Utility Vehicles Size

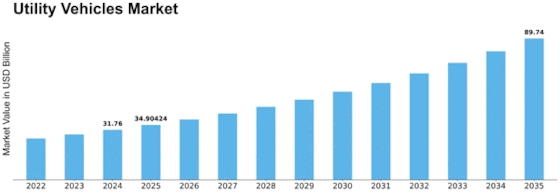

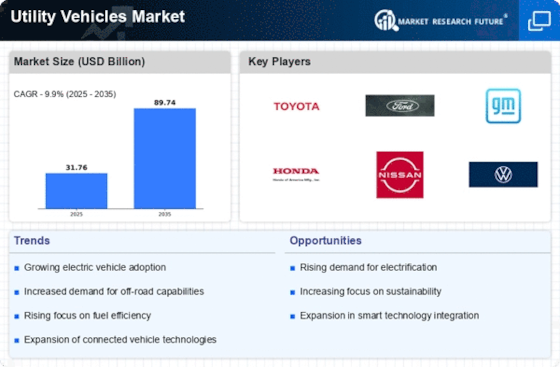

Utility Vehicles Market Growth Projections and Opportunities

A multitude of interconnected influencing factors determine the market's course for utility vehicles. Consumer demand, which is driven by a wide range of requirements ranging from leisure activities to business implementations, is a crucial determinant. The rising predominance of urbanization and changing ways of life have prompted a significant flood in the interest for flexible utility vehicles, including hybrids and SUVs. Furthermore, mileage and reasonableness are huge elements, as customers habitually search for vehicles that accomplish an amicable blend of execution and monetary reasonability.

Moreover, government arrangements and guidelines are essential market factors. The worldwide execution of outflow guidelines, security guidelines, and eco-friendliness orders impacts the conceptualization, assembling, and advancement of utility vehicles. To meet these prerequisites, producers should distribute assets towards innovative work, which brings about mechanical developments that significantly affect the market climate.

Critical effect is applied by monetary circumstances available for utility vehicles. Purchasers for the most part have more noteworthy dispensable incomes during times of monetary development, which invigorates the interest in utility vehicles. Going against the norm, monetary constrictions could provoke a progress towards vehicles that are more prudent and harmless to the ecosystem regarding gas utilization. Also, supporting choices and loan costs impact the buying choices of purchasers, with ideal funding terms regularly invigorating business sector development.

Mechanical development arises as an outlook changing specialist inside the market for utility vehicles. The conspicuousness of electric and mixture innovation headways has expanded because of the overall development towards maintainability and ecological mindfulness. Utility vehicles gain an upper hand by integrating shrewd innovations, including network includes and high level driver help frameworks (ADAS), which oblige to the changing inclinations of mechanically slanted customers.

The business of auto is altogether impacted by serious powers that shape the utility vehicle market. Rivalry among makers, incorporating both deep rooted firms and newbies, invigorates the headway of items and developments. Besides, market elements are affected by essential coalitions, consolidations, and acquisitions, which thusly influence market focus and the cutthroat climate. The limit of makers to change in light of advancing customer inclinations and emanant patterns is basic to their proceeded with success.

International and foreign relations acquaint a component of unconventionality with the utility vehicle market. Inventory network disturbances brought about in terms of professional career questions, taxes, and international pressures can possibly affect creation costs and, therefore, vehicle costs. Manufacturing costs are significantly impacted by price fluctuations in primary materials, particularly aluminum and steel, which in turn affects pricing strategies employed by industry players.

Inclinations and view of customers essentially impact the development of the market. The increased attention given to electric and hybrid utility vehicles as a result of an increased focus on sustainability is indicative of a more general shift toward environmentally conscious modes of transportation. Customer choices are furthermore affected by wellbeing ascribes, visual appeal, and brand picture, which forces makers to give priority to these elements during the method involved with fostering their items.

The market for utility vehicles is a multifaceted biological system that is influenced by a broad number of interrelated components. The market elements are formed by an intersection of variables including shopper interest, unofficial laws, monetary circumstances, innovative progressions, serious powers, worldwide occasions, and customer inclinations. By staying aware of these factors, adapting their strategies to match emerging trends, and meeting the ever-changing needs of customers in a dynamic automotive industry, skilled manufacturers are able to successfully navigate this complicated terrain.

Leave a Comment