Expansion of Recreational Activities

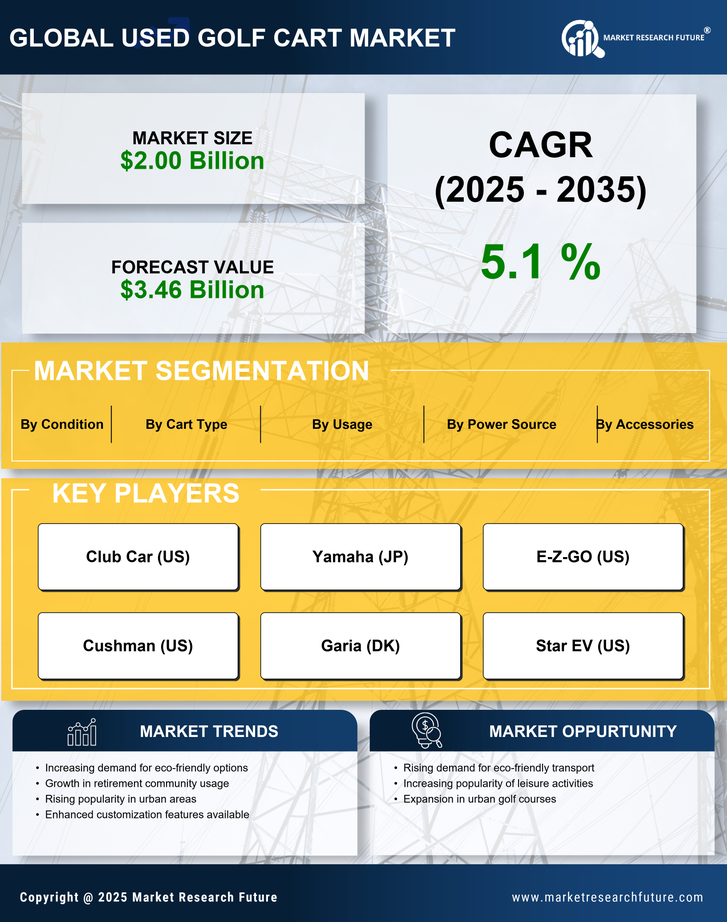

The Used Golf Cart Market is benefiting from the expansion of recreational activities, particularly in residential communities and golf courses. As leisure activities gain popularity, the demand for golf carts has increased significantly. Many communities are incorporating golf carts as a primary mode of transportation within their premises, leading to a rise in the purchase of used models. Reports indicate that the market for used golf carts has seen a growth rate of approximately 5% annually, driven by this trend. Furthermore, the versatility of golf carts for various recreational purposes, such as neighborhood transport and event shuttles, enhances their appeal. This expansion in recreational activities indicates a promising future for the Used Golf Cart Market.

Technological Advancements in Golf Carts

The Used Golf Cart Market is witnessing a wave of technological advancements that enhance the functionality and appeal of used models. Innovations such as improved battery technology, GPS navigation systems, and enhanced safety features are making used golf carts more attractive to consumers. These advancements not only increase the resale value of used carts but also expand their usability beyond traditional golf courses. For instance, the integration of smart technology allows for better tracking and management of golf carts, appealing to both individual users and commercial operators. As technology continues to evolve, it is likely that the Used Golf Cart Market will see an increase in demand for technologically advanced used models.

Rising Popularity of Online Sales Platforms

The Used Golf Cart Market is experiencing a transformation due to the rising popularity of online sales platforms. Consumers are increasingly turning to digital marketplaces to purchase used golf carts, which offers a wider selection and competitive pricing. This shift has made it easier for buyers to compare models and prices, leading to a more informed purchasing decision. Data suggests that online sales of used golf carts have increased by over 30% in recent years, indicating a significant change in consumer behavior. The convenience of online shopping, coupled with the ability to access detailed product information, is likely to continue driving growth in the Used Golf Cart Market.

Changing Consumer Preferences and Demographics

The Used Golf Cart Market is influenced by changing consumer preferences and demographics. Younger generations are increasingly interested in golf and recreational activities, leading to a shift in the target market for used golf carts. This demographic change is accompanied by a preference for more versatile and stylish models that cater to a broader range of uses. Additionally, the rise of remote work has led to an increase in leisure time, prompting more individuals to invest in golf carts for personal use. Market analysis indicates that the demand for used golf carts among younger consumers has risen by approximately 25%, suggesting a shift in the market dynamics. This evolving consumer landscape is likely to shape the future of the Used Golf Cart Market.

Increased Demand for Eco-Friendly Transportation

The Used Golf Cart Market is experiencing a notable shift towards eco-friendly transportation solutions. As consumers become more environmentally conscious, the demand for electric golf carts has surged. This trend is reflected in the increasing sales of used electric models, which accounted for approximately 40% of the total used golf cart sales in recent years. The appeal of lower operating costs and reduced carbon footprints is driving this demand. Additionally, municipalities and golf courses are adopting electric carts to comply with sustainability initiatives, further propelling the market. The growing awareness of climate change and the need for sustainable practices suggest that the Used Golf Cart Market will continue to thrive as consumers seek greener alternatives.