Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the US Wireless Network Infrastructure Ecosystem Market. Federal and state governments are increasingly recognizing the importance of robust wireless infrastructure for economic growth and national security. Programs such as the Federal Communications Commission's (FCC) Rural Digital Opportunity Fund aim to bridge the digital divide by providing funding for broadband expansion in underserved areas. This initiative is expected to allocate billions of dollars to enhance wireless infrastructure, thereby stimulating market growth. Additionally, the Biden administration's infrastructure plan emphasizes investments in broadband connectivity, which could further bolster the wireless ecosystem. These government-backed efforts not only facilitate the deployment of advanced technologies but also encourage private sector participation, creating a more competitive and resilient market landscape.

Increased Adoption of Cloud Services

The growing adoption of cloud services is reshaping the US Wireless Network Infrastructure Ecosystem Market. As businesses migrate to cloud-based solutions for data storage and application hosting, the demand for reliable and high-capacity wireless networks intensifies. According to industry reports, the cloud computing market in the US is projected to exceed 500 billion dollars by 2026, underscoring the critical need for robust wireless infrastructure to support this growth. This trend compels network providers to enhance their offerings, ensuring seamless connectivity and low latency for cloud applications. Moreover, the integration of cloud services with emerging technologies, such as artificial intelligence and machine learning, further amplifies the demand for advanced wireless networks. Thus, the increased adoption of cloud services is likely to be a key driver in the evolution of the US Wireless Network Infrastructure Ecosystem Market.

Emerging Technologies and Innovations

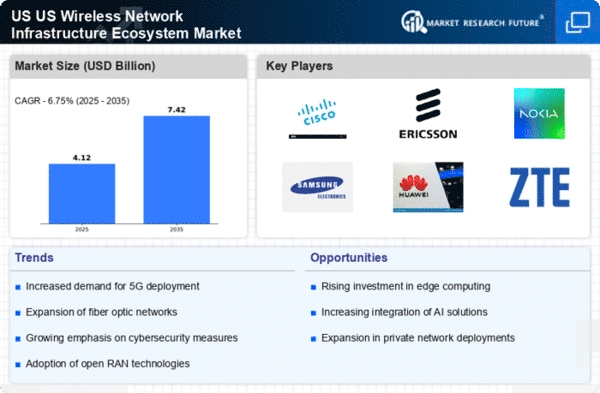

The continuous emergence of new technologies and innovations is a driving force in the US Wireless Network Infrastructure Ecosystem Market. Technologies such as 5G, edge computing, and artificial intelligence are transforming the landscape of wireless communication. The deployment of 5G networks, for instance, is expected to enable unprecedented data speeds and connectivity, fostering new applications across various sectors. Additionally, edge computing allows for data processing closer to the source, reducing latency and enhancing the performance of wireless networks. As companies explore innovative solutions to meet the demands of a digital-first economy, investments in wireless infrastructure are likely to increase. This focus on emerging technologies not only enhances the capabilities of the existing ecosystem but also paves the way for future advancements in the US Wireless Network Infrastructure Ecosystem Market.

Rise of Smart Cities and Urbanization

The trend towards urbanization and the development of smart cities significantly influence the US Wireless Network Infrastructure Ecosystem Market. As urban populations grow, the demand for efficient and interconnected services increases, necessitating advanced wireless infrastructure. Smart city initiatives, which leverage IoT devices and data analytics, require robust wireless networks to function effectively. For instance, cities like San Francisco and New York are investing in smart traffic management systems and public safety solutions that rely on high-speed wireless connectivity. This shift towards smart urban environments is expected to drive substantial investments in wireless infrastructure, as municipalities seek to enhance the quality of life for residents. Consequently, the rise of smart cities presents a lucrative opportunity for stakeholders within the US Wireless Network Infrastructure Ecosystem Market.

Growing Demand for High-Speed Connectivity

The US Wireless Network Infrastructure Ecosystem Market is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on digital services. As businesses and consumers seek faster internet speeds, the deployment of advanced wireless technologies, such as 5G, becomes imperative. According to recent data, the number of 5G subscriptions in the US is projected to reach over 200 million by 2026, indicating a robust growth trajectory. This demand compels network providers to invest in infrastructure upgrades, thereby enhancing the overall ecosystem. Furthermore, the proliferation of remote work and online education has intensified the need for reliable and high-speed internet access, further propelling investments in wireless network infrastructure. Consequently, this growing demand is likely to shape the future landscape of the US Wireless Network Infrastructure Ecosystem Market.