North America : Renewable Energy Leader

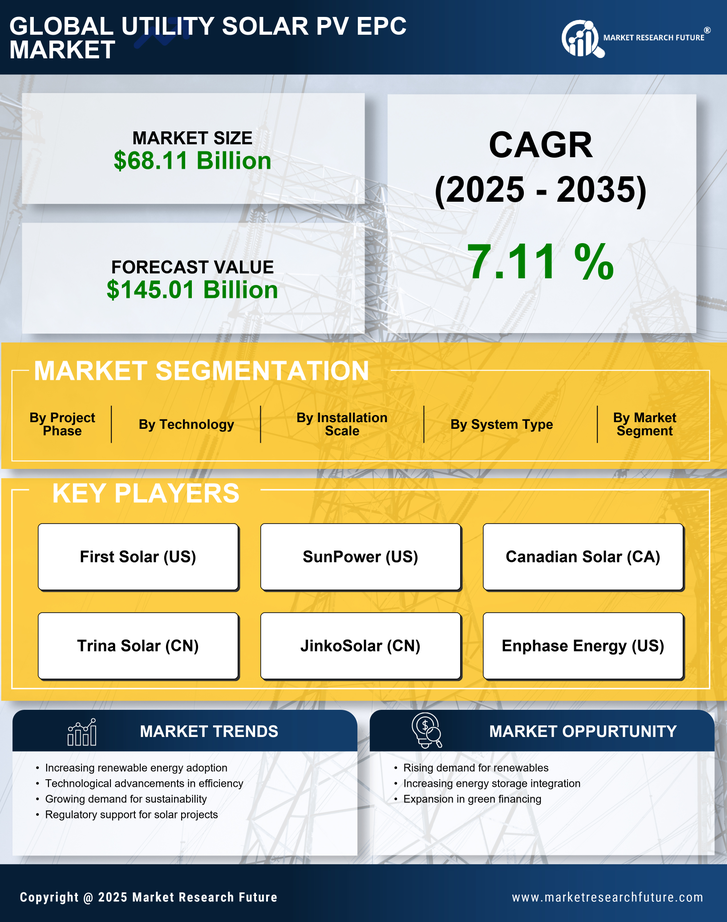

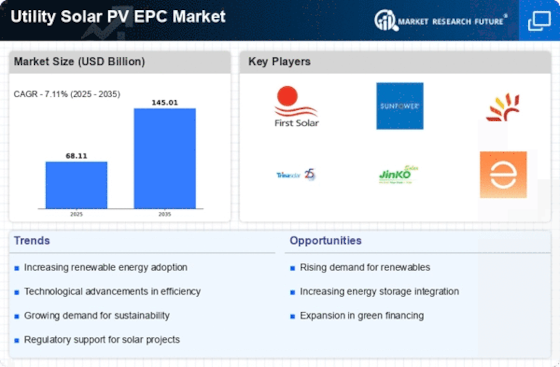

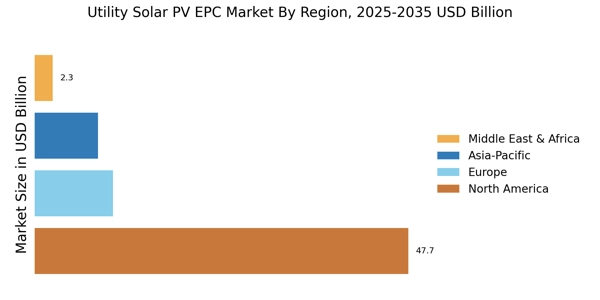

North America is witnessing robust growth in the Utility Solar PV EPC Market, driven by favorable government policies, technological advancements, and increasing demand for renewable energy. The United States is the largest market, holding approximately 70% of the regional share, followed by Canada with around 15%. Regulatory incentives, such as the Investment Tax Credit (ITC), are catalyzing investments in solar projects, enhancing market dynamics.

The competitive landscape is dominated by key players like First Solar, SunPower, and Canadian Solar, which are leveraging innovative technologies to enhance efficiency and reduce costs. The presence of established firms and new entrants is fostering a dynamic market environment. As states implement more aggressive renewable energy targets, the demand for solar EPC services is expected to surge, further solidifying North America's position as a leader in the solar sector.

Europe : Sustainable Energy Transition

Europe is rapidly advancing in the Utility Solar PV EPC Market, driven by stringent climate policies and a strong commitment to renewable energy. Germany and Spain are the largest markets, collectively accounting for over 50% of the region's share. The European Union's Green Deal and national initiatives are pivotal in promoting solar energy adoption, with ambitious targets for carbon neutrality by 2050, stimulating demand for solar EPC services.

Leading countries like Germany, Spain, and France are at the forefront of this transition, supported by key players such as Trina Solar and JinkoSolar. The competitive landscape is characterized by a mix of established firms and innovative startups, enhancing technological advancements in solar energy. As Europe continues to invest in solar infrastructure, the EPC market is poised for significant growth, aligning with the region's sustainability goals.

Asia-Pacific : Emerging Solar Powerhouse

The Asia-Pacific region is emerging as a powerhouse in the Utility Solar PV EPC Market, driven by rapid industrialization, urbanization, and government support for renewable energy. China is the largest market, holding approximately 60% of the regional share, followed by India with around 20%. Government initiatives, such as subsidies and feed-in tariffs, are propelling solar energy adoption, making it a key focus for energy security and sustainability in the region.

China's dominance is complemented by the presence of major players like LONGi Green Energy and Risen Energy, while India is witnessing a surge in investments from both domestic and international firms. The competitive landscape is evolving, with a focus on innovation and cost reduction. As countries in the region ramp up their solar capacity, the EPC market is expected to experience substantial growth, driven by increasing energy demands and environmental commitments.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa are witnessing significant growth in the Utility Solar PV EPC Market, driven by abundant solar resources and increasing energy demands. The United Arab Emirates and South Africa are the largest markets, collectively holding around 40% of the regional share. Government initiatives, such as the UAE's Energy Strategy 2050, are catalyzing investments in solar projects, enhancing the region's renewable energy landscape.

Countries like Saudi Arabia and Egypt are also emerging as key players, supported by investments from global firms and local enterprises. The competitive landscape is characterized by a mix of established companies and new entrants, focusing on innovative solutions to harness solar energy effectively. As the region continues to prioritize renewable energy, the EPC market is set for substantial growth, aligning with global sustainability trends.