Corporate Sustainability Goals

Many corporations in the US are setting ambitious sustainability goals, which is driving demand for renewable energy, particularly in the wind power market. Companies are increasingly committing to 100% renewable energy targets, leading to significant corporate purchases of wind energy. In 2025, it is estimated that corporate buyers will account for nearly 30% of new wind power capacity installations. This trend is indicative of a broader movement towards corporate responsibility and environmental stewardship. The wind power market stands to gain from these commitments, as businesses seek long-term power purchase agreements to secure stable energy costs while enhancing their sustainability profiles.

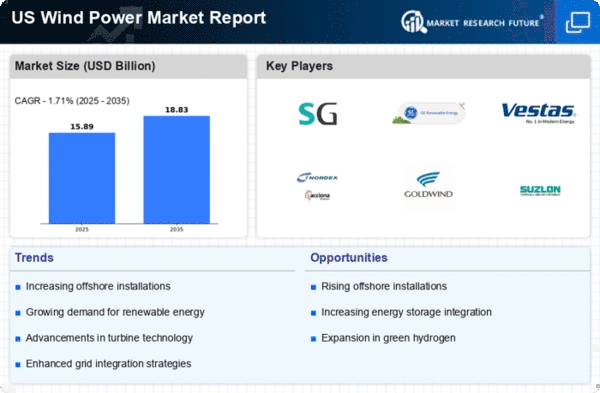

Rising Demand for Renewable Energy

The increasing demand for renewable energy sources in the US is a primary driver for the wind power market. As consumers and businesses alike seek to reduce their carbon footprints, the shift towards sustainable energy solutions has gained momentum. In 2025, renewable energy accounted for approximately 20% of the total energy consumption in the US, with wind power contributing a significant share. This trend is likely to continue as more states implement renewable portfolio standards, mandating a certain percentage of energy to come from renewable sources. The wind power market is poised to benefit from this growing demand, as investments in wind energy infrastructure are expected to rise, potentially leading to a doubling of installed capacity by 2030.

Economic Incentives and Tax Benefits

Economic incentives play a crucial role in the growth of the wind power market. The federal government offers various tax credits, such as the Production Tax Credit (PTC) and Investment Tax Credit (ITC), which significantly lower the cost of wind energy projects. These incentives have been instrumental in driving investments in the wind power market, making it more competitive against fossil fuels. In 2025, the wind power market is projected to attract over $20 billion in investments, largely due to these financial incentives. Furthermore, state-level programs and grants further enhance the attractiveness of wind energy projects, encouraging developers to pursue new installations and expansions.

Technological Innovations in Wind Turbines

Technological innovations in wind turbine design and efficiency are transforming the wind power market. Advances in turbine technology, such as larger rotor diameters and improved materials, have led to increased energy output and reduced costs. The wind power market is witnessing a trend towards offshore wind farms, which can harness stronger and more consistent winds. In 2025, the average capacity of newly installed wind turbines is expected to exceed 3 MW, reflecting these advancements. This evolution not only enhances the viability of wind energy but also positions it as a key player in the transition to a low-carbon energy system.

Public Awareness and Support for Clean Energy

Public awareness regarding climate change and the benefits of clean energy is a significant driver for the wind power market. As more individuals and organizations recognize the importance of sustainable energy solutions, support for wind energy initiatives has grown. Surveys indicate that over 70% of Americans favor the expansion of wind energy projects, viewing them as essential for reducing greenhouse gas emissions. This societal shift is influencing policymakers to prioritize renewable energy legislation, further bolstering the wind power market. The increasing public support is likely to lead to more community-based wind projects, enhancing local economies and fostering job creation.