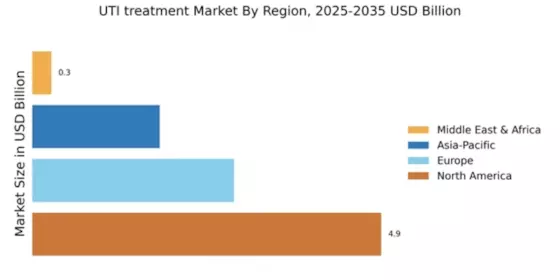

North America : Market Leader in UTI Treatment

North America is poised to maintain its leadership in the UTI treatment market, holding a significant share of 4.93 in 2024. The region's growth is driven by increasing UTI prevalence, advancements in treatment options, and robust healthcare infrastructure. Regulatory support and initiatives aimed at improving patient outcomes further catalyze market expansion. The rising awareness of UTI symptoms and the importance of timely treatment are also contributing to the growing demand for effective therapies. The competitive landscape in North America is characterized by the presence of major pharmaceutical players such as Johnson & Johnson, Merck & Co., and Pfizer. These companies are actively engaged in research and development to innovate new treatment modalities. The U.S. remains the largest market, supported by a well-established healthcare system and high healthcare expenditure. The focus on personalized medicine and the introduction of novel therapies are expected to enhance market dynamics in the coming years.

Europe : Emerging Market with Growth Potential

Europe's UTI treatment market is valued at 2.85, reflecting a growing demand for effective therapies. The region benefits from a strong regulatory framework that encourages innovation and ensures patient safety. Increasing UTI incidence, particularly among women, and the rising awareness of preventive measures are key growth drivers. Additionally, government initiatives aimed at improving healthcare access and affordability are expected to further boost market growth in the coming years. Leading countries in Europe include Germany, France, and the UK, where major players like F. Hoffmann-La Roche and Sanofi are actively involved. The competitive landscape is marked by a mix of established pharmaceutical companies and emerging biotech firms. Collaborative efforts between public and private sectors are fostering innovation, while the focus on antibiotic stewardship is shaping treatment protocols. The European Medicines Agency continues to play a crucial role in regulating and approving new therapies.

Asia-Pacific : Rapidly Growing UTI Market

The Asia-Pacific region, with a market size of 1.8, is witnessing rapid growth in the UTI treatment sector. Factors such as increasing urbanization, changing lifestyles, and rising healthcare expenditure are driving demand for effective UTI therapies. The region's diverse population and varying healthcare access levels present both challenges and opportunities for market players. Regulatory bodies are increasingly focusing on improving healthcare standards, which is expected to enhance treatment accessibility and efficacy. Countries like China, India, and Japan are leading the market, with significant contributions from local and international pharmaceutical companies. Key players such as Teva Pharmaceutical Industries are expanding their presence through strategic partnerships and product launches. The competitive landscape is evolving, with a growing emphasis on research and development to address the unique healthcare needs of the region. The increasing prevalence of antibiotic resistance is also prompting a shift towards alternative treatment options.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 0.27, presents a unique landscape for UTI treatment. The market is characterized by a growing awareness of UTI issues and an increasing demand for effective therapies. However, challenges such as limited healthcare infrastructure and varying access to medications hinder market growth. Regulatory bodies are working to improve healthcare standards, which is expected to gradually enhance treatment availability and patient outcomes in the region. Leading countries in this region include South Africa and the UAE, where local and international players are striving to establish a foothold. The competitive landscape is marked by a mix of established pharmaceutical companies and emerging startups. Efforts to improve healthcare access and affordability are crucial for market expansion. The focus on education and awareness campaigns is also vital to address the rising incidence of UTIs and promote timely treatment.