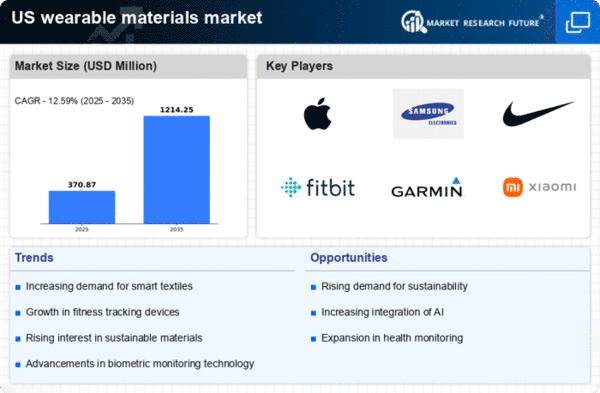

The wearable materials market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and evolving consumer preferences. Key players such as Apple Inc (US), Samsung Electronics (KR), and Nike Inc (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Apple Inc (US) continues to innovate with its health-focused features, integrating advanced sensors into its wearables, which not only cater to fitness enthusiasts but also appeal to a broader audience concerned with health monitoring. Meanwhile, Samsung Electronics (KR) emphasizes regional expansion and partnerships, particularly in Asia, to bolster its market share and enhance its product offerings. Nike Inc (US) leverages its strong brand identity in sports to create wearables that resonate with athletes, focusing on performance metrics and user engagement, thereby shaping a competitive environment that prioritizes innovation and consumer-centric design.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing, which is crucial in a moderately fragmented market. This competitive structure allows for a diverse range of products and price points, catering to various consumer segments. The collective influence of these key players fosters an environment where agility and responsiveness to market trends are paramount, enabling them to adapt swiftly to changing consumer demands and technological advancements.

In October Apple Inc (US) announced a strategic partnership with a leading health technology firm to enhance its wearable health monitoring capabilities. This collaboration is expected to integrate advanced AI algorithms into Apple’s devices, potentially revolutionizing how users track their health metrics. Such a move underscores Apple's commitment to maintaining its competitive edge through innovation and strategic alliances, which may significantly enhance user experience and engagement.

In September Samsung Electronics (KR) launched a new line of smart wearables that incorporate sustainable materials, reflecting a growing trend towards eco-friendly products. This initiative not only aligns with global sustainability goals but also positions Samsung as a leader in responsible manufacturing practices. The strategic importance of this launch lies in its potential to attract environmentally conscious consumers, thereby expanding Samsung's market reach and reinforcing its brand image.

In August Nike Inc (US) unveiled a new fitness tracker that utilizes biometric data to provide personalized training recommendations. This product launch is indicative of Nike's focus on integrating cutting-edge technology into its wearables, enhancing user engagement through tailored experiences. The strategic significance of this innovation lies in its ability to differentiate Nike's offerings in a crowded market, appealing to consumers seeking personalized fitness solutions.

As of November the wearable materials market is increasingly defined by trends such as digitalization, sustainability, and AI integration. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing product offerings. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainability. Companies that successfully navigate these trends are likely to secure a more robust market position, ultimately reshaping consumer expectations and industry standards.