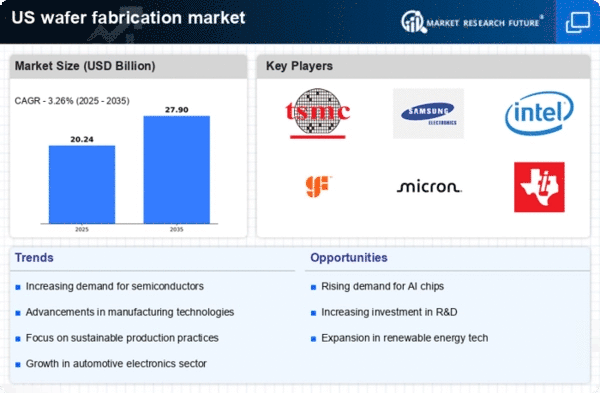

The wafer fabrication market is characterized by intense competition and rapid technological advancements, driven by the increasing demand for semiconductors across various sectors, including automotive, consumer electronics, and telecommunications. Major players such as Intel Corporation (US), GlobalFoundries (US), and Micron Technology (US) are strategically positioned to leverage their technological expertise and manufacturing capabilities. Intel Corporation (US) focuses on innovation and has committed to significant investments in research and development to enhance its process technologies. GlobalFoundries (US), on the other hand, emphasizes partnerships and collaborations to expand its service offerings, while Micron Technology (US) is concentrating on memory solutions, particularly in the context of AI and data centers, thereby shaping a competitive environment that prioritizes technological leadership and strategic alliances.

Key business tactics within the wafer fabrication market include localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness. The market structure appears moderately fragmented, with a mix of established players and emerging companies. The collective influence of key players is substantial, as they engage in strategic maneuvers to capture market share and respond to evolving customer needs.

In October 2025, Intel Corporation (US) announced a groundbreaking partnership with a leading AI firm to develop next-generation semiconductor technologies. This collaboration is poised to enhance Intel's capabilities in AI-driven applications, potentially positioning the company as a leader in the rapidly growing AI semiconductor segment. The strategic importance of this partnership lies in its potential to accelerate innovation and improve product offerings, thereby strengthening Intel's competitive edge.

In September 2025, GlobalFoundries (US) unveiled plans to expand its manufacturing footprint in the US, with an investment of $1.5 billion aimed at increasing production capacity for advanced nodes. This expansion is strategically significant as it aligns with the growing demand for high-performance chips, particularly in the automotive and IoT sectors. By enhancing its manufacturing capabilities, GlobalFoundries is likely to solidify its position as a key player in the domestic semiconductor landscape.

In August 2025, Micron Technology (US) launched a new line of memory products specifically designed for AI applications, reflecting its commitment to innovation in high-demand sectors. This strategic move not only addresses the increasing need for advanced memory solutions but also positions Micron as a frontrunner in the AI market, potentially driving revenue growth and market share.

As of November 2025, current competitive trends in the wafer fabrication market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, advanced technology, and supply chain reliability, underscoring the importance of agility and responsiveness in a rapidly changing market.