Market Share

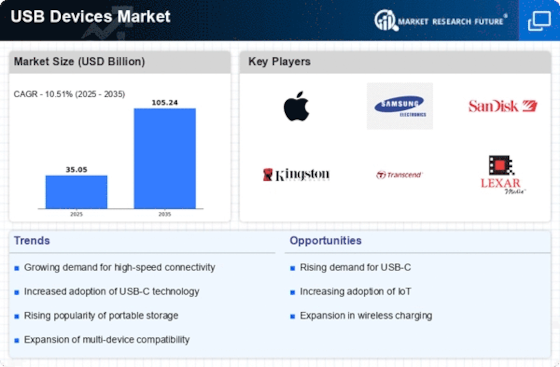

USB Devices Market Share Analysis

Collaborating and forming strategic alliances are essential for securing market share. Manufacturers may offer complementary solutions and grow their product ecosystem by partnering with other tech businesses. For instance, a producer of USB devices and a smartphone company may work together to develop USB accessories that are compatible with the newest mobile devices. These collaborations not only improve product offers but also present chances for co-branding, expanding reach, and gaining market share. The market share positioning of USB devices has seen a growing significance of e-commerce and online retail techniques. In order to provide simple accessibility and exposure for customers, manufacturers are focusing on enhancing their presence on e-commerce platforms in response to the growing popularity of online shopping. Companies may also use online platforms for consumer interaction programs, discounts, and exclusive product debuts. By doing so, they may improve their digital presence and take a substantial chunk of the expanding online market. Market share positioning requires both consumer loyalty and brand credibility. Manufacturers make investments in upholding a favorable brand image by providing after-sale services, customer assistance, and consistently high-quality products. Customers that are happy with a brand are more likely to use it again and to recommend it to others, which helps maintain a steady market share. Prioritizing customer happiness gives brands a competitive edge since satisfied consumers recommend them to others and read online reviews before making a purchase. Manufacturers of USB devices use tactics of global growth and market penetration to expand their presence in various locations. Businesses may modify their offerings to satisfy the particular demands of various markets by taking into account elements including local competition, legal constraints, and regional preferences. Manufacturers may increase their market share of USB devices worldwide and broaden their client base by proactively entering new areas and building a strong presence.

Leave a Comment