The smart home-automation market is currently characterized by intense competition and rapid innovation, driven by increasing consumer demand for convenience, energy efficiency, and enhanced security. Major players such as Amazon (US), Google (US), and Apple (US) are at the forefront, each adopting distinct strategies to solidify their market positions. Amazon (US) continues to leverage its extensive ecosystem, integrating Alexa into a wide array of devices, while Google (US) focuses on enhancing its Google Home platform through strategic partnerships and AI advancements. Apple (US), on the other hand, emphasizes privacy and security, positioning its HomeKit as a premium offering in the market. Collectively, these strategies contribute to a dynamic competitive environment, where innovation and user experience are paramount.

Key business tactics within the market include localized manufacturing and supply chain optimization, which are increasingly vital in addressing consumer preferences and reducing operational costs. The competitive structure appears moderately fragmented, with a mix of established giants and emerging startups vying for market share. This fragmentation allows for diverse offerings, yet the influence of key players remains substantial, as they set trends and standards that smaller companies often follow.

In October 2025, Amazon (US) announced the launch of a new line of smart home devices that integrate seamlessly with its existing Alexa ecosystem. This strategic move not only expands its product portfolio but also reinforces its commitment to creating a cohesive smart home experience. By enhancing interoperability among devices, Amazon (US) aims to capture a larger share of the market, appealing to consumers seeking convenience and ease of use.

In September 2025, Google (US) unveiled a significant update to its Nest product line, incorporating advanced AI features that allow for predictive energy management. This development is crucial as it aligns with growing consumer interest in sustainability and energy efficiency. By positioning its products as not only smart but also environmentally friendly, Google (US) enhances its competitive edge in a market increasingly focused on eco-conscious solutions.

In August 2025, Apple (US) expanded its HomeKit framework to include support for a wider range of third-party devices, signaling a strategic shift towards greater interoperability. This move is indicative of Apple's recognition of the need to adapt to consumer demands for flexibility and compatibility, thereby enhancing its market appeal. By fostering a more inclusive ecosystem, Apple (US) aims to attract users who may have previously opted for competitors' products.

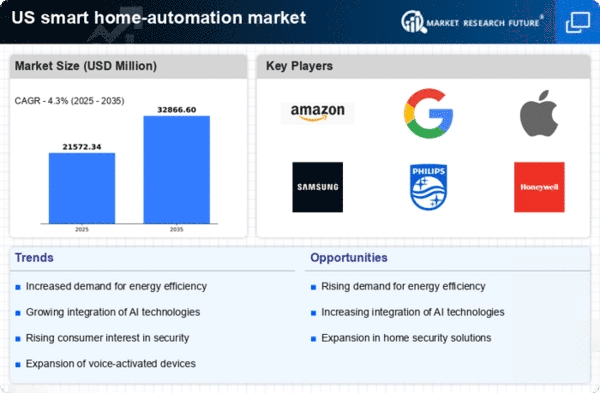

As of November 2025, current trends in the smart home-automation market are heavily influenced by digitalization, sustainability, and AI integration. Strategic alliances among companies are increasingly shaping the landscape, as partnerships enable enhanced product offerings and shared technological advancements. Looking ahead, competitive differentiation is likely to evolve, with a pronounced shift from price-based competition to a focus on innovation, technology, and supply chain reliability. Companies that prioritize these aspects may find themselves better positioned to thrive in an ever-evolving market.