Growth of the DIY Lawn Care Trend

The zero turn-mowers market is significantly influenced by the growth of the DIY lawn care trend among homeowners. As more individuals take on lawn maintenance tasks themselves, the demand for high-performance mowing equipment has risen. Zero turn-mowers, known for their ease of use and efficiency, are becoming the preferred choice for DIY enthusiasts. The zero turn-mowers market industry is projected to grow by approximately 4.5% annually, driven by this trend. Homeowners are increasingly investing in quality equipment to achieve professional-looking results without hiring external services. This shift towards DIY lawn care reflects a broader cultural trend of self-sufficiency and personal investment in home aesthetics, further propelling the market forward.

Environmental Regulations and Compliance

The zero turn-mowers market is also shaped by increasing environmental regulations and compliance requirements. As concerns about emissions and noise pollution grow, manufacturers are compelled to develop more eco-friendly mowing solutions. The zero turn-mowers market industry is adapting to these regulations by introducing electric and hybrid models that meet stringent environmental standards. This shift not only aligns with regulatory requirements but also appeals to environmentally conscious consumers. The market for electric zero turn-mowers is expected to expand, with projections indicating a growth rate of around 7% over the next few years. As sustainability becomes a priority for both consumers and regulators, the demand for compliant and environmentally friendly mowing equipment is likely to rise, influencing purchasing decisions in the market.

Rising Popularity of Landscaping Services

The zero turn-mowers market is benefiting from the rising popularity of landscaping services among homeowners and businesses. As property owners increasingly recognize the value of professional landscaping, the demand for efficient mowing equipment has escalated. Landscaping companies are investing in zero turn-mowers to enhance their service offerings, as these machines provide the speed and precision required for large-scale lawn care. The zero turn-mowers market industry is projected to see a growth rate of around 6% annually, fueled by this trend. Furthermore, the ability of robotic lawn mower to reduce labor costs and improve operational efficiency makes them an attractive option for landscaping professionals. This shift towards outsourcing lawn care tasks is likely to continue, further driving the demand for advanced mowing technologies in the market.

Technological Integration in Lawn Care Equipment

The zero turn-mowers market is witnessing a significant transformation due to the integration of advanced technologies in lawn care equipment. Innovations such as GPS tracking, automated mowing systems, and smart connectivity are becoming increasingly prevalent. These technological advancements enhance the user experience by providing features like real-time monitoring and remote control capabilities. The zero turn-mowers market industry is expected to expand as consumers become more tech-savvy and seek equipment that offers convenience and efficiency. According to recent data, approximately 30% of consumers express interest in smart lawn care solutions, indicating a strong potential for growth in this segment. As manufacturers continue to innovate and incorporate cutting-edge technology, the appeal of zero turn-mowers is likely to increase, attracting a broader customer base.

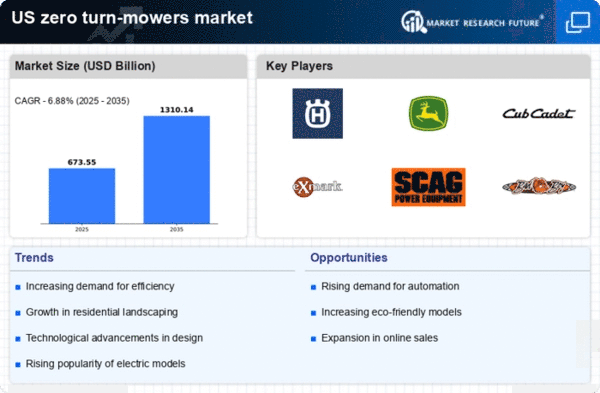

Increased Demand for Efficient Lawn Care Solutions

The zero turn-mowers market is experiencing a surge in demand as consumers seek efficient lawn care solutions. With the growing trend of home gardening and landscaping, homeowners are increasingly investing in advanced mowing technologies. The zero turn-mowers market industry is projected to grow at a CAGR of approximately 5.5% over the next few years, driven by the need for faster and more efficient mowing options. These mowers offer superior maneuverability and speed, allowing users to complete lawn maintenance tasks in significantly less time compared to traditional mowers. As urban areas expand and residential properties become smaller, the appeal of zero turn-mowers, which can navigate tight spaces, is likely to increase. This trend indicates a shift towards more sophisticated lawn care equipment, reflecting changing consumer preferences and the desire for high-quality results in lawn maintenance.