Increasing Industrial Automation

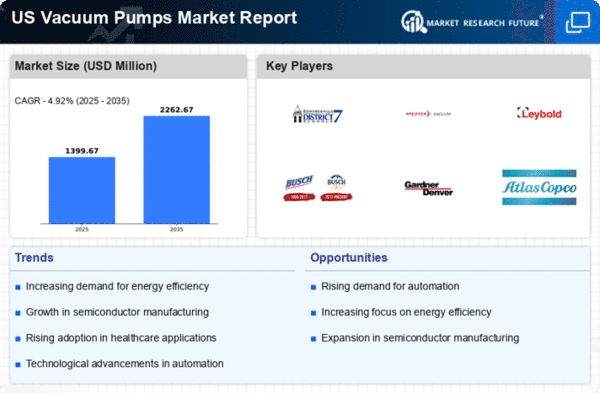

The vacuum pumps market is experiencing a notable surge due to the increasing industrial automation across various sectors. Industries such as manufacturing, food processing, and pharmaceuticals are increasingly adopting automated systems to enhance efficiency and reduce operational costs. This trend is likely to drive the demand for vacuum pumps, which are essential for processes like material handling, packaging, and vacuum drying. In fact, the market for vacuum pumps in the US is projected to grow at a CAGR of approximately 5.5% from 2025 to 2030, reflecting the growing reliance on automated solutions. As companies strive for higher productivity and lower labor costs, the vacuum pumps market stands to benefit significantly from this shift towards automation.

Growth in Semiconductor Manufacturing

The vacuum pumps market is poised for growth, particularly due to the expansion of the semiconductor manufacturing sector in the US. As the demand for electronic devices continues to rise, semiconductor manufacturers are increasingly investing in advanced production technologies that require high-performance vacuum pumps. These pumps are critical for processes such as chemical vapor deposition and etching, which are essential in chip fabrication. The semiconductor industry is expected to reach a market value of $500 billion by 2026, which could lead to a corresponding increase in the demand for vacuum pumps. This growth in semiconductor manufacturing is likely to be a key driver for the vacuum pumps market, as manufacturers seek reliable and efficient pumping solutions.

Advancements in Vacuum Pump Technology

The vacuum pumps market is benefiting from ongoing advancements in vacuum pump technology. Innovations such as improved energy efficiency, enhanced performance, and the development of smart vacuum systems are reshaping the landscape of the industry. These technological advancements enable manufacturers to offer products that meet the evolving needs of various sectors, including food processing, electronics, and chemical industries. For instance, the introduction of variable speed drives and advanced control systems allows for greater flexibility and efficiency in vacuum applications. As industries seek to optimize their processes and reduce energy consumption, the vacuum pumps market is likely to see increased adoption of these advanced technologies, driving overall market growth.

Rising Demand in Healthcare and Pharmaceutical Sectors

The vacuum pumps market is significantly impacted by the rising demand in the healthcare and pharmaceutical sectors. These industries require vacuum pumps for various applications, including laboratory processes, drug manufacturing, and sterilization. The increasing focus on healthcare innovation and the development of new pharmaceuticals are driving the need for reliable vacuum systems. The pharmaceutical market in the US is projected to reach $600 billion by 2025, which could lead to a substantial increase in the demand for vacuum pumps. As the healthcare sector continues to expand, the vacuum pumps market is likely to experience robust growth, driven by the need for efficient and effective pumping solutions.

Environmental Regulations and Sustainability Initiatives

The vacuum pumps market is influenced by stringent environmental regulations and a growing emphasis on sustainability initiatives. Industries are increasingly required to comply with regulations aimed at reducing emissions and waste, which often necessitates the use of vacuum pumps for efficient material handling and waste management. For instance, vacuum pumps are utilized in processes that minimize solvent emissions and enhance energy efficiency. As companies strive to meet these regulatory requirements, the demand for advanced vacuum pump technologies is expected to rise. The vacuum pumps market may see a shift towards more eco-friendly solutions, as manufacturers innovate to create pumps that not only meet performance standards but also align with sustainability goals.