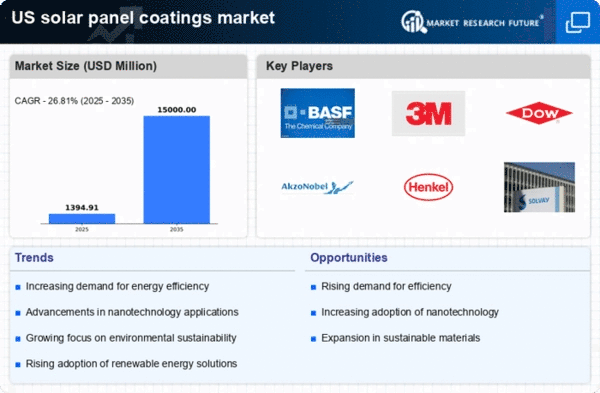

The solar panel-coatings market is currently characterized by a dynamic competitive landscape, driven by increasing demand for renewable energy solutions and advancements in coating technologies. Key players such as BASF SE (DE), 3M Company (US), and Dow Inc. (US) are strategically positioned to leverage innovation and sustainability in their operations. BASF SE (DE) focuses on developing high-performance coatings that enhance the efficiency and durability of solar panels, while 3M Company (US) emphasizes its commitment to sustainability through the introduction of environmentally friendly coatings. Dow Inc. (US) is actively pursuing partnerships to expand its product offerings, indicating a trend towards collaborative innovation that shapes the competitive environment.In terms of business tactics, companies are increasingly localizing manufacturing to reduce supply chain vulnerabilities and optimize logistics. The market appears moderately fragmented, with several players vying for market share, yet the collective influence of major companies like AkzoNobel N.V. (NL) and Henkel AG & Co. KGaA (DE) is notable. These firms are enhancing their operational efficiencies and product portfolios, which contributes to a competitive structure that encourages innovation and responsiveness to market demands.

In October 3M Company (US) announced a strategic partnership with a leading solar technology firm to co-develop next-generation coatings aimed at improving energy conversion efficiency. This collaboration is significant as it not only enhances 3M's product offerings but also positions the company at the forefront of technological advancements in the solar sector. The partnership reflects a broader trend of companies seeking synergies to drive innovation and meet the evolving needs of the market.

In September Dow Inc. (US) launched a new line of coatings designed to withstand extreme weather conditions, thereby extending the lifespan of solar panels. This move is crucial as it addresses a key concern among consumers and manufacturers regarding the durability of solar installations. By focusing on resilience, Dow is likely to enhance its competitive edge and appeal to a broader customer base.

In August AkzoNobel N.V. (NL) unveiled a sustainability initiative aimed at reducing the carbon footprint of its manufacturing processes. This initiative aligns with the growing emphasis on environmental responsibility within the industry and positions AkzoNobel as a leader in sustainable practices. Such strategic actions not only enhance brand reputation but also cater to the increasing consumer demand for eco-friendly products.

As of November the competitive trends in the solar panel-coatings market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, fostering innovation and enhancing product development capabilities. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, underscoring the importance of adaptability in a rapidly changing market.