Research Methodology on Digital Utility Market

The published report aims at understanding the landscape of the global Digital Utility Market. To conduct this research, Market Research Future (MRFR) has applied both primary and secondary research methodologies and has used extensive data triangulation methods. During this research, extensive interviews with key industry participants, opinion leaders, and stakeholders and extensive secondary sources (trade journals, magazines and verified press releases) were conducted.

The primary research method involves comprehensive interviews and analysis of the opinions provided by the primary respondents. MRFR also contacted various data organizations for primary and secondary data concerning the Digital Utility Market. Secondary research entailed the use of information from subscription resources and other databases such as industry trade journals, the definition and scope of the market, and economic data from the secondary resources. After data gathering, data collation and examination, a few key observations on the global Digital Utility Market are observed.

In the initial step, the market definition and scope of the global Digital Utility Market were analyzed. This is done by studying numerous factors including the definition of the industry, applications, technology and region. After that, the production of the global Digital Utility Market is studied based on region, pricing of the products, costs of raw materials, total value of the products, and other factors.

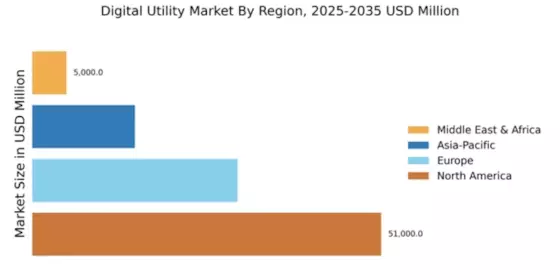

The Global Digital Utility Market was studied by region. The market regional segments studied in this research are North America, Europe, Asia Pacific, and the Rest of the World. Regional segmentation was done while considering factors such as growth rate, the dominant players, opportunities, trends and investments across different geographies. To study production methods, cost of labour and investment, key players’ strategies were included for each region.

The most important factor for any market analysis is the demand and supply. However, the global Digital Utility Market’s demand-supply chain was studied with the help of Porter's Five Forces Model. More importantly, the market dynamics, like the latest trends, development, opportunities and market scenarios were also studied to give a deeper understanding of the Digital Utility Market.

To study the competition in the global Digital Utility Market and to get elaborative insights into the market, various competitors’ portfolios, financials, strategies and investments were studied. The competitors studied in this research are IBM Corporation, Microsoft Corporation, Zuercher Schlucht AG, Cisco System Inc., Oracle Corporation, SAP SE and others.

Furthermore, relevant data such as market players’ strategies to stay ahead in the race was studied. Market attractiveness in terms of every region is studied in the next section to provide a better understanding of the market segments.

Lastly, the findings and verdict of the research performed are summarized in the conclusion part of the report.