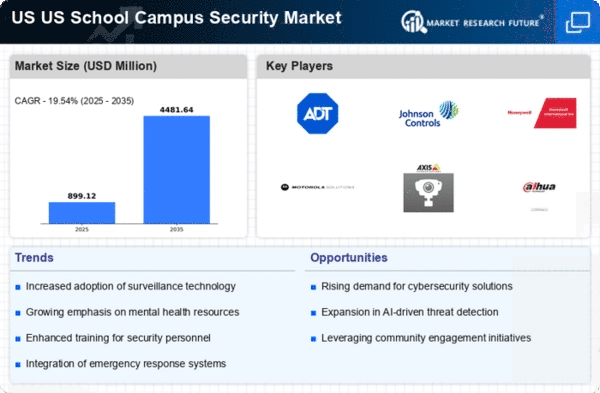

Growing Awareness of School Safety

There is a growing awareness regarding the importance of school safety within the US School Campus Security Market. Recent surveys indicate that parents, educators, and students are increasingly concerned about safety issues on campuses. This heightened awareness has led to a demand for more robust security solutions, including the installation of surveillance cameras and the employment of security personnel. According to the National Center for Education Statistics, nearly 20 percent of public schools reported having a security officer on site during the 2020-2021 school year. This trend suggests that educational institutions are prioritizing safety, which is likely to drive the market for security products and services in the coming years.

Focus on Comprehensive Safety Programs

The US School Campus Security Market is witnessing a shift towards comprehensive safety programs that encompass not only physical security but also mental health and crisis management. Schools are increasingly recognizing the importance of addressing the root causes of violence and insecurity. This holistic approach involves training staff in conflict resolution, implementing mental health resources, and fostering a supportive school environment. As educational institutions adopt these comprehensive safety programs, the demand for related security services and products is likely to increase. This trend suggests that the market will evolve to include a broader range of solutions aimed at ensuring the overall well-being of students and staff.

Increased Funding for Security Measures

The US School Campus Security Market is experiencing a notable increase in funding allocated for security measures. Federal and state governments are recognizing the necessity of enhancing safety protocols in educational institutions. For instance, the U.S. Department of Education has provided grants aimed at improving school security infrastructure. This financial support is likely to facilitate the adoption of advanced security technologies, such as surveillance systems and access control mechanisms. As a result, schools are better equipped to address potential threats, thereby fostering a safer learning environment. The increased funding not only aids in the implementation of physical security measures but also promotes the development of comprehensive emergency response plans, which are essential in today's educational landscape.

Legislative Support for Enhanced Security

Legislative measures aimed at enhancing school security are playing a crucial role in shaping the US School Campus Security Market. Various states have enacted laws mandating the implementation of specific security protocols in schools. For example, some states require schools to conduct regular safety drills and develop comprehensive emergency plans. These legislative initiatives not only promote a culture of safety but also create a framework for schools to follow, thereby increasing the demand for security solutions. As schools strive to comply with these regulations, the market for security technologies and services is expected to expand, providing opportunities for vendors and service providers.

Technological Advancements in Security Solutions

Technological advancements are significantly influencing the US School Campus Security Market. Innovations such as artificial intelligence, facial recognition, and advanced analytics are being integrated into security systems, enhancing their effectiveness. Schools are increasingly adopting these technologies to monitor activities and respond to incidents in real-time. For instance, the use of AI-driven surveillance cameras can help identify unusual behavior, allowing for timely intervention. The market for these advanced security solutions is projected to grow as educational institutions seek to leverage technology to improve safety. This trend indicates a shift towards more proactive security measures, which could redefine the landscape of school safety.