiency and effectiveness of radiotherapy, further propelling the market. The continuous evolution of technology in this field indicates a robust growth trajectory for the radiotherapy market.