Advancements in Biologic Therapies

Innovations in biologic therapies represent a significant driver for the seropositive rheumatoid-arthritis-drug market. Biologics, which target specific components of the immune system, have transformed the treatment landscape for rheumatoid arthritis. The introduction of new biologic agents has been associated with improved patient outcomes, including reduced disease activity and enhanced quality of life. As of 2025, the market for biologics is projected to account for over 50% of the total rheumatoid arthritis drug sales in the US, indicating a strong preference for these therapies among both patients and healthcare providers. The seropositive rheumatoid-arthritis-drug market is thus poised for growth as more innovative biologics enter the market.

Enhanced Patient Access to Treatments

Improved patient access to treatments is a significant driver for the seropositive rheumatoid-arthritis-drug market. Initiatives aimed at reducing barriers to healthcare, such as expanded insurance coverage and patient assistance programs, are facilitating greater access to necessary medications. In 2025, it is projected that over 80% of patients with rheumatoid arthritis have access to some form of treatment, compared to 70% in previous years. This increase in accessibility is likely to lead to higher treatment adherence and improved health outcomes, thereby driving demand within the seropositive rheumatoid-arthritis-drug market. As more patients receive timely and effective treatment, the overall market is expected to expand.

Growing Demand for Combination Therapies

The trend towards combination therapies is emerging as a key driver for the seropositive rheumatoid-arthritis-drug market. Healthcare providers are increasingly recognizing the benefits of using multiple agents to achieve better disease control and minimize side effects. This approach is particularly relevant for patients who do not respond adequately to monotherapy. As of 2025, it is estimated that combination therapies account for nearly 30% of the total prescriptions in the rheumatoid arthritis treatment landscape. This shift in treatment paradigms is likely to stimulate growth in the seropositive rheumatoid-arthritis-drug market as pharmaceutical companies develop and market new combination products.

Increased Investment in Rheumatology Research

The surge in funding for rheumatology research is a crucial driver for the seropositive rheumatoid-arthritis-drug market. Public and private sectors are increasingly investing in research initiatives aimed at understanding the underlying mechanisms of rheumatoid arthritis and developing novel treatment options. In 2025, it is estimated that research funding in this area has reached approximately $500 million, reflecting a commitment to advancing therapeutic strategies. This influx of capital not only supports the development of new drugs but also enhances clinical trials, which are essential for bringing effective treatments to market. The seropositive rheumatoid-arthritis-drug market stands to benefit significantly from these research advancements.

Rising Prevalence of Seropositive Rheumatoid Arthritis

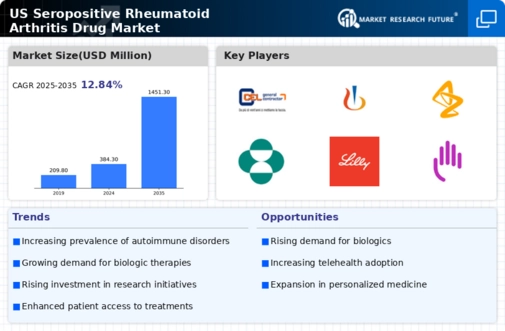

The increasing incidence of seropositive rheumatoid arthritis in the US is a primary driver for the seropositive rheumatoid-arthritis-drug market. Recent estimates suggest that approximately 1.3 million individuals in the US are affected by this condition, with a notable rise in diagnoses over the past decade. This growing patient population necessitates the development and availability of effective therapeutic options, thereby propelling market growth. Furthermore, as awareness of the disease improves, more patients are seeking treatment, which could lead to an increase in drug utilization. The seropositive rheumatoid-arthritis-drug market is likely to expand as healthcare providers focus on managing this chronic condition more effectively.