Expansion of Transmission Networks

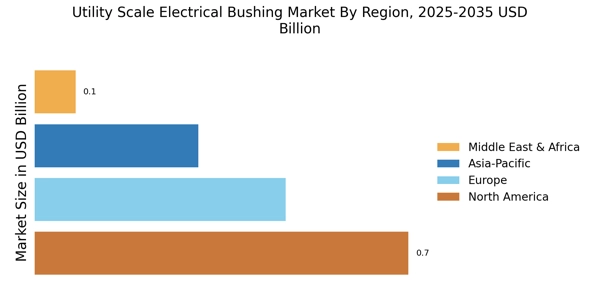

The expansion of transmission networks is a crucial factor propelling the Utility Scale Electrical Bushing Market. As energy consumption continues to rise, there is a pressing need for enhanced transmission capabilities to transport electricity from generation sites to end-users. This expansion often involves the construction of new transmission lines and substations, which require reliable electrical bushings to ensure safe and efficient operation. Data suggests that The Utility Scale Electrical Bushing Market is projected to grow significantly, with investments in new infrastructure expected to exceed hundreds of billions of dollars. This growth directly correlates with an increased demand for utility-scale electrical bushings, as they play a vital role in maintaining system integrity and performance.

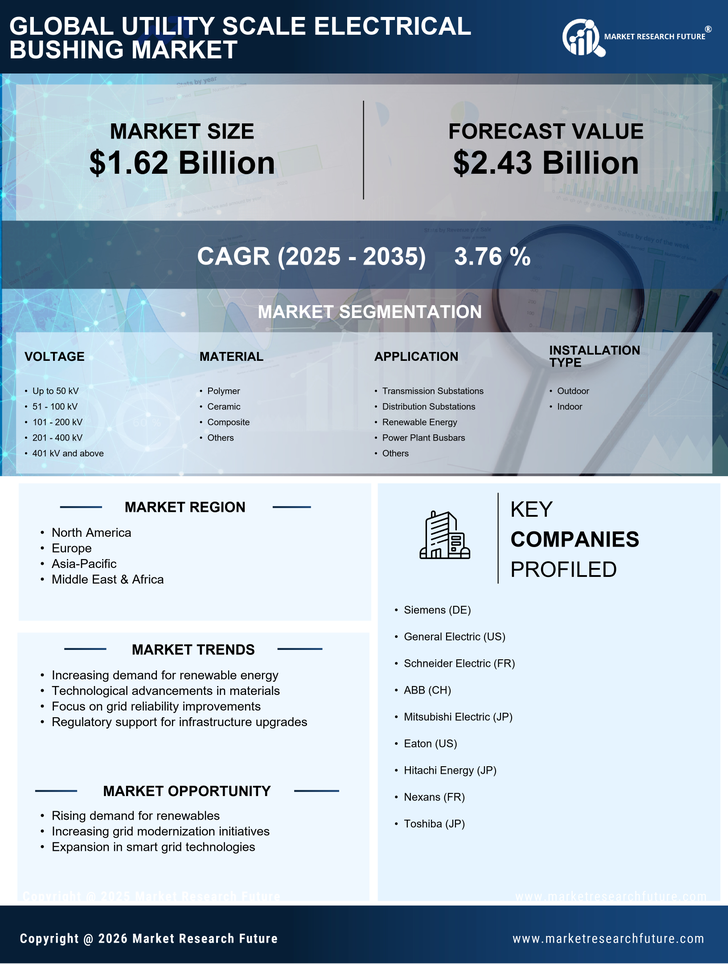

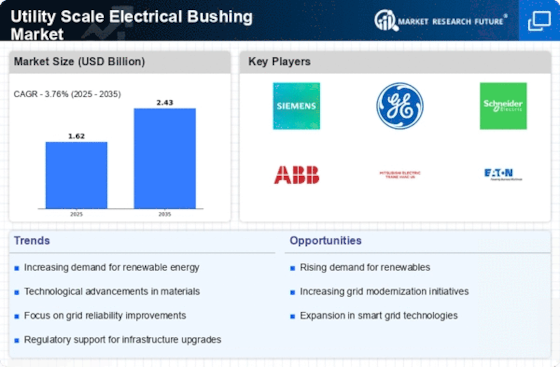

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is a primary driver for the Utility Scale Electrical Bushing Market. As nations strive to meet ambitious carbon reduction targets, the deployment of renewable energy projects, such as wind and solar farms, has surged. This trend necessitates the use of high-quality electrical bushings to ensure efficient energy transmission and distribution. According to recent data, the renewable energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years. Consequently, the demand for utility-scale electrical bushings is expected to rise, as these components are critical for connecting renewable energy sources to the grid, thereby enhancing the overall reliability and efficiency of energy systems.

Infrastructure Modernization Initiatives

Infrastructure modernization initiatives are significantly influencing the Utility Scale Electrical Bushing Market. Governments and utility companies are increasingly investing in upgrading aging electrical infrastructure to improve reliability and efficiency. This modernization often involves the replacement of outdated components, including electrical bushings, with advanced technologies that offer better performance and longevity. Recent reports indicate that investments in infrastructure are expected to reach trillions of dollars over the next decade, creating substantial opportunities for manufacturers of utility-scale electrical bushings. As utilities seek to enhance grid resilience and accommodate growing energy demands, the need for high-performance electrical bushings becomes paramount, driving market growth.

Increased Investment in Energy Storage Solutions

Increased investment in energy storage solutions is emerging as a significant driver for the Utility Scale Electrical Bushing Market. As the integration of renewable energy sources grows, the need for effective energy storage systems becomes more pronounced. These systems require robust electrical components, including bushings, to ensure seamless operation and connectivity. Recent trends indicate that investments in energy storage technologies are expected to reach substantial figures, driven by the need to balance supply and demand in energy systems. This trend not only supports the growth of the utility-scale electrical bushing market but also enhances the overall stability and reliability of energy networks, as storage solutions play a critical role in managing intermittent renewable energy generation.

Technological Innovations in Electrical Components

Technological innovations in electrical components are reshaping the Utility Scale Electrical Bushing Market. Advances in materials science and engineering have led to the development of more durable and efficient electrical bushings. These innovations not only enhance the performance of electrical systems but also extend the lifespan of components, reducing maintenance costs for utilities. The introduction of smart technologies, such as condition monitoring systems, further optimizes the performance of electrical bushings by providing real-time data on their operational status. As utilities increasingly adopt these advanced technologies, the demand for innovative utility-scale electrical bushings is likely to rise, reflecting a shift towards more efficient and reliable energy systems.