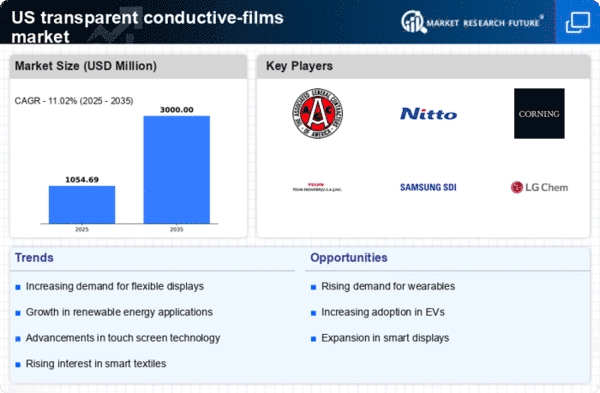

The transparent conductive-films market is characterized by a dynamic competitive landscape, driven by increasing demand for advanced electronic devices and renewable energy applications. Key players such as Corning Inc (US), AGC Inc (Japan), and DuPont de Nemours Inc (US) are strategically positioned to leverage innovation and technological advancements. Corning Inc (US) focuses on developing high-performance materials, while AGC Inc (Japan) emphasizes expanding its product portfolio through research and development. DuPont de Nemours Inc (US) is actively pursuing partnerships to enhance its market presence, indicating a collective strategy among these companies to foster innovation and maintain competitive advantage.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set industry standards and drive technological advancements. This competitive structure suggests that while there is room for smaller players, the dominance of established firms shapes market dynamics.

In October Corning Inc (US) announced the launch of a new line of transparent conductive films designed for next-generation displays. This strategic move is likely to enhance their product offerings and cater to the growing demand for high-resolution screens in consumer electronics. By focusing on innovation, Corning aims to solidify its position as a leader in the market, responding to the evolving needs of manufacturers and consumers alike.

In September DuPont de Nemours Inc (US) entered into a strategic partnership with a leading solar technology firm to develop transparent conductive films for photovoltaic applications. This collaboration is indicative of DuPont's commitment to sustainability and renewable energy solutions, aligning with global trends towards greener technologies. Such partnerships may enhance DuPont's competitive edge by diversifying its product applications and tapping into the expanding solar market.

In August AGC Inc (Japan) expanded its manufacturing capabilities in the US by investing in a new facility dedicated to producing advanced transparent conductive films. This expansion not only signifies AGC's commitment to meeting local demand but also reflects a broader trend of companies investing in regional production to enhance supply chain resilience. This strategic move may position AGC favorably against competitors by ensuring quicker delivery times and reduced operational costs.

As of November current trends in the transparent conductive-films market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to innovate and meet consumer demands. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices. This shift suggests that companies that prioritize R&D and strategic partnerships will be better positioned to thrive in an increasingly competitive environment.