Growth of the Internet of Things (IoT)

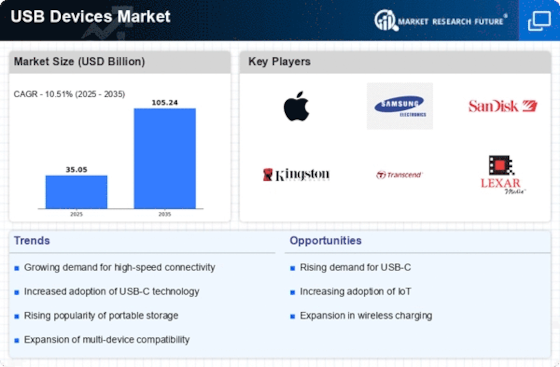

The growth of the Internet of Things (IoT) is significantly impacting the USB Devices Market. As more devices become interconnected, the need for reliable and efficient data transfer solutions is paramount. USB devices play a crucial role in facilitating connectivity among IoT devices, which are projected to reach over 30 billion by 2025. This surge in IoT adoption is likely to drive demand for USB hubs, adapters, and other related accessories. The integration of USB technology in IoT applications suggests a promising future for the USB Devices Market, as manufacturers innovate to create products that cater to the unique requirements of IoT ecosystems. This trend indicates a shift towards a more interconnected world, where USB devices serve as essential components.

Increasing Adoption of Portable Devices

The proliferation of portable devices such as smartphones, tablets, and laptops has catalyzed the USB Devices Market. As consumers increasingly rely on these devices for both personal and professional use, the demand for USB devices has surged. In 2025, it is estimated that the number of portable device users will exceed 3 billion, driving the need for compatible USB accessories. This trend indicates a robust growth trajectory for the USB Devices Market, as manufacturers strive to meet the evolving needs of consumers. Furthermore, the integration of USB-C technology in many new devices enhances compatibility and convenience, further propelling market expansion. The shift towards portability and convenience appears to be a key driver in shaping the future landscape of the USB Devices Market.

Expansion of E-commerce and Online Retail

The rapid expansion of e-commerce and online retail platforms has significantly influenced the USB Devices Market. As consumers increasingly turn to online shopping for electronics and accessories, the accessibility of USB devices has improved. In 2025, online sales of USB devices are projected to account for over 40% of total sales, reflecting a shift in consumer purchasing behavior. This trend not only enhances market reach for manufacturers but also fosters competition among retailers, leading to better pricing and product variety. The convenience of online shopping, coupled with the growing trend of home office setups, suggests that the USB Devices Market will continue to thrive as consumers seek reliable and efficient connectivity solutions.

Rising Demand for Data Security Solutions

As data breaches and cyber threats become increasingly prevalent, the demand for data security solutions within the USB Devices Market is on the rise. Consumers and businesses alike are seeking USB devices that offer enhanced security features, such as encryption and secure access controls. In 2025, the market for secure USB devices is expected to grow by over 25%, reflecting a heightened awareness of data protection. This trend indicates that manufacturers must prioritize security in their product offerings to remain competitive. The increasing reliance on USB devices for sensitive data transfer suggests that the USB Devices Market will continue to evolve, focusing on integrating advanced security measures to meet consumer expectations.

Technological Advancements in USB Standards

Technological advancements in USB standards, particularly the introduction of USB 4.0, are poised to reshape the USB Devices Market. This new standard offers enhanced data transfer speeds, improved power delivery, and greater versatility in device connectivity. As more devices adopt USB 4.0, the demand for compatible accessories is likely to increase. In 2025, it is anticipated that USB 4.0-enabled devices will constitute a significant portion of the market, driving innovation among manufacturers. The evolution of USB technology not only enhances user experience but also encourages the development of new applications and functionalities, thereby expanding the USB Devices Market. This ongoing technological evolution appears to be a critical factor in sustaining market growth.