Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the tendinitis treatment market. As individuals allocate more resources towards health and wellness, the demand for effective treatment options for conditions like tendinitis is likely to rise. In 2025, healthcare spending is projected to reach approximately $4 trillion, reflecting a growing emphasis on preventive care and treatment accessibility. This trend may lead to greater investment in various treatment modalities, including physical therapy, medications, and surgical interventions. Additionally, as insurance coverage expands, more patients may seek treatment for tendinitis, further propelling market growth. The rising healthcare expenditure indicates a robust environment for the tendinitis treatment market, fostering innovation and improved patient care.

Increased Awareness and Education

The growing awareness and education surrounding tendinitis are vital drivers for the tendinitis treatment market. Public health campaigns and educational initiatives by healthcare professionals are helping to inform individuals about the symptoms, causes, and treatment options for tendinitis. This increased awareness is likely to lead to earlier diagnosis and intervention, which can improve patient outcomes. Moreover, as more people understand the importance of seeking treatment for tendinitis, the demand for various therapeutic options is expected to rise. This trend may encourage healthcare providers to enhance their services and expand treatment offerings, thereby positively impacting the tendinitis treatment market. The emphasis on education and awareness is crucial for fostering a proactive approach to managing tendinitis.

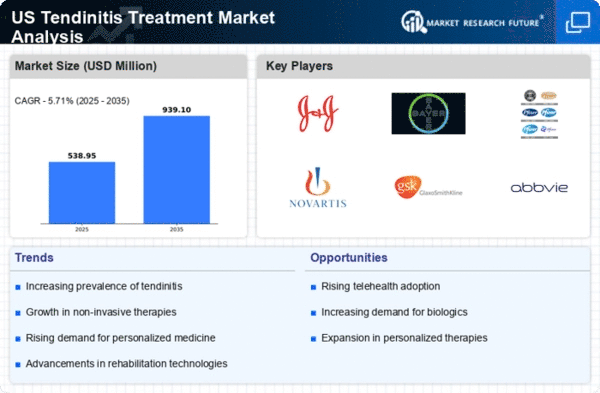

Increasing Prevalence of Tendinitis

The rising incidence of tendinitis in the US population is a crucial driver for the tendinitis treatment market. Factors such as an aging population and increased participation in sports and physical activities contribute to this trend. According to recent health statistics, approximately 10% of adults experience some form of tendinitis, which translates to millions of individuals seeking treatment options. This growing patient base necessitates a diverse range of treatment modalities, including physical therapy, medications, and surgical interventions. As awareness of tendinitis increases, healthcare providers are likely to expand their offerings, thereby enhancing the overall market landscape. The increasing prevalence of this condition underscores the need for effective treatment solutions, driving innovation and investment in the tendinitis treatment market.

Advancements in Treatment Technologies

Technological advancements play a pivotal role in shaping the tendinitis treatment market. Innovations in medical devices, such as ultrasound therapy and regenerative medicine techniques, are enhancing treatment efficacy and patient outcomes. For instance, the introduction of platelet-rich plasma (PRP) therapy has shown promising results in reducing pain and promoting healing in tendinitis patients. Furthermore, the integration of minimally invasive surgical techniques is likely to improve recovery times and reduce complications. As these technologies continue to evolve, they may attract more patients seeking effective and less invasive treatment options. The ongoing research and development in this area suggest a dynamic future for the tendinitis treatment market, with potential for significant growth driven by these advancements.

Growing Demand for Rehabilitation Services

The rising demand for rehabilitation services is a notable driver for the tendinitis treatment market. As more individuals seek to recover from injuries and improve their physical function, the need for specialized rehabilitation programs is increasing. This trend is particularly evident among athletes and active individuals who are more susceptible to tendinitis. Rehabilitation services, including physical therapy and occupational therapy, are essential for effective recovery and pain management. The market for rehabilitation services is projected to grow significantly, with estimates indicating an annual increase of over 5%. This growth is likely to enhance the overall landscape of the tendinitis treatment market, as more patients turn to rehabilitation as a primary treatment option.