Advancements in Imaging Technologies

Innovations in imaging technologies, such as MRI and CT scans, are significantly enhancing the capabilities of stereotactic surgery-devices market. These advancements allow for improved visualization of target areas, leading to more accurate and effective surgical outcomes. Enhanced imaging techniques facilitate real-time monitoring during procedures, which is crucial for minimizing risks and optimizing patient safety. The integration of advanced imaging modalities is expected to drive market growth, as healthcare facilities increasingly invest in state-of-the-art equipment. The US market is witnessing a shift towards hybrid imaging systems, which combine different modalities to provide comprehensive data, further supporting the adoption of stereotactic surgery.

Growing Investment in Healthcare Infrastructure

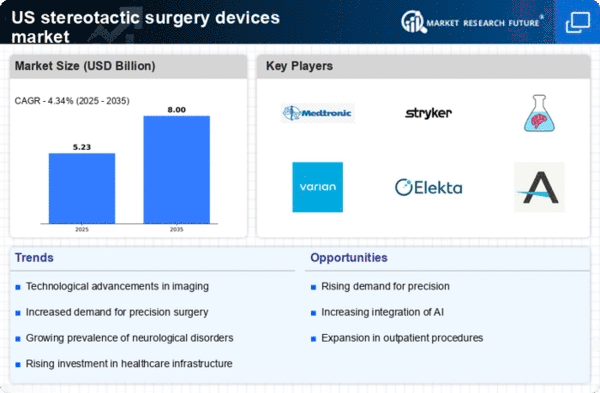

Investment in healthcare infrastructure in the US is a significant driver for the stereotactic surgery-devices market. As hospitals and surgical centers expand their capabilities, there is a heightened focus on acquiring advanced surgical technologies. This trend is supported by government initiatives aimed at improving healthcare access and quality. For instance, funding programs have been established to enhance surgical facilities, which in turn encourages the adoption of innovative devices. The market is projected to benefit from these investments, as healthcare providers seek to offer cutting-edge treatments that meet current surgical standards.

Increasing Prevalence of Neurological Disorders

The rising incidence of neurological disorders, such as brain tumors and epilepsy, is a key driver for the stereotactic surgery-devices market. As the population ages, the prevalence of these conditions is expected to increase, necessitating advanced surgical interventions. According to recent estimates, neurological disorders affect approximately 1 in 6 individuals in the US, leading to a growing demand for effective treatment options. Stereotactic surgery offers precision and minimal invasiveness, making it an attractive choice for both patients and healthcare providers. This trend is likely to propel the market forward, as healthcare systems seek to adopt innovative technologies to address the increasing burden of neurological diseases.

Regulatory Support for Innovative Surgical Devices

Regulatory bodies in the US are increasingly supportive of innovative surgical devices, which is positively impacting the stereotactic surgery-devices market. Streamlined approval processes for new technologies are encouraging manufacturers to invest in research and development. This regulatory environment fosters innovation, allowing for the introduction of advanced devices that enhance surgical precision and patient outcomes. The FDA's commitment to expediting the review of breakthrough devices is likely to stimulate market growth, as it enables quicker access to cutting-edge solutions for healthcare providers. This supportive framework is essential for the ongoing evolution of the stereotactic surgery landscape.

Rising Awareness and Acceptance of Stereotactic Techniques

There is a notable increase in awareness and acceptance of stereotactic techniques among both healthcare professionals and patients. Educational initiatives and professional training programs are contributing to a better understanding of the benefits associated with stereotactic surgery. As more practitioners become proficient in these techniques, the stereotactic surgery-devices market is likely to experience growth. Patients are also becoming more informed about their treatment options, leading to a greater demand for minimally invasive procedures. This shift in perception is expected to drive market expansion, as healthcare providers respond to the evolving preferences of patients.