Focus on Grid Modernization

The ongoing focus on grid modernization in the US is a pivotal driver for the smart transformers market. Aging infrastructure poses challenges for energy distribution, prompting utilities to seek innovative solutions. Smart transformers are integral to modernizing the grid, as they provide advanced functionalities such as real-time data analytics and remote monitoring. The US Energy Information Administration has highlighted that investments in grid modernization could exceed $200 billion over the next decade. This investment is likely to accelerate the adoption of smart transformers, which enhance grid reliability and efficiency. As utilities strive to meet the demands of a changing energy landscape, the smart transformers market is expected to flourish, driven by the need for modernization.

Emerging Cybersecurity Concerns

As the energy sector becomes increasingly digitized, cybersecurity concerns are emerging as a significant driver for the smart transformers market. The integration of smart technologies into the grid raises vulnerabilities that could be exploited by cyber threats. Consequently, utilities are prioritizing the implementation of smart transformers equipped with advanced cybersecurity features. This trend is underscored by the US Department of Homeland Security's emphasis on securing critical infrastructure. The smart transformers market is likely to benefit from this heightened focus on cybersecurity. Utilities are investing in technologies that enhance operational efficiency and protect against potential cyberattacks. The demand for secure and resilient energy systems is expected to propel the growth of the smart transformers market.

Growing Demand for Energy Efficiency

The increasing emphasis on energy efficiency in the US is driving the smart transformers market. As utilities and consumers seek to reduce energy consumption, smart transformers offer enhanced performance and lower losses. According to recent data, smart transformers can reduce energy losses by up to 30%, making them an attractive option for energy providers. This demand for efficiency is further supported by state-level initiatives aimed at modernizing the grid. The smart transformers market is expected to benefit from these trends. Utilities are investing in advanced technologies to meet regulatory requirements and consumer expectations. The integration of smart transformers into the grid not only enhances reliability but also contributes to overall energy savings, thereby fostering a more sustainable energy landscape.

Rising Adoption of Electric Vehicles

The surge in electric vehicle (EV) adoption in the US is influencing the smart transformers market. As more consumers transition to EVs, the demand for charging infrastructure is increasing. Smart transformers play a crucial role in supporting this infrastructure by managing the load and ensuring efficient energy distribution. The US Department of Energy estimates that by 2030, there could be over 18 million EVs on the road, necessitating a robust charging network. This growth presents a significant opportunity for the smart transformers market, as utilities and private companies invest in smart transformers to accommodate the rising energy demands associated with EV charging stations. The integration of smart transformers into this ecosystem enhances grid stability and supports the transition to cleaner transportation.

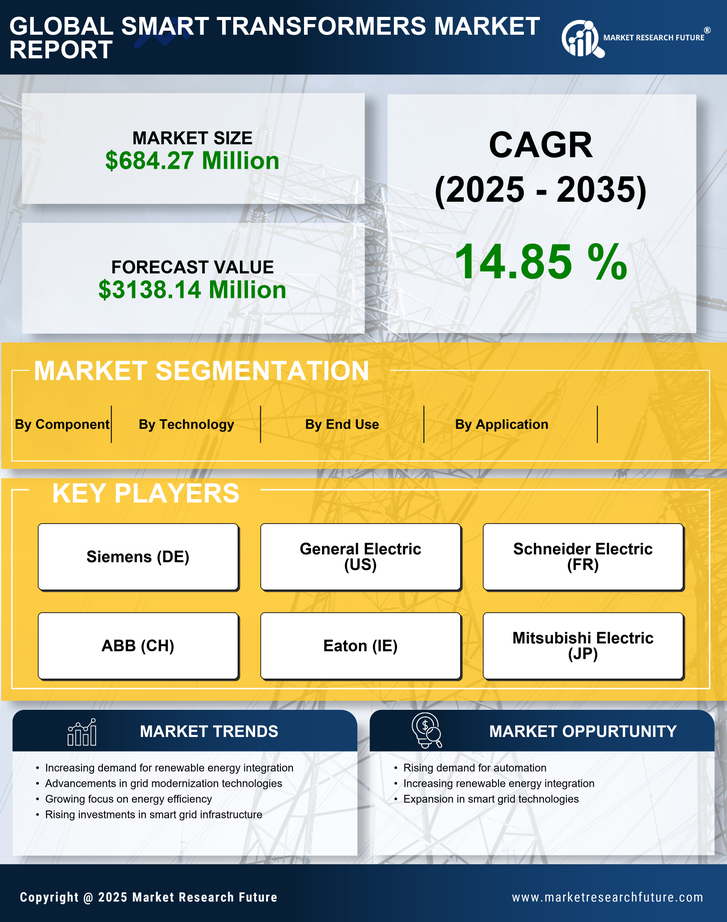

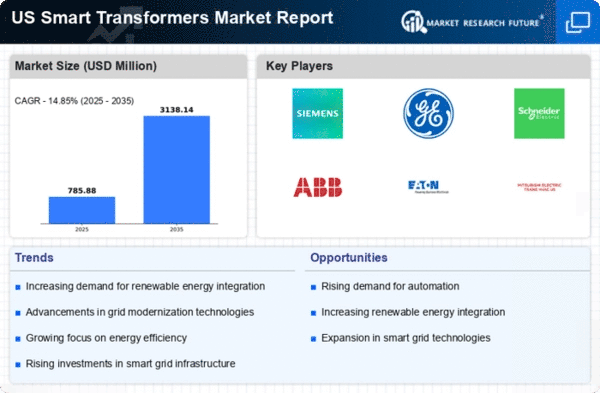

Increased Investment in Smart Grid Infrastructure

Investment in smart grid infrastructure is a key driver for the smart transformers market. The US government and private sector are allocating substantial funds to upgrade aging electrical grids. Reports indicate that investments in smart grid technologies are projected to reach $100 billion by 2025. This influx of capital is likely to accelerate the deployment of smart transformers, which are essential for managing the complexities of modern energy distribution. Smart transformers facilitate real-time monitoring and control, enabling utilities to optimize performance and reduce operational costs. As the smart grid evolves, the smart transformers market is poised for growth, driven by the need for enhanced grid resilience and efficiency.