Increased Focus on Preventive Care

The telemedicine market is also being driven by an increased focus on preventive care. Healthcare providers are recognizing the importance of early intervention and regular monitoring to prevent chronic diseases. Telemedicine facilitates this approach by enabling continuous patient engagement and follow-up consultations. The Centers for Disease Control and Prevention (CDC) emphasizes that preventive care can significantly reduce healthcare costs and improve patient outcomes. As more healthcare systems integrate telemedicine into their preventive care strategies, the market is expected to grow. This shift towards proactive health management aligns with the broader goals of improving public health and reducing the burden on healthcare facilities.

Rising Demand for Accessible Healthcare

The telemedicine market is significantly influenced by the rising demand for accessible healthcare services. Patients are increasingly seeking convenient options for consultations, particularly in rural and underserved areas. The U.S. Census Bureau indicates that approximately 19% of the population lives in rural areas, where access to healthcare facilities is limited. Telemedicine offers a viable solution, allowing patients to connect with healthcare providers without the need for extensive travel. This demand for accessibility is expected to drive the telemedicine market, as more individuals recognize the benefits of remote consultations. Furthermore, the increasing prevalence of chronic diseases necessitates ongoing patient management, further propelling the need for telemedicine services.

Technological Advancements in Healthcare

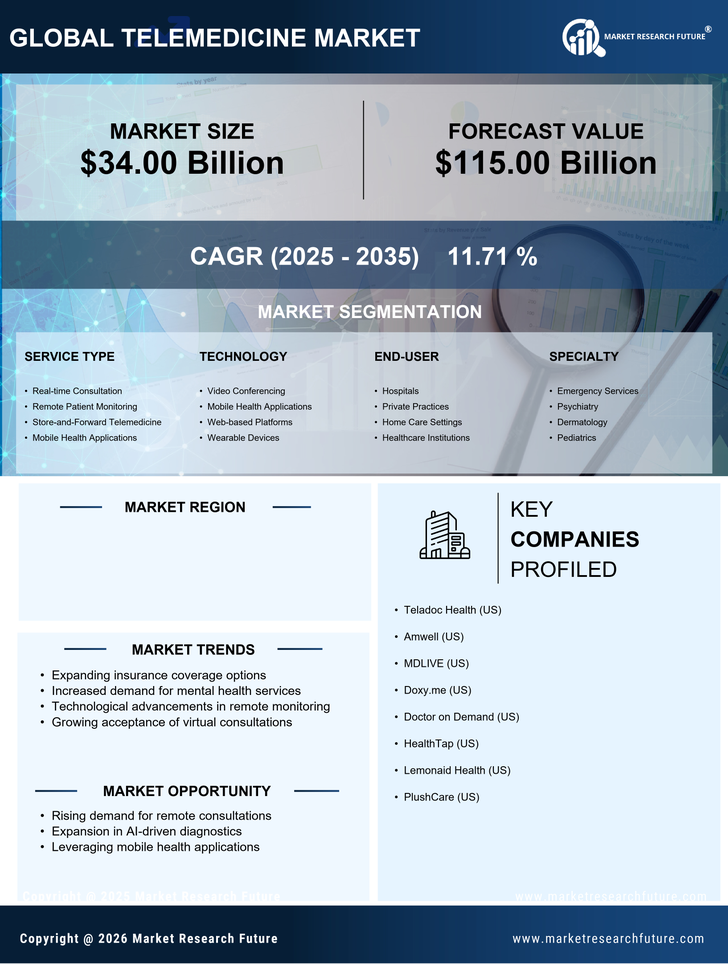

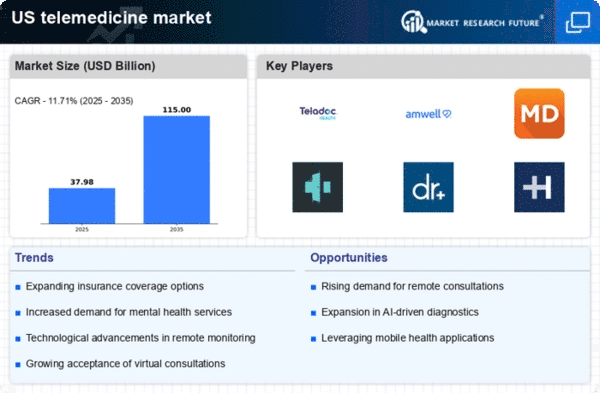

The telemedicine market is experiencing a surge due to rapid technological advancements in healthcare. Innovations such as artificial intelligence, machine learning, and mobile health applications are enhancing the delivery of remote care. These technologies facilitate real-time patient monitoring and improve diagnostic accuracy. According to recent data, the telemedicine market is projected to reach approximately $175 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 25%. This growth is driven by the increasing integration of advanced technologies into healthcare systems, which enhances patient engagement and satisfaction. As healthcare providers adopt these technologies, the telemedicine market is likely to expand, offering more efficient and accessible healthcare solutions.

Cost-Effectiveness of Telehealth Solutions

Cost considerations play a pivotal role in the growth of the telemedicine market. Telehealth solutions often reduce the overall cost of healthcare delivery by minimizing the need for in-person visits and associated expenses. A study by the American Medical Association suggests that telemedicine can save patients an average of $100 per visit compared to traditional healthcare settings. This cost-effectiveness appeals to both patients and healthcare providers, as it allows for more efficient resource allocation. As healthcare costs continue to rise, the telemedicine market is likely to benefit from this trend, with more stakeholders recognizing the financial advantages of adopting telehealth solutions.

Regulatory Support for Telehealth Services

Regulatory support is a crucial driver for the telemedicine market. Recent policy changes at both federal and state levels have expanded the scope of telehealth services, making it easier for providers to offer remote care. The Centers for Medicare & Medicaid Services (CMS) has implemented policies that reimburse telehealth services, thereby encouraging healthcare providers to adopt these solutions. This regulatory environment fosters innovation and investment in telemedicine technologies. As more states enact favorable legislation, the telemedicine market is likely to see increased participation from healthcare providers, ultimately enhancing service availability and patient access.