Rising Quality Standards

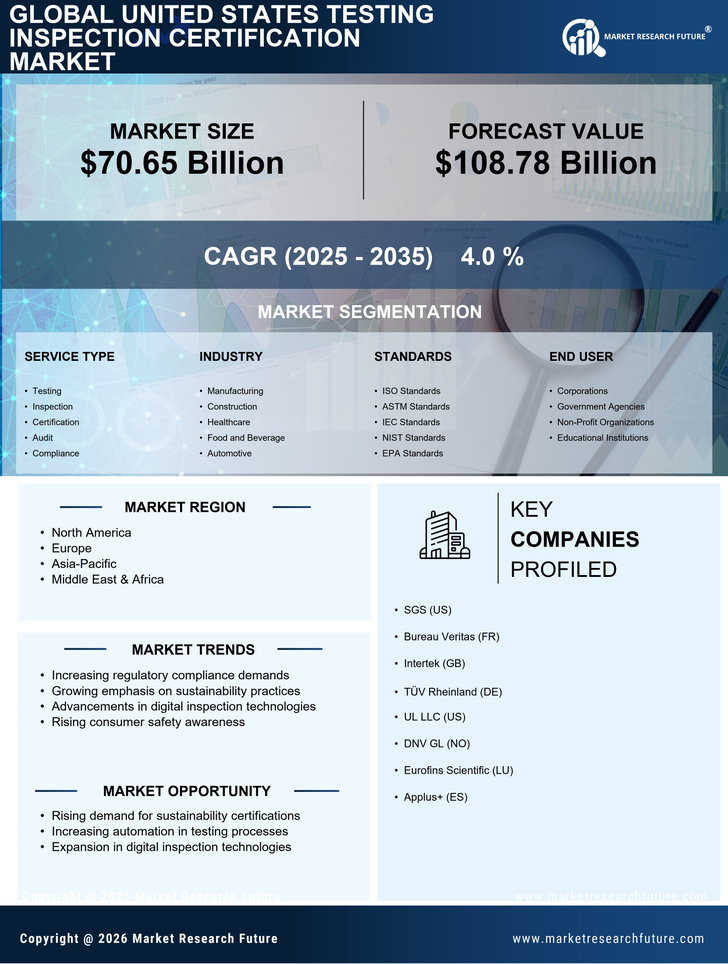

The increasing emphasis on quality assurance across various industries is a pivotal driver for the testing inspection-certification market. As companies strive to meet stringent quality standards, the demand for reliable testing and certification services has surged. In the manufacturing sector, for instance, adherence to ISO standards has become essential, leading to a projected growth of 5.5% in the market by 2026. This trend is not limited to manufacturing; sectors such as food safety and pharmaceuticals are also witnessing heightened scrutiny, necessitating robust testing protocols. Consequently, organizations are investing in comprehensive testing solutions to ensure compliance, thereby propelling the growth of the testing inspection-certification market.

Increased Consumer Awareness

Consumer awareness regarding product safety and quality is significantly influencing the testing inspection-certification market. As consumers become more informed about the implications of substandard products, they are demanding higher levels of transparency and assurance from manufacturers. This shift in consumer behavior has prompted companies to prioritize certification processes, particularly in sectors like electronics and food. For example, the demand for certified organic products has led to a 7% increase in testing services within the food industry. This heightened focus on consumer safety and quality assurance is likely to drive the expansion of the testing inspection-certification market, as businesses seek to enhance their credibility and meet consumer expectations.

Focus on Environmental Compliance

The increasing focus on environmental compliance is emerging as a crucial driver for the testing inspection-certification market. With growing concerns over sustainability and environmental impact, regulatory bodies are imposing stricter guidelines on emissions and waste management. Industries such as construction and manufacturing are particularly affected, as they must adhere to environmental standards to avoid penalties. This has led to a surge in demand for environmental testing services, which are essential for ensuring compliance with regulations. the testing inspection-certification market is expected to grow by 5% as companies invest in testing solutions to meet these environmental requirements and enhance their sustainability practices..

Global Trade and Export Requirements

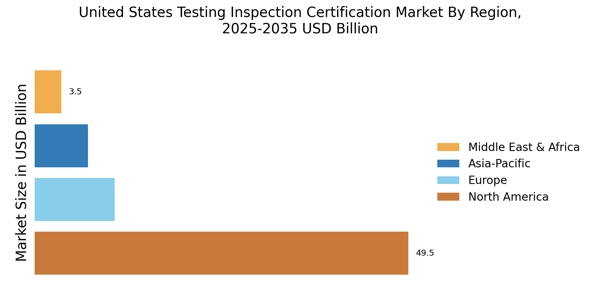

The dynamics of global trade are significantly impacting the testing inspection-certification market. As businesses expand their reach into international markets, compliance with foreign regulations and standards becomes paramount. Countries often require third-party certifications to ensure that imported goods meet local safety and quality standards. This necessity is particularly evident in sectors such as automotive and electronics, where compliance with international standards can determine market access. The testing inspection-certification market is likely to benefit from this trend, as companies seek to obtain the necessary certifications to facilitate exports. The market is projected to grow by 4% annually as businesses navigate the complexities of international trade regulations.

Technological Advancements in Testing Methods

The advent of advanced technologies is reshaping the landscape of the testing inspection-certification market. Innovations such as artificial intelligence, machine learning, and automation are streamlining testing processes, enhancing accuracy, and reducing turnaround times. For instance, the integration of AI in testing protocols has shown to improve efficiency by up to 30%, allowing companies to conduct more tests in less time. This technological evolution not only boosts operational efficiency but also enables organizations to meet the growing demand for rapid testing solutions. As industries increasingly adopt these technologies, the testing inspection-certification market is poised for substantial growth, with an expected CAGR of 6% over the next five years.